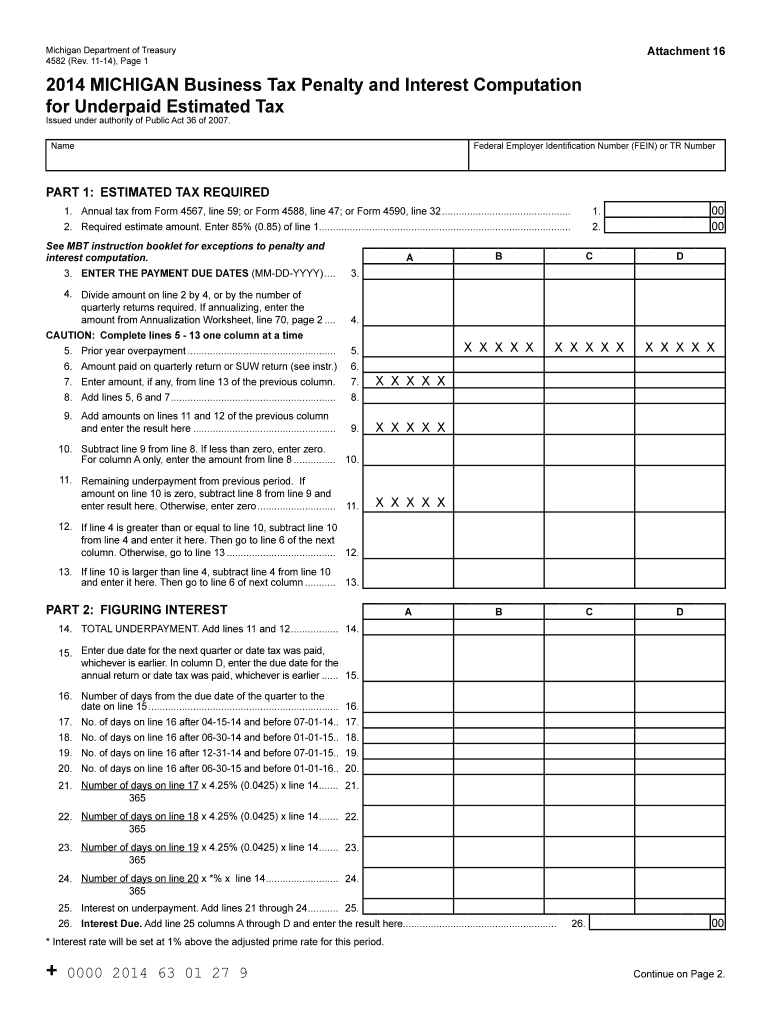

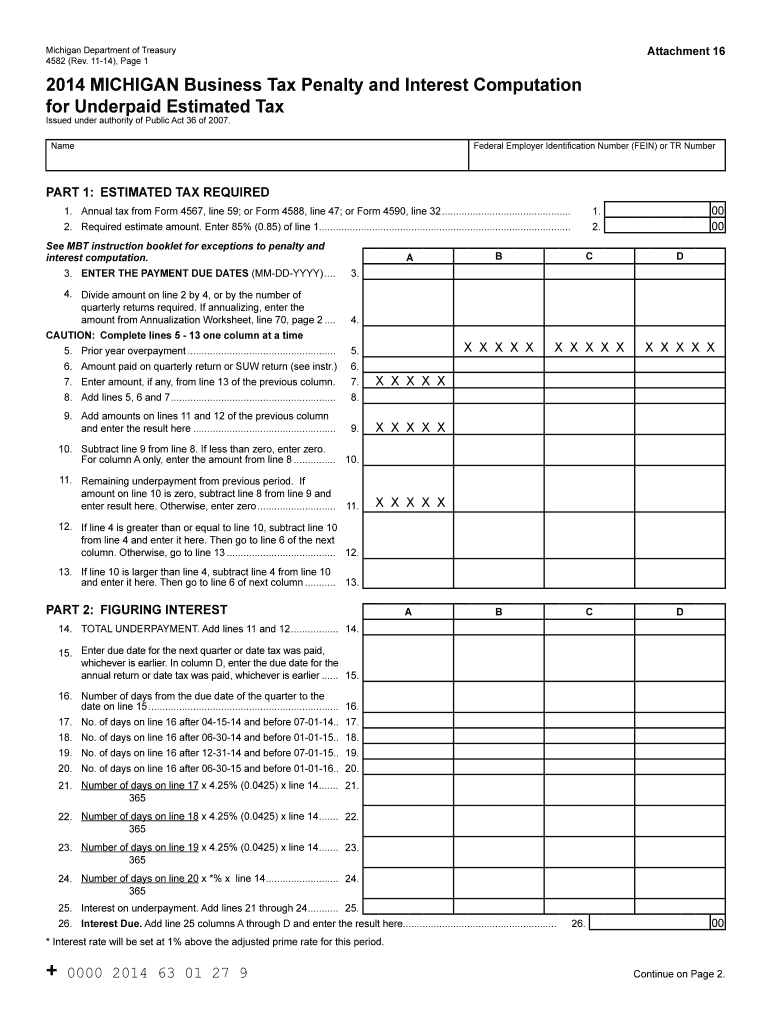

MI DoT 4582 2014 free printable template

Get, Create, Make and Sign MI DoT 4582

How to edit MI DoT 4582 online

Uncompromising security for your PDF editing and eSignature needs

MI DoT 4582 Form Versions

How to fill out MI DoT 4582

How to fill out MI DoT 4582

Who needs MI DoT 4582?

Instructions and Help about MI DoT 4582

This is Joe from how to form an LLC org, and today we are going to form an LLC in the state of Michigan so the first step in forming an LLC is to get a name for our LLC and the reason why we want to go over that right now is because the number one reason why these LLC's get rejected in Michigan is because people file a name that already exists in the system so what we want to do is this webpage by the way is in the description so right below the video there's a link click on that, and you can follow right along if you want to go down you can see this Michigan LLC search right below the box if you click on that that will bring us to the Michigan LLC's search it's on our website, but we work with the state, so we can search all their LLC's and all you have to do is just search the name hit search, and it'll tell you if there's anything in here in their database for example if we did real estate LLC hit Search I'll tell us if it's available or not this is name not available, so we cannot use that name I mean that was pretty common I didn't expect it to be available but anyways you just search right in here this machine will tell you right away and so that's that so let's get right to the steps we have our name for our LLC hopefully, and we are ready to start filling out some stuff, so we want to go right to the Michigan articles of organization right here click on it the Michigan form will pop up and that it is pretty easy pretty self-explanatory full you can fill in the blanks all right here so who you want the first box is who you want it to be sent back to, and you just write your name in here address city state zip code keep scrolling down the name of the name of the limited liability company is you write it right here a