Oregon State University Sample Earnings Statement 2019-2025 free printable template

Show details

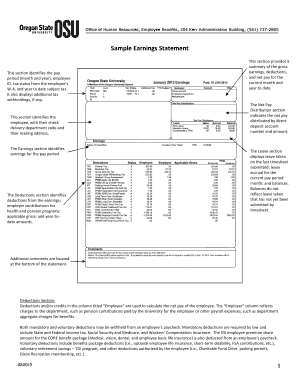

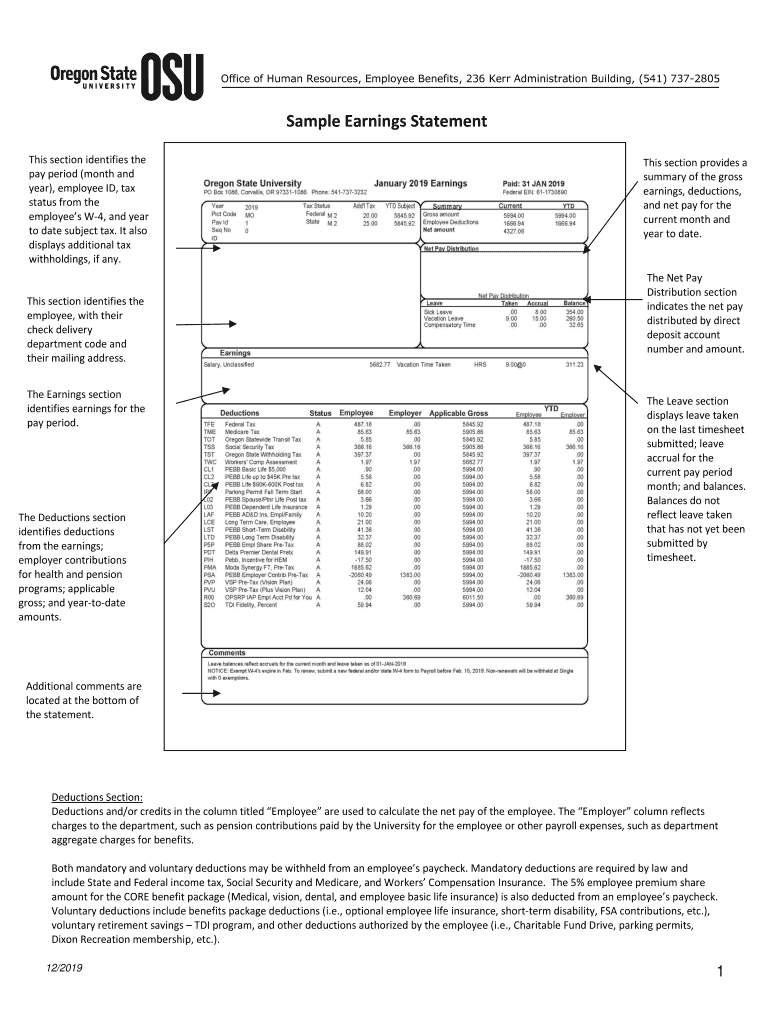

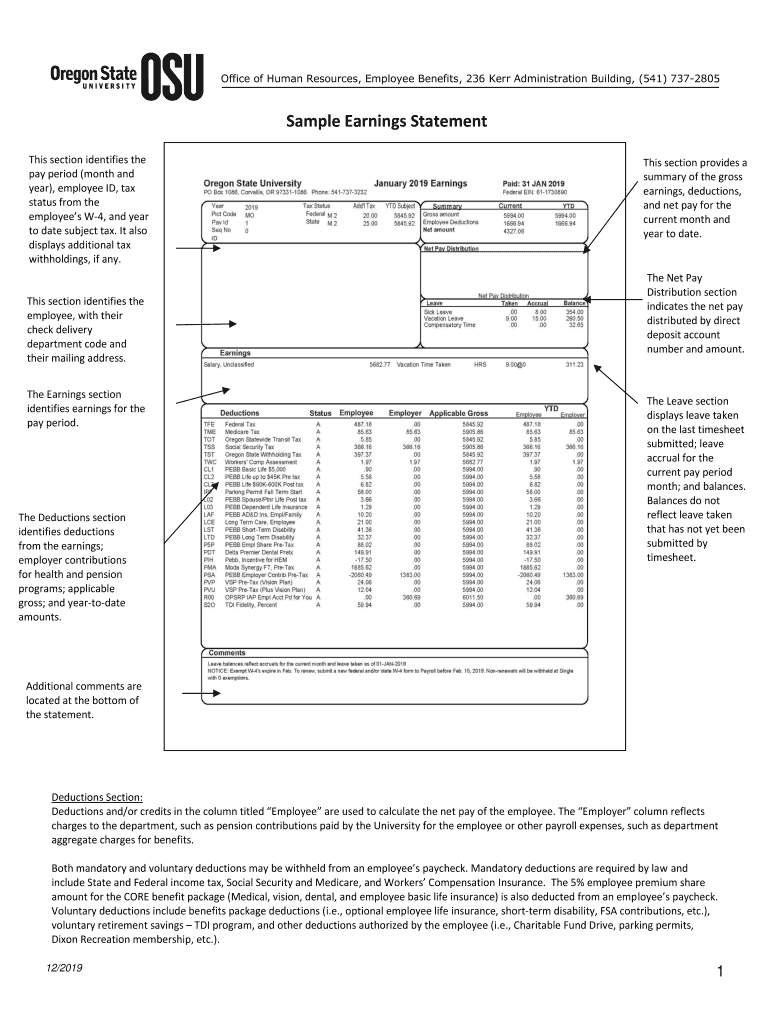

Office of Human Resources, Employee Benefits, 236 Kerr Administration Building, (541) 7372805Sample Earnings Statement

This section identifies the

pay period (month and

year), employee ID, tax

status

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sample earnings

Edit your sample earnings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample earnings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sample earnings online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sample earnings. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Oregon State University Sample Earnings Statement Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sample earnings

How to fill out Oregon State University Sample Earnings Statement

01

Start by locating the Oregon State University Sample Earnings Statement provided by the university.

02

Enter the employee's name at the top of the statement.

03

Fill in the employee's ID number, which can usually be found on their university identification card.

04

Specify the pay period for which the earnings statement is being filled out.

05

List all earnings categories such as regular wages, overtime pay, and bonuses under the 'Earnings' section.

06

Calculate and enter the total earnings for the pay period.

07

In the 'Deductions' section, fill in amounts for taxes, retirement contributions, and other deductions applicable to the employee.

08

Calculate and enter the total deductions.

09

Finally, calculate the net pay by subtracting total deductions from total earnings and enter this amount.

Who needs Oregon State University Sample Earnings Statement?

01

Employees of Oregon State University who receive paychecks.

02

Human resources personnel managing employee compensation.

03

Accounting staff who process payroll information.

04

Students working in on-campus jobs who need to track their earnings.

Fill

form

: Try Risk Free

People Also Ask about

How do I get an earnings statement?

Certified yearly earnings totals or an itemized earnings statement (certified or non-certified) can be obtained by completing the Request for Social Security Earnings Information (Form SSA-7050).

How do I get a copy of my Social Security earnings statement?

If you would like to receive your Social Security Statement by mail, please print and complete a "Request For Social Security Statement" (Form SSA-7004) and mail it to the address provided on the form. You should receive your paper Social Security Statement in the mail in four to six weeks.

How do I check my Social Security earnings online?

You can view your personal Social Security Statement (Statement) online by creating a personal my Social Security account with us. Your online Statement displays your yearly earnings history free of charge but does not show any employer information.

What is the form SSA 7050 F 4?

