Get the free uce 101 s

Show details

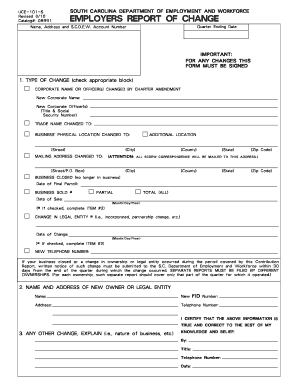

South Carolina Department of Employment Workforce Unemployment Insurance Tax Division SPECIFICATIONS FOR QUARTERLY EMPLOYER SCAN LINES AND BAR CODES We prefer that employers use the forms provided by this Agency however the SCDEW will accept a facsimile of the Employer Quarterly Contribution and Wage Report Form UCE-101/120 produced to our exact specifications. The Employer Contribution Report Form UCE-101 bottom portion of Form UCE-120 must be a...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uce 101 s form

Edit your uce 101 s form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uce 101 s form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing uce 101 s form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit uce 101 s form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out uce 101 s form

How to fill out blank printable uce 101:

01

Start by gathering all the necessary information that needs to be filled out on the form, such as your personal details, contact information, and any other relevant information required.

02

Carefully read the instructions provided on the form to ensure you understand what information is required in each section.

03

Begin filling out the form by entering your personal details accurately and legibly. This may include your full name, address, date of birth, and social security number, among others, depending on the specific requirements of the form.

04

Move on to the next sections of the form, providing the requested information in an organized and clear manner. It is important to double-check your entries to ensure accuracy before proceeding.

05

If the form requires any additional supporting documents or signatures, make sure to attach or provide them as instructed. This may involve attaching photocopies of identification documents, bank statements, or any other relevant paperwork.

06

Once you have completed all the required sections, review the entire form once again to make sure you haven't missed any necessary information or made any errors.

07

Finally, sign and date the form as required. If there is a need for witnesses or additional signatures, ensure that it is properly completed.

Who needs blank printable uce 101:

01

Individuals who are planning to apply for a specific program, service, or benefit that requires the completion of uce 101.

02

Students who are enrolling in a university or college and need to provide certain information about themselves.

03

Employees who are required to submit the form as part of their hiring process or to update their personal information with their employer.

04

Anyone who needs to request or provide specific information to a government agency, such as for tax purposes or applying for a permit or license.

05

Individuals who are involved in legal proceedings that require them to fill out uce 101 as part of the documentation or evidence submission process.

It is important to note that the specific need for blank printable uce 101 may vary depending on the context or the requirements of the organization or institution where it is being used. Therefore, it is always advisable to carefully read and understand the instructions provided with the form before filling it out.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my uce 101 s form directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your uce 101 s form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send uce 101 s form for eSignature?

Once your uce 101 s form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the uce 101 s form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your uce 101 s form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is blank printable uce 101?

Blank printable uce 101 is a form used to report income and expenses for tax purposes.

Who is required to file blank printable uce 101?

Any individual or business entity that has income and expenses to report must file blank printable uce 101.

How to fill out blank printable uce 101?

Blank printable uce 101 can be filled out manually or electronically, following the instructions provided on the form.

What is the purpose of blank printable uce 101?

The purpose of blank printable uce 101 is to accurately report income and expenses for tax assessment.

What information must be reported on blank printable uce 101?

Information such as income sources, expenses, deductions, and tax identification numbers must be reported on blank printable uce 101.

Fill out your uce 101 s form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uce 101 S Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.