purpose for which it's being formed I usually just write any legal anything legal in the state of Michigan or any lawful purpose I mean they don't really want to know exactly what it is you're doing you just want to know that what you're doing is legal the duration of the limited liability company other than perpetual is a lot of people get just totally confused on this question and all this really means is that you don't do anything fill in anything in that blank unless your LLC is only going to be around for a year or less such as if you're a construction company doing some work you might make an LLC just until the construction is done, and it'll end, but I would say 99% of you are looking to make a nice long healthy business they'll hopefully never die so let's go on to article for the name of the resident agent at the registered office is a registered agent is someone who's just a representative of the LLC it doesn't have to be the owner for example a lot of companies use an attorneys or accountants to be the registered agent basically a registered agent is if anyone's going to be coming after you or trying to get contact with you whether it be the state on a filing fee or some kind of judgment debt collection they're going...

People Also Ask about

What happens if I don't have a w2?

What is 4852?

What form is used for depreciation?

Who must file Schedule D?

What is a 4562 used for?

Where do I find special depreciation allowance?

How do I get my IRS form 4852?

Can you file form 4852 electronically?

What is Schedule D Form 1040?

What happens if you file taxes without all your w2s?

Do I need to file Schedule D and form 8949?

When Should form 4852 be filed?

What are the main example of Schedule D income?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MI DoT 4582 from Google Drive?

How do I fill out MI DoT 4582 using my mobile device?

How do I complete MI DoT 4582 on an Android device?

What is MI DoT 4582?

Who is required to file MI DoT 4582?

How to fill out MI DoT 4582?

What is the purpose of MI DoT 4582?

What information must be reported on MI DoT 4582?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.