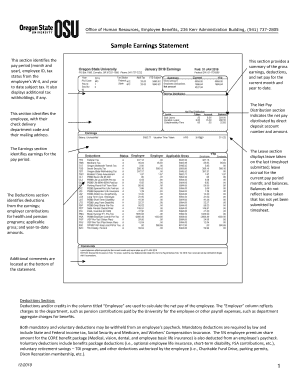

Oregon State University Sample Earnings Statement 2013 free printable template

Show details

Office of Human Resources, Employee Benefits, 204 Kerr Administration Building, (541) 737-2805 begin of the Skype highlighting (541) 737-2805 end of the Skype highlighting. 05/2012. 1. Sample Earnings

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Oregon State University Sample Earnings Statement

Edit your Oregon State University Sample Earnings Statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Oregon State University Sample Earnings Statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Oregon State University Sample Earnings Statement online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Oregon State University Sample Earnings Statement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Oregon State University Sample Earnings Statement Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Oregon State University Sample Earnings Statement

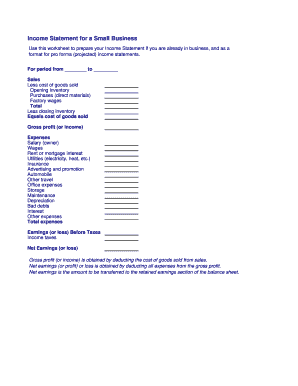

How to fill out an earning statement:

01

Gather all necessary information, such as your personal details, employer information, and relevant financial data.

02

Start by entering your full name, address, and other personal information at the top of the form.

03

Proceed to input your employer's name, address, and contact details.

04

Include the period for which the earnings statement is being prepared, typically the start and end date of the pay period.

05

List your income sources, such as regular wages, overtime pay, bonuses, commissions, or any other type of earnings.

06

Deduct any pre-tax deductions, such as contributions to retirement plans, health insurance premiums, or flexible spending accounts.

07

Calculate and subtract applicable taxes, including federal, state, and local income taxes, as well as Social Security and Medicare taxes.

08

Include any post-tax deductions, such as contributions to post-tax retirement accounts or charitable donations.

09

Calculate the net pay by subtracting all deductions from the total earnings.

10

Review the statement for accuracy, ensuring that all numbers and calculations are correct.

11

Sign and date the earning statement if required.

12

Keep a copy for your records and provide the statement to anyone who needs it, such as your employer or a financial institution.

Who needs an earning statement?

01

Employees who receive a regular wage or salary from their employer.

02

Contractors or freelancers who need to report their income to the appropriate authorities.

03

Individuals applying for loans or mortgages, as lenders often require proof of income.

04

Landlords or rental agencies who may request an earning statement to verify a tenant's ability to pay rent.

05

Individuals seeking government assistance or benefits that are income-based.

06

Those involved in legal matters where income verification is necessary, such as divorce or child support cases.

Fill

form

: Try Risk Free

People Also Ask about

How do I get an earnings statement?

Certified yearly earnings totals or an itemized earnings statement (certified or non-certified) can be obtained by completing the Request for Social Security Earnings Information (Form SSA-7050).

How do I get a copy of my Social Security earnings statement?

If you would like to receive your Social Security Statement by mail, please print and complete a "Request For Social Security Statement" (Form SSA-7004) and mail it to the address provided on the form. You should receive your paper Social Security Statement in the mail in four to six weeks.

How do I check my Social Security earnings online?

You can view your personal Social Security Statement (Statement) online by creating a personal my Social Security account with us. Your online Statement displays your yearly earnings history free of charge but does not show any employer information.

What is the form SSA 7050 F 4?

The Social Security Administration (SSA) uses the Request for Social Security Earnings Information (Form SSA-7050-F4) for Social Security number (SSN) holders or their legal representative to request an Itemized Statement of Earnings (Form SSA-1826) for various non-program related reasons.

What is the earnings statement on a pay stub?

Your paystub is an earnings statement that includes details on the gross wages you earned for the pay period, the federal and state taxes withheld, MIT Benefits-related deductions, and your net pay.

What is an earning statement?

Your Earnings Statement provides employees detailed information on the additions to and subtractions from gross salary or wage in order to arrive at your net pay. Net pay is your “take home” pay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Oregon State University Sample Earnings Statement?

With pdfFiller, the editing process is straightforward. Open your Oregon State University Sample Earnings Statement in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I edit Oregon State University Sample Earnings Statement on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing Oregon State University Sample Earnings Statement right away.

Can I edit Oregon State University Sample Earnings Statement on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as Oregon State University Sample Earnings Statement. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is Oregon State University Sample Earnings Statement?

The Oregon State University Sample Earnings Statement is a document that outlines an individual's earnings and deductions for a specific period, providing a detailed summary of income received by employees.

Who is required to file Oregon State University Sample Earnings Statement?

Individuals who are employed by Oregon State University and receive wages or other types of earnings are typically required to fill out the Sample Earnings Statement.

How to fill out Oregon State University Sample Earnings Statement?

To fill out the Oregon State University Sample Earnings Statement, individuals should enter their personal information, report their earnings over the specified period, list any deductions, and ensure accuracy before submission.

What is the purpose of Oregon State University Sample Earnings Statement?

The purpose of the Oregon State University Sample Earnings Statement is to provide employees with a clear and concise record of their earnings, deductions, and net income, which is essential for tax reporting and personal financial management.

What information must be reported on Oregon State University Sample Earnings Statement?

The information that must be reported on the Oregon State University Sample Earnings Statement includes the employee's name, Social Security number, the pay period, total gross earnings, itemized deductions (such as taxes, retirement contributions), and net pay.

Fill out your Oregon State University Sample Earnings Statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oregon State University Sample Earnings Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.