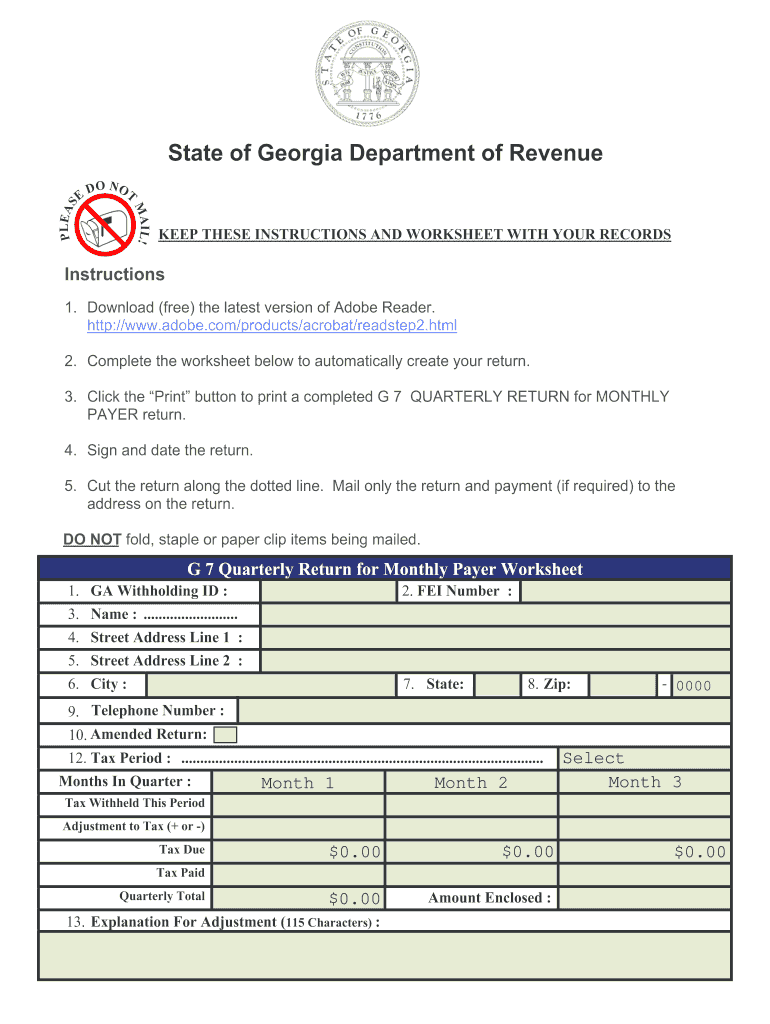

GA DoR G-7 2013 free printable template

Get, Create, Make and Sign 2013 g 7 form

Editing 2013 g 7 form online

Uncompromising security for your PDF editing and eSignature needs

GA DoR G-7 Form Versions

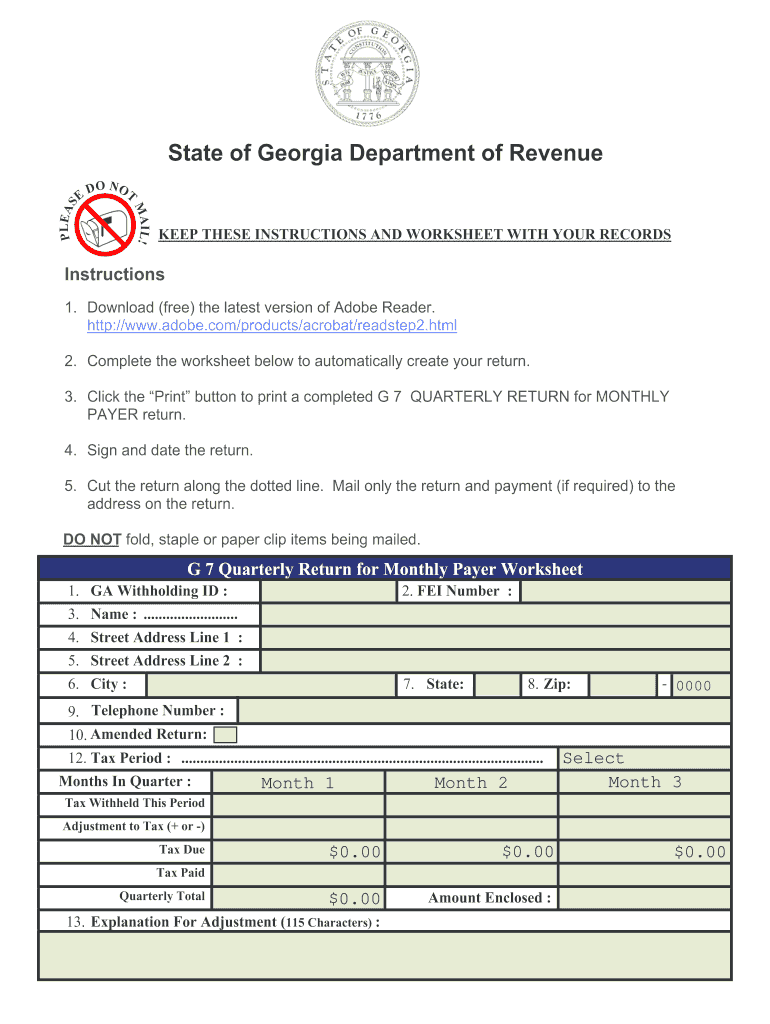

How to fill out 2013 g 7 form

How to fill out GA DoR G-7

Who needs GA DoR G-7?

Instructions and Help about 2013 g 7 form

Now we're down to something very personal in respect to what each of us as players perform our substitutions for the chords that we're playing in such as a chord let's say like this or chord like this or even more simplistic Accord like this I have always been prone to appreciate one type of form more than any other and that's been the minor form which again of course came from this parental form that the Triad the Augmented triad, and it was an asset the creation of a relative minor so that when I think of a chord I think of the inversion and literally the way it looks for instance if I saw a chord like this it's a B minor 7th flat 5 chords I don't see it as that I see it as what it contains these three notes are stronger than the core the incorporation of 4 this is ad minor triad it came from this augmented form D minor over B therefore if I were to play against a D minor chord it fits like a glove not only that if I were to take for instance let's talk about the diminished chord now if I were to take this diminished chord let me move it up a half-step and I lower the g-sharp to a G natural I now have a G 7th the Blues in the key of G well what I play against on this cluster came from this watch what happens here if I take this form here this diminished chord in G and I move it up to the next fingering on the next set with the same fingers and I move that up to a diminished and I then take the diminished chord and instead of lowering its own to a dominant seventh I raise its own to a minor seven flat five here's a C minor