Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file georgia form g 7?

The Georgia Form G-7 or Georgia Annual Return is required to be filed by any individual or business entity that has made income from Georgia sources during the tax year and is required to file a federal income tax return. This includes resident individuals, non-resident individuals, partnerships, corporations, and fiduciaries.

When is the deadline to file georgia form g 7 in 2023?

The specific deadline to file Georgia Form G-7 in 2023 is not available as of now. The deadline for filing Georgia Form G-7 generally falls on April 15th each year, unless that date happens to fall on a weekend or holiday. It is advisable to check for any updates or changes from the Georgia Department of Revenue or consult a tax professional for the most accurate deadline information.

What is georgia form g 7?

Georgia form G-7 is a tax return form used by individuals or businesses in the state of Georgia to report and pay their sales and use tax liabilities. It is also used to claim sales tax credits, request refunds, or report any manufacturing exemptions. The G-7 form must be filed monthly, quarterly, or annually, based on the frequency assigned by the Georgia Department of Revenue.

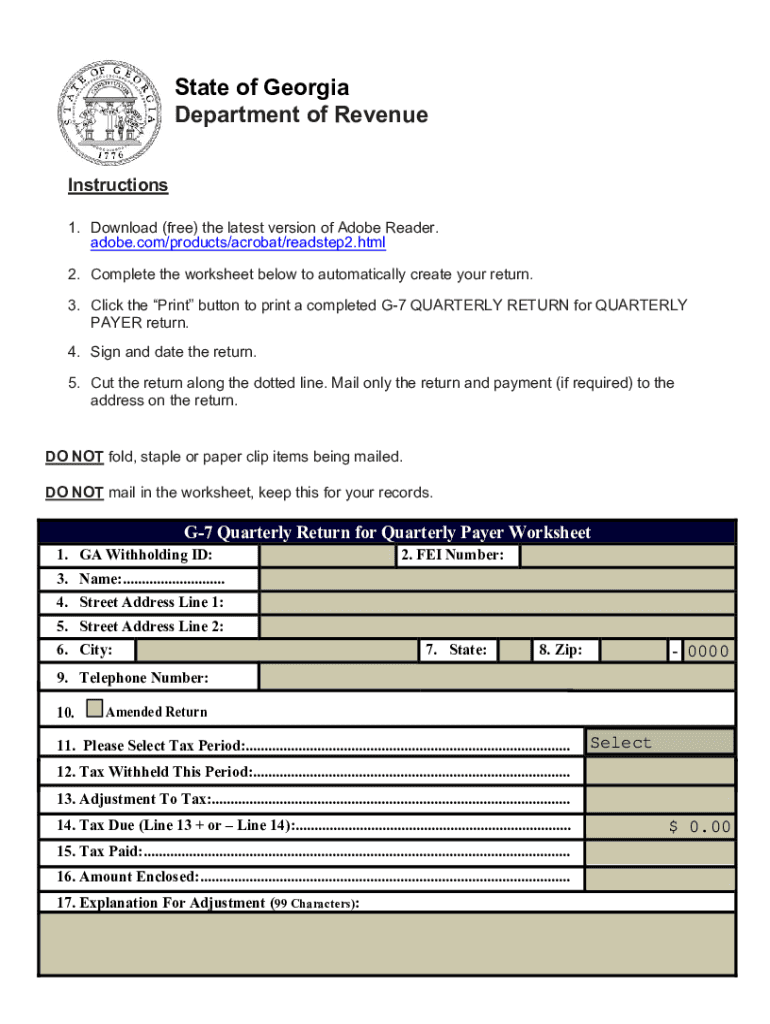

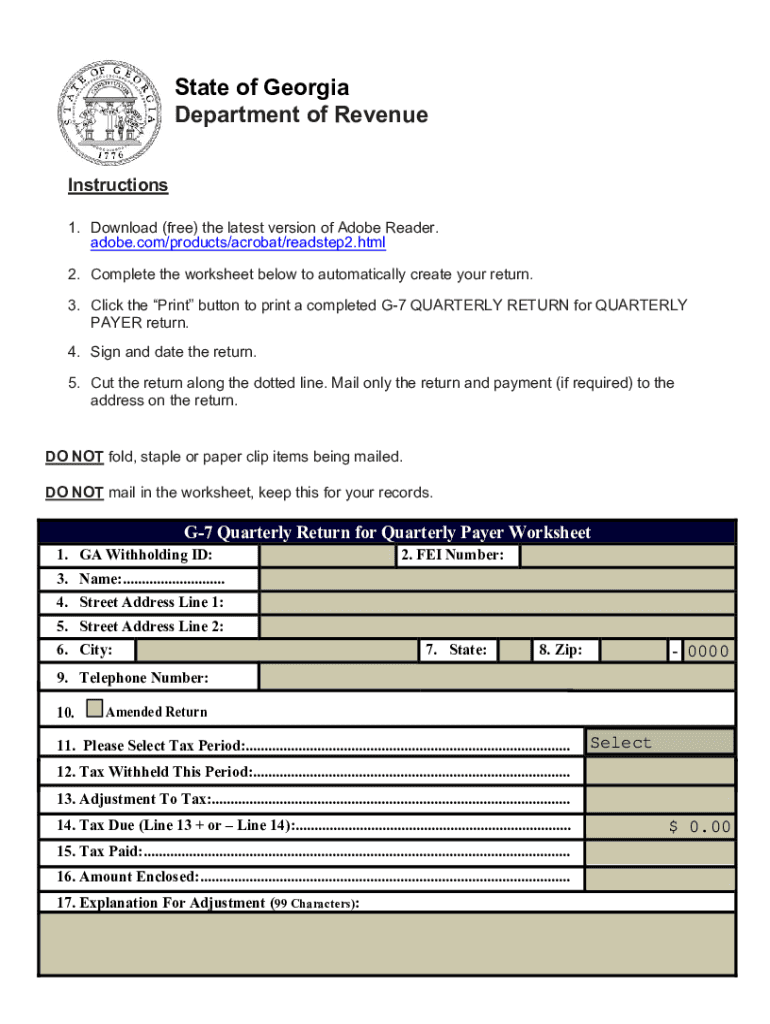

How to fill out georgia form g 7?

To fill out Georgia Form G-7, Sales and Use Tax Return, follow these steps:

1. Provide company information: Fill in your business name, address, and federal employer identification number (FEIN) in the appropriate fields at the top of the form.

2. Reporting period: Indicate the reporting period for which you are filing the return by entering the beginning and ending dates in the corresponding fields.

3. Gross sales and taxable sales: Report your total gross sales and taxable sales during the reporting period in the designated sections of the form. Separate line items may be available to account for different types of sales, such as local jurisdictions, local option sales tax, or sales exempt from tax.

4. Deductions: Deduct any allowable sales tax exemptions or credits from the taxable sales total, if applicable. These may include nontaxable sales, bad debts, documented sales for resale, or any other allowable deduction.

5. Sales and use tax due: Calculate the total sales and use tax due by applying the applicable tax rate(s) to the taxable sales amount. The tax rate may vary depending on the jurisdiction and type of sale. Record the calculated tax due in the appropriate sections of the form.

6. Prepayments and credits: Enter any prepayments made during the reporting period along with their corresponding dates. If you have any credits from previous returns, record them as well. These will be subtracted from the total tax due to determine the net amount owed.

7. Miscellaneous information: Provide any additional requested information or explanations, such as changes to the business address, tax period, or additional tax liabilities.

8. Signature and date: Sign and date the completed form to certify its accuracy and completeness.

9. Payment and submission: Include payment for the net amount owed with the return. Forms can be submitted online through the Georgia Tax Center, mailed with a check or money order, or paid in person at the Georgia Department of Revenue.

