Probate Court Forms Ct

What is probate court forms ct?