The Social Security Administration (SSA) uses the Request for Social Security Earnings Information (Form SSA-7050-F4) for Social Security number (SSN) holders or their legal representative to request an Itemized Statement of Earnings (Form SSA-1826) for various non-program related reasons.

What is the earnings statement on a pay stub?

Your paystub is an earnings statement that includes details on the gross wages you earned for the pay period, the federal and state taxes withheld, MIT Benefits-related deductions, and your net pay.

What is an earning statement?

Your Earnings Statement provides employees detailed information on the additions to and subtractions from gross salary or wage in order to arrive at your net pay. Net pay is your “take home” pay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sample earnings?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the sample earnings in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I edit sample earnings on an iOS device?

Use the pdfFiller mobile app to create, edit, and share sample earnings from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out sample earnings on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your sample earnings. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is Oregon State University Sample Earnings Statement?

The Oregon State University Sample Earnings Statement is a document that outlines the earnings and deductions of employees or student workers at the university, serving as a summary of the financial compensation received during a specific pay period.

Who is required to file Oregon State University Sample Earnings Statement?

All employees and student workers at Oregon State University who receive compensation for their work are required to file the Oregon State University Sample Earnings Statement as part of their employee records and payroll processing.

How to fill out Oregon State University Sample Earnings Statement?

To fill out the Oregon State University Sample Earnings Statement, start by entering personal and employment details such as name, employee ID, pay period, and position. Then, input the total earnings, any deductions, and the net pay for the period, ensuring clarity and accuracy in all entries.

What is the purpose of Oregon State University Sample Earnings Statement?

The purpose of the Oregon State University Sample Earnings Statement is to provide a clear and detailed account of an employee's earnings, deductions, taxes, and overall pay for a given period, which is essential for financial record-keeping and tax reporting.

What information must be reported on Oregon State University Sample Earnings Statement?

The Oregon State University Sample Earnings Statement must report information such as the employee's name, ID number, pay period dates, gross earnings, deductions (such as taxes and benefits), and net pay for that specific pay period.

Fill out your sample earnings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Earnings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.