Remember to review the instructions provided by the Georgia Department of Revenue to ensure accurate and proper completion of Form G-7. This guide is meant to provide a general overview and is not a substitute for professional tax advice.

What is the purpose of georgia form g 7?

Georgia Form G-7 is the "Quarterly Return of Sales and Use Tax" form used by businesses in Georgia to report their sales and use tax liabilities for a specific quarter. The purpose of this form is to accurately report and remit the sales and use tax collected by businesses in Georgia to the Georgia Department of Revenue. It helps ensure compliance with state tax laws and allows the state to collect the appropriate amount of sales and use tax revenue.

What information must be reported on georgia form g 7?

Form G-7 in Georgia is used for businesses to report their sales tax liability. The following information must be reported on this form:

1. Business name and address: Include the legal name and physical address of the business.

2. Sales tax account number: Enter the sales tax account number assigned by the Georgia Department of Revenue.

3. Reporting period: State the specific month, quarter, or year for which the sales tax is being reported.

4. Gross sales or receipts: Report the total amount of gross sales or receipts for the reporting period. This includes sales of products or taxable services.

5. Exempt sales: If any sales were exempt from sales tax, report the total amount of exempt sales separately.

6. Taxable sales: Deduct the exempt sales from the gross sales to calculate the total taxable sales.

7. Tax rate: Apply the applicable sales tax rate to the taxable sales amount and calculate the sales tax liability.

8. Total sales tax liability: Summarize the total sales tax liability for the reporting period.

9. Prepayments and credits: If any prepayments or credits were made during the reporting period, provide details regarding these amounts.

10. Use tax: If the business has purchases subject to use tax, report the total amount separately.

11. Interest and penalties: If there are any interest or penalties due, report them separately.

12. Total amount due: Add the sales tax liability, use tax, interest, and penalty amounts (if applicable) to calculate the total amount due to the Georgia Department of Revenue.

13. Payment: Provide information on how the payment will be made, including the payment method and the amount enclosed.

14. Signature and date: The form must be signed and dated by an authorized representative of the business.

It is important to consult the official instructions provided by the Georgia Department of Revenue for specific guidance on completing Form G-7 accurately.

What is the penalty for the late filing of georgia form g 7?

According to the Georgia Department of Revenue, the penalty for late filing of Georgia Form G-7 (Quarterly Return of Georgia Withholding) is 5% of the tax due per month of being late, with a maximum penalty of 25%. Additionally, there is an additional penalty of 0.5% per month for any late payments. It is important to timely file and pay taxes to avoid penalties and interest charges.

How can I send georgia form g 7 quarterly return to be eSigned by others?

Once your ga payer form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the form g 7 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the georgia revenue dept electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your georgia form quarterly in seconds.