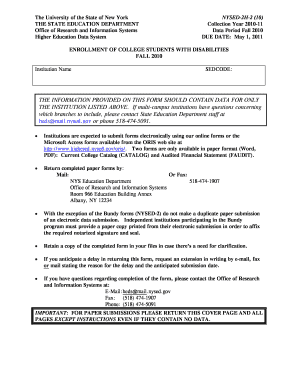

Get the free ct 706 nt tax forms

Show details

Who Must Sign and File Form CT-706 NT file Form CT-706 NT. If there is no executor or administrator then the survivor s or transferee s of the estate must file Form CT-706 NT. Individual Retirement Accounts Schedule A NT General Instructions If you are not required to file federal Form 709 stop here. You are not required to complete Schedule A NT. Enter a zero on Form CT-706 NT Section 2 Line 4. If you are required to file a federal Form 709 the ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ct 706 nt tax

Edit your ct 706 nt tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 706 nt tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct 706 nt tax online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ct 706 nt tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct 706 nt tax

How to fill out ct 706 nt tax:

01

Gather all necessary information and documents: Before filling out the ct 706 nt tax form, make sure you have all the required information and documents ready. This may include details about the decedent's estate, assets, liabilities, and any applicable tax deductions.

02

Start with the basic information: Begin by entering the basic information required on the form, such as the decedent's name, date of death, and social security number. Ensure that all the information is accurate and up-to-date.

03

Calculate the gross estate: Determine the total value of the decedent's gross estate by including all assets, such as real estate, bank accounts, investments, and personal belongings. This should also include any joint property or property held in trust.

04

Deduct allowable expenses: Subtract any allowable expenses from the gross estate. These may include funeral costs, administrative expenses, debts owed by the decedent, and charitable contributions.

05

Determine taxable estate: After deducting allowable expenses, calculate the taxable estate by subtracting exemptions and deductions. It's important to refer to the current tax laws and guidelines to ensure accurate calculations.

06

Calculate the tentative tax: Use the provided tax tables or the applicable tax rates to determine the estate tax owed on the taxable estate. This will help you calculate the tentative tax amount based on the estate's value.

07

Apply any applicable credits: Check if there are any tax credits that can be applied to reduce the estate tax liability. Examples of credits may include state death taxes or foreign death taxes.

08

Calculate the net estate tax: Subtract any applicable credits from the tentative tax to arrive at the final net estate tax owed. This is the final amount that needs to be paid or accounted for.

Who needs ct 706 nt tax:

01

Executors and administrators: The ct 706 nt tax form is typically required to be filled out by executors or administrators of an estate. They are responsible for ensuring that the decedent's estate tax is properly calculated and paid.

02

Estates exceeding the exemption amount: Generally, ct 706 nt tax is required for estates that exceed the IRS threshold for estate tax exemption. These exemption amounts are determined by current tax laws and may change from year to year.

03

Certain transfers and trusts: Additionally, ct 706 nt tax may be required for certain transfers or trusts that have specific tax implications. It's important to consult with a tax professional or refer to the IRS guidelines to determine if ct 706 nt tax is necessary.

In summary, filling out ct 706 nt tax involves gathering information, calculating the gross estate, deducting allowable expenses, determining the taxable estate, calculating the tentative tax, applying credits, and arriving at the net estate tax owed. It is typically required for executors or administrators of estates that exceed the IRS estate tax exemption threshold.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ct 706 nt tax in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your ct 706 nt tax in seconds.

How do I complete ct 706 nt tax on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your ct 706 nt tax. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I fill out ct 706 nt tax on an Android device?

Use the pdfFiller mobile app and complete your ct 706 nt tax and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is ct 706 nt tax?

The ct 706 nt tax is a form used to report generation-skipping transfer tax.

Who is required to file ct 706 nt tax?

Individuals or estates making generation-skipping transfers are required to file ct 706 nt tax.

How to fill out ct 706 nt tax?

CT 706 NT tax can be filled out by providing information about the transferor, transferee, and details of the generation-skipping transfer.

What is the purpose of ct 706 nt tax?

The purpose of ct 706 nt tax is to ensure that generation-skipping transfers are properly taxed.

What information must be reported on ct 706 nt tax?

Information such as the value of the generation-skipping transfer, relationship between the transferor and transferee, and any exemptions claimed must be reported on ct 706 nt tax.

Fill out your ct 706 nt tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct 706 Nt Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.