SC UCE-101-S 2010 free printable template

Show details

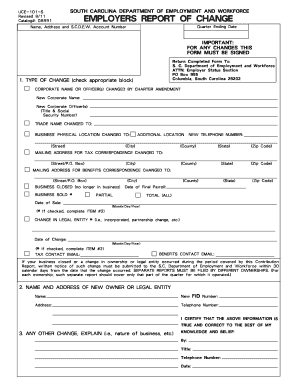

SOUTH CAROLINA DEPARTMENT UCE101S Revised 6/10 Catalog#: 08991 Name, Address and S.C.D.E.W. Account Number OF EMPLOYMENT AND WORKFORCE EMPLOYERS REPORT OF CHANGE Date Quarter Ending IMPORTANT: FOR

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign uce-101-s

Edit your uce-101-s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uce-101-s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing uce-101-s online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit uce-101-s. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC UCE-101-S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out uce-101-s

How to fill out SC UCE-101-S

01

Start by downloading the SC UCE-101-S form from the official website.

02

Read the instructions carefully to understand the information required.

03

Fill in your personal information, including name, address, and contact details in the designated fields.

04

Provide relevant details about the purpose of the form and any additional information as requested.

05

Review the form thoroughly to ensure all information is accurate and complete.

06

Sign and date the form at the bottom before submitting.

07

Submit the completed form as per the specified submission guidelines, either online or via mail.

Who needs SC UCE-101-S?

01

Individuals applying for a specific service or benefits provided by SC.

02

Organizations or entities required to submit documentation or information relevant to SC.

03

Any person seeking to validate or authorize a particular action as outlined in the form.

Fill

form

: Try Risk Free

People Also Ask about

What is a SC UCE 101 form?

Employers Report of Change (UCE-101-S) Application for Exemption of Business Entity Owners from Unemployment Insurance Coverage (UCE-1060) Application for Exemption of Corporate Officers from Unemployment Insurance Coverage (UCE 1050)

What is the rate of SUI?

Additional facts about suicide in the US The age-adjusted suicide rate in 2021 was 14.04 per 100,000 individuals. The rate of suicide is highest in middle-aged white men. In 2021, men died by suicide 3.90x more than women. On average, there are 132 suicides per day.

What is the Sui rate for South Carolina?

South Carolina Announces 2023 Unemployment Insurance Tax Rates Unemployment tax rates for experienced employers will range from 0.06% to 5.46% The tax rate for new employers will decrease to 0.45% from 0.55%

What is SC SUI rate for 2023?

The new employer tax rate remains at 2.7% and the 0.2% administrative assessment (paid by both experienced and new employers) continues to be in effect in 2023. The unemployment taxable wage base remains at $9,000 in 2023.

How long does an employer have to respond to unemployment in SC?

You must respond to the department within 10 calendar days of receiving the notification in order to prevent a former employee from wrongfully receiving UI benefits.

What disqualifies you from unemployment in South Carolina?

Even when sufficient wages qualify you for benefits, other reasons can disqualify you including: Leaving work voluntarily without good cause. Being discharged for misconduct connected with employment. Being discharged for cause, other than misconduct.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit uce-101-s in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your uce-101-s, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the uce-101-s in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your uce-101-s right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit uce-101-s straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing uce-101-s.

What is SC UCE-101-S?

SC UCE-101-S is a specific form used for reporting unemployment compensation in the state of South Carolina.

Who is required to file SC UCE-101-S?

Employers in South Carolina who are subject to unemployment insurance laws are required to file SC UCE-101-S.

How to fill out SC UCE-101-S?

To fill out SC UCE-101-S, employers must provide accurate details regarding their unemployment compensation, employee information, and ensure all required sections are completed before submission.

What is the purpose of SC UCE-101-S?

The purpose of SC UCE-101-S is to report unemployment compensation data to the South Carolina Department of Employment and Workforce for the administration of unemployment insurance programs.

What information must be reported on SC UCE-101-S?

SC UCE-101-S must report information including total wages paid, number of employees, unemployment claims filed, and other relevant data required by the state.

Fill out your uce-101-s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uce-101-S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.