MI DoT 4582 2009 free printable template

Show details

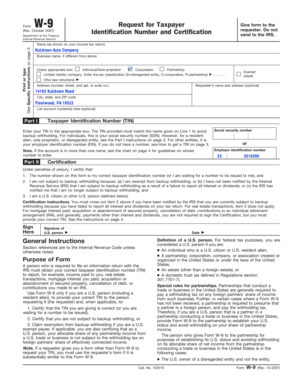

Reset Form Attachment 16 Michigan Department of Treasury 4582 Rev. 10-09 Page 1 2009 MICHIGAN Business Tax Penalty and Interest Computation for Underpaid Estimated Tax Issued under authority of Public Act 36 of 2007.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI DoT 4582

Edit your MI DoT 4582 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT 4582 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI DoT 4582 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MI DoT 4582. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 4582 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT 4582

How to fill out MI DoT 4582

01

Begin by downloading the MI DoT 4582 form from the Michigan Department of Transportation website.

02

On the top of the form, fill in the date of completion.

03

Provide the vehicle identification number (VIN) in the specified section.

04

Fill out the owner's name and address accurately.

05

Indicate the type of vehicle (e.g., passenger car, truck, etc.) in the corresponding box.

06

Complete the mileage reading at the time of the report.

07

If applicable, include any special notes or conditions related to the vehicle.

08

Double-check all the information for accuracy.

09

Sign and date the form at the bottom.

10

Submit the completed form as per the instructions provided.

Who needs MI DoT 4582?

01

Individuals or businesses registering a vehicle in Michigan.

02

Vehicle owners applying for a title transfer.

03

Individuals needing to report a vehicle's odometer reading.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I don't have a w2?

If you're unable to get your Form W-2 from your employer, contact the Internal Revenue Service at 800-TAX-1040. The IRS will contact your employer or payer and request the missing form.

What is 4852?

Form 4852 serves as a substitute for Form W-2, Form W-2c, and Form 1099-R, and is completed by taxpayers or their representatives when: Their employer or payer does not give them a Form W-2 or Form 1099-R. An employer or payer has issued an incorrect Form W-2 or Form 1099-R.

What form is used for depreciation?

Filing Form 4562 File Form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a Section 179 election.

Who must file Schedule D?

Who Needs to File Schedule D: Capital Gains and Losses? In general, taxpayers who have short-term capital gains, short-term capital losses, long-term capital gains, or long-term capital losses must report this information on Schedule D, an IRS form that accompanies form 1040.

What is a 4562 used for?

Use Form 4562 to: Claim your deduction for depreciation and amortization. Make the election under section 179 to expense certain property. Provide information on the business/investment use of automobiles and other listed property.

Where do I find special depreciation allowance?

For qualified property that is listed property, enter the special depreciation allowance on Form 4562, Part V, line 25. TIP: If you place qualified property in service in a short tax year, you can take the full amount of a special depreciation allowance. Depreciating the remaining cost.

How do I get my IRS form 4852?

The IRS will contact your employer or payer and request the missing form. The IRS will also send you a Form 4852. If you don't receive the missing form in sufficient time to file your income tax return timely, you may use the Form 4852 that the IRS sent you to file with your return.

Can you file form 4852 electronically?

Unfortunately, as the IRS does not allow e-filing of Form 4852, a paper return must be mailed to the IRS. Print your return through TaxAct, then attach a copy of Form 4852 with the return before mailing. Please visit the IRS web site to print a copy of Form 4852.

What is Schedule D Form 1040?

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

What happens if you file taxes without all your w2s?

If you file without all of your W-2s, it could delay processing of your return — and the arrival of any refund. Federal law requires employers to send W-2s to workers by Jan. 31 each year, or a few days later if the end of the month falls on a weekend.

Do I need to file Schedule D and form 8949?

Preparing Schedule D and 8949 Any year that you have to report a capital asset transaction, you'll need to prepare Form 8949 before filling out Schedule D unless an exception applies. Form 8949 requires the details of each capital asset transaction.

When Should form 4852 be filed?

Form 4852 is used to report information about wage or retirement income when you do not receive a Form W-2 or Form 1099-R. Generally, payers must furnish these forms to payees by January 31 of the following year.

What are the main example of Schedule D income?

Schedule D is used to report income or losses from capital assets. Assets owned by you are considered capital assets. These include your home, car, boat, furniture, and stocks, to name a few.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the MI DoT 4582 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your MI DoT 4582.

How can I edit MI DoT 4582 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit MI DoT 4582.

Can I edit MI DoT 4582 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share MI DoT 4582 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is MI DoT 4582?

MI DoT 4582 is a specific form used in the state of Michigan for reporting certain transportation-related data.

Who is required to file MI DoT 4582?

Individuals or entities that transport specific types of cargo or operate certain vehicles as defined by Michigan Department of Transportation regulations are required to file MI DoT 4582.

How to fill out MI DoT 4582?

To fill out MI DoT 4582, one must provide detailed information about the transportation service, including the type of cargo, vehicle details, and other required data as specified in the form instructions.

What is the purpose of MI DoT 4582?

The purpose of MI DoT 4582 is to collect data for regulatory oversight, safety monitoring, and to ensure compliance with state transportation laws.

What information must be reported on MI DoT 4582?

Required information on MI DoT 4582 includes the type of transportation service, cargo details, vehicle identification, and compliance history.

Fill out your MI DoT 4582 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT 4582 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.