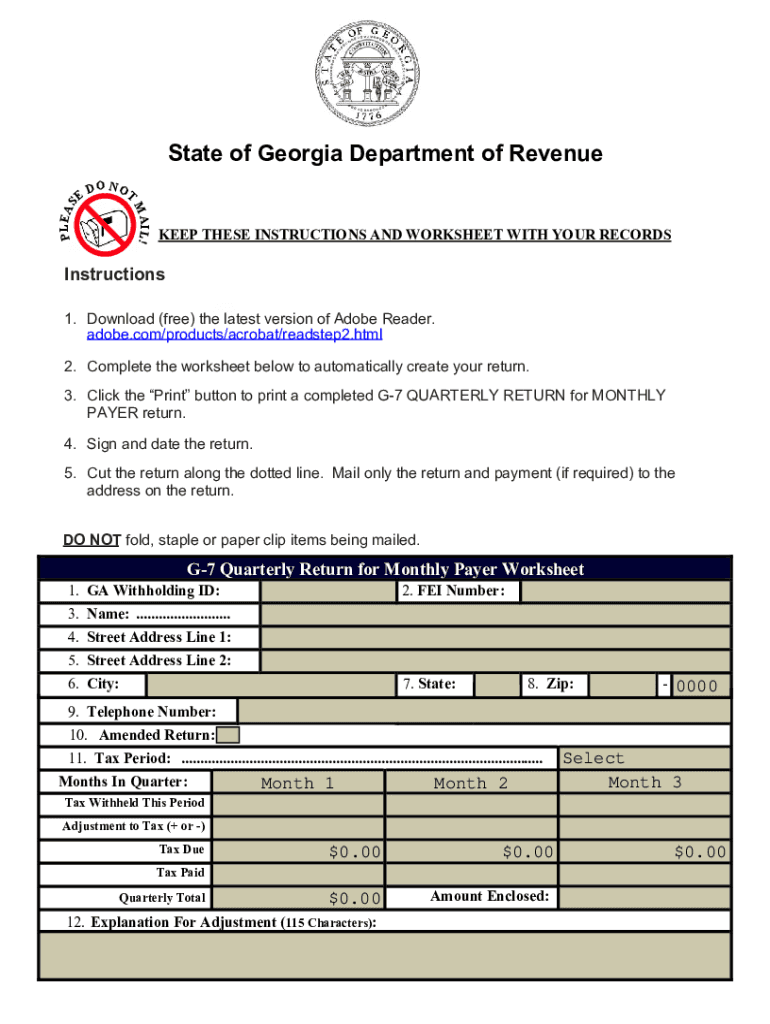

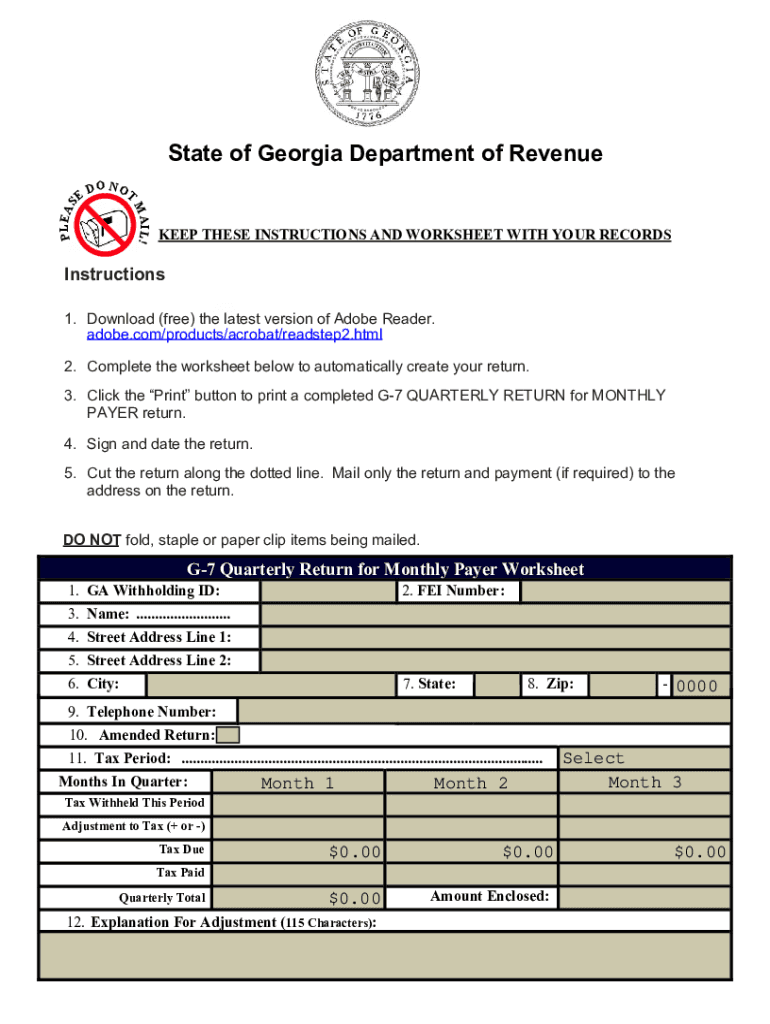

GA DoR G-7 2023 free printable template

Get, Create, Make and Sign form g7

How to edit g 7 quarterly return online

Uncompromising security for your PDF editing and eSignature needs

GA DoR G-7 Form Versions

How to fill out georgia form g7

How to fill out GA DoR G-7

Who needs GA DoR G-7?

Video instructions and help with filling out and completing georgia g 7 quarterly

Instructions and Help about g 7 quarterly return

Ever wonder what the g7 is well it's an informal club like a high school clique made up of the major developed economies the United States Canada the United Kingdom France Germany Italy and Japan since the mid 1970s they've been gathering once a year for a photo op and to discuss economic policies like exchange rates international trade development, and you know how to run the world it became the g8 when Russia joined, but they got the boot over their role in Crimea Russia said they didn't care because they're part of this other group the g20 who are the new kids on the economic power block the g20 was created to counter the influence of the g7 it includes the g7 plus China Brazil India and other major emerging countries the g20 represents 85 percent of the global economy you

People Also Ask about ga form g 7

What is GA Revenue?

What is GA state sales tax?

When can I expect my Kemp refund?

What is GA withholding?

How does Google Analytics track revenue?

What are transactions in GA?

Who gets the Kemp tax refund?

How does Google Analytics track purchases?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit georgia g 7 quarterly from Google Drive?

How can I send g 7 return monthly for eSignature?

How do I fill out the ga g7 quarterly return form fillable form on my smartphone?

What is GA DoR G-7?

Who is required to file GA DoR G-7?

How to fill out GA DoR G-7?

What is the purpose of GA DoR G-7?

What information must be reported on GA DoR G-7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.