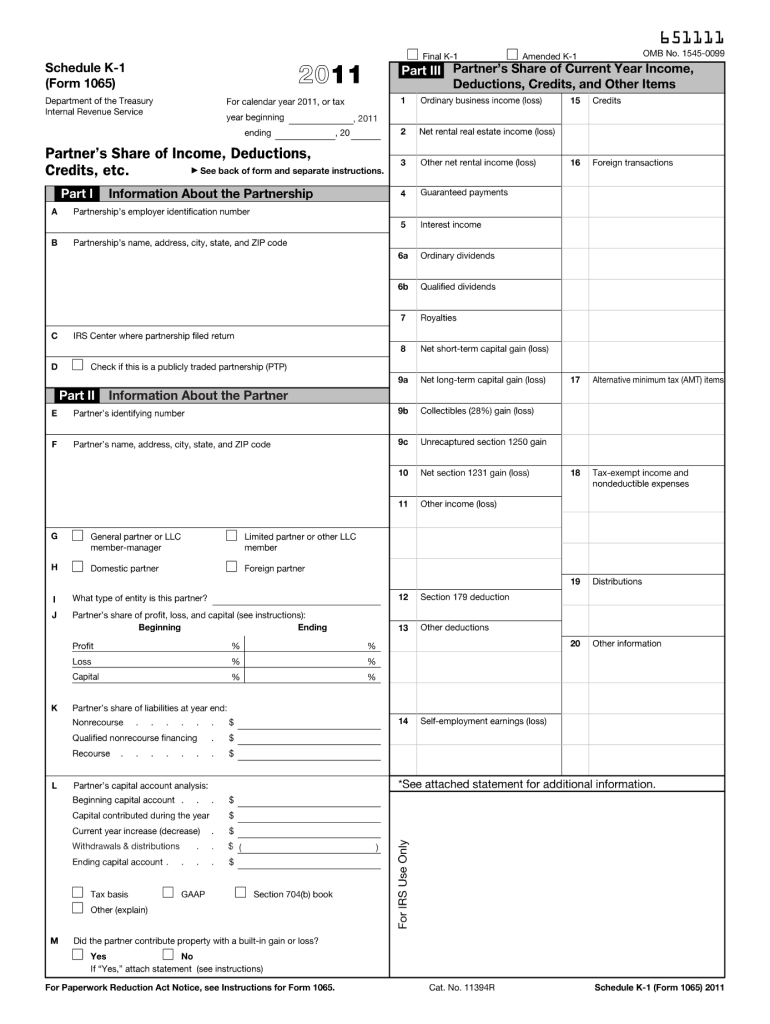

IRS 1065 - Schedule K-1 2011 free printable template

Instructions and Help about IRS 1065 - Schedule K-1

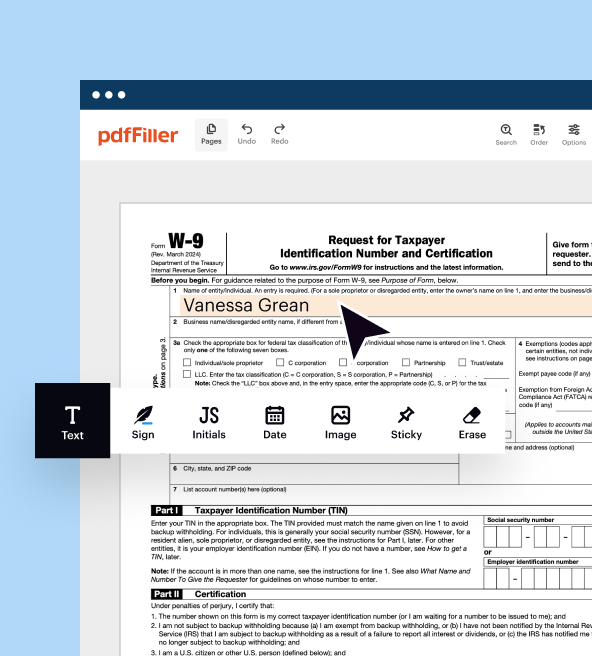

How to edit IRS 1065 - Schedule K-1

How to fill out IRS 1065 - Schedule K-1

About IRS 1065 - Schedule K-1 2011 previous version

What is IRS 1065 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

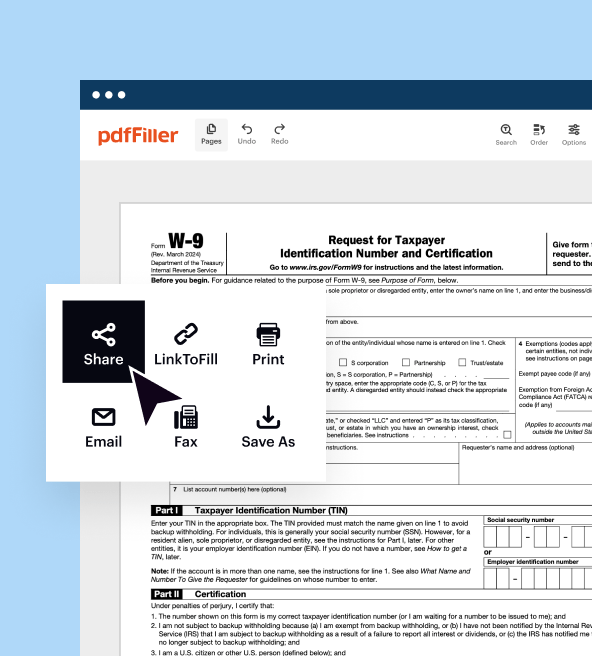

Where do I send the form?

FAQ about IRS 1065 - Schedule K-1

What should I do if I made a mistake on my form 1065 K-1 after filing?

If you realize there is an error on your form 1065 K-1 after submission, you should file an amended return. To amend your form, use the corrected information and submit it along with a letter explaining the changes. This ensures that the IRS has accurate data regarding your income and deductions.

How can I verify if my form 1065 K-1 was processed successfully?

To verify the processing status of your form 1065 K-1, you can check your tax account on the IRS website or use their resources to track the status of your submitted form. Keep an eye out for any correspondence from the IRS, which may indicate if there are issues requiring your attention.