seven flat five let's move it down a half step to a B minor seven flat five over G and there's the blues again so this D minor triad is right at the top of it, and it could be seen and quite a number of its inversion likewise so let's begin to think about that, and now I'm going to take substitutions for certain forms that's one of the substitutions a D minor over G is what I would use for all what I would refer to as the consonant chord forms in the key of G that would be like a g9 a G 7th a G 13 a g11, and then I would use dissonant forms such as a g g7 sharp nine a half-step up instead of down which gives me a G sharp minor and that would be this I take off the root I take off the seventh I take off I take off the B flat in this which is the third the minor third and what's left is this is a g7 sharp five or if you'd like to call it a flat thirteen flat nine for dissonance I take off the root the seventh here's the third the flat 13 in the flat 9 what's left when I take the root in the seventh out is a flat minor or G sharp minor as a triad so like I did with with with the consonant set of dominant 7th chords like G 7th and I used E minor now I used for these forms G sharp minor because that's part of the formation itself

People Also Ask about

What is GA Revenue?

What is GA state sales tax?

When can I expect my Kemp refund?

What is GA withholding?

How does Google Analytics track revenue?

What are transactions in GA?

Who gets the Kemp tax refund?

How does Google Analytics track purchases?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2013 g 7 form online?

How do I complete 2013 g 7 form on an iOS device?

Can I edit 2013 g 7 form on an Android device?

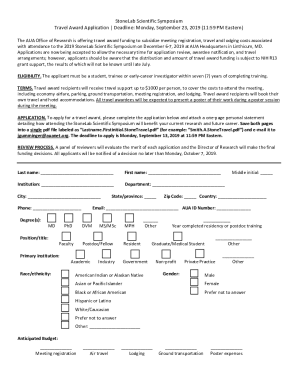

What is GA DoR G-7?

Who is required to file GA DoR G-7?

How to fill out GA DoR G-7?

What is the purpose of GA DoR G-7?

What information must be reported on GA DoR G-7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.