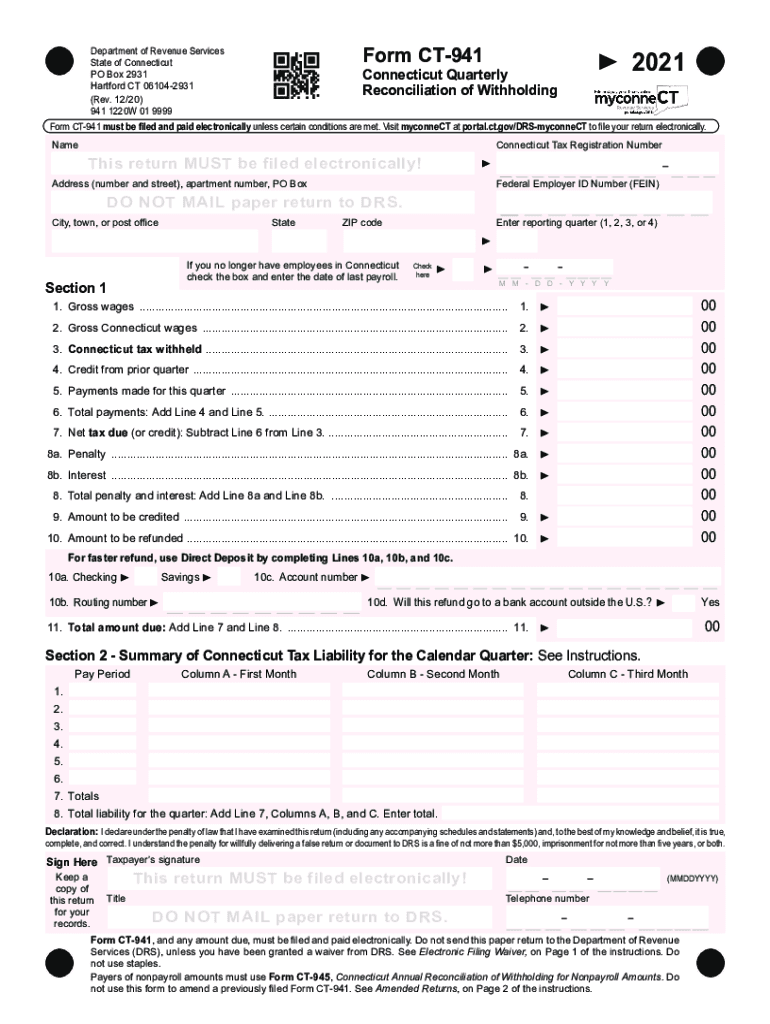

Who needs a CT-941 form?

This form is used by taxpayers in the state of Connecticut to reconcile income tax withholding from their wages. Usually, these taxpayers are employers registered for Connecticut income tax withholding. They have to file this form even if no tax is due or no tax is required to be withheld.

What is the purpose of the CT-941 form?

The Connecticut Quarterly Reconciliation of Withholding form is used to file the reconciliation of tax withholding with the Department of Revenue Service. The form contains information about the employer, paid wages and withheld taxes.

What other documents should accompany the CT-941 form?

As a rule, there is no need to attach other documents to this form. If the taxpayer has strong reasons for filing the paper version of the form, he may complete the DRS-EWVR, Electronic Filing and Payment Waiver Request. In case of paper filing, the taxpayer should make the check payable to the Commissioner of Revenue Services. If you want to change the information in the previously filed form, use CT-941X, Amended Connecticut Reconciliation of Withholding.

When is the CT-941 form due?

This form must be filed quarterly. The due dates in 2014 are the 30th of April, the 31st of July, the 31st of October and the 31st of January 2015.

What information should be provided in CT-941 form?

The taxpayer must file and pay this form electronically and provide the following details:

-

Personal information (name, address)

-

Information about the business entity and filing (Connecticut Tax Registration Number, Federal Employer ID Number, due date and reporting quarter)

-

Total amount of the wages

-

Total amount of withheld taxes

-

Account number

-

Summary of Connecticut Tax Liability for the calendar quarter (fill in the table)

The form should also be signed and dated by the taxpayer.

What do I do with the form after its completion?

If you have the right to file a paper withholding form, send it to Department of Revenue Services, Hartford CT.