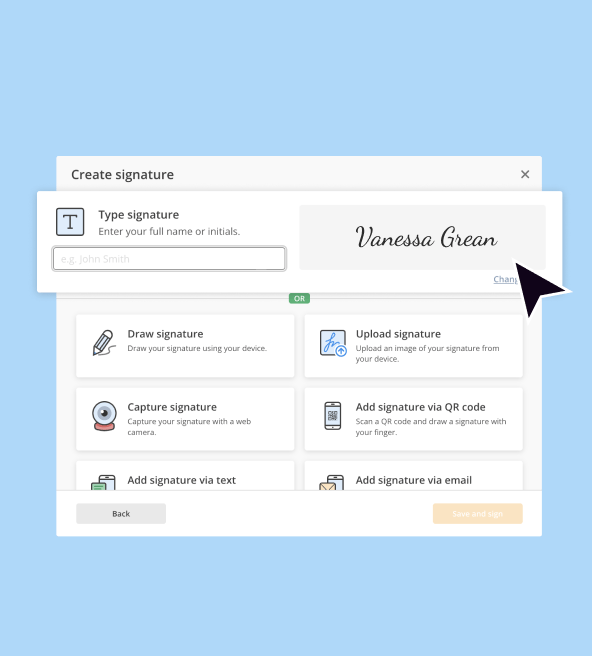

Are there specific legal requirements for using an e-signature on form 1065 K-1?

Yes, the IRS does accept e-signatures on form 1065 K-1, provided that certain conditions are met. It's important to ensure that the e-signature process complies with IRS guidelines, including maintaining a secure and verifiable method for the signature to uphold the integrity of the filing.

What common errors should I be aware of when submitting my form 1065 K-1?

Common errors when submitting form 1065 K-1 include incorrect Social Security Numbers, missing information, and failing to check calculations. These mistakes can lead to processing delays or rejections, so review the form carefully before submission to avoid complications.

What are the potential fees for e-filing my form 1065 K-1?

E-filing your form 1065 K-1 may involve service fees depending on the software or tax service you choose to use. It's a good idea to research several options, as some services offer competitive pricing or even free options for simple filings, which can save you money.

See what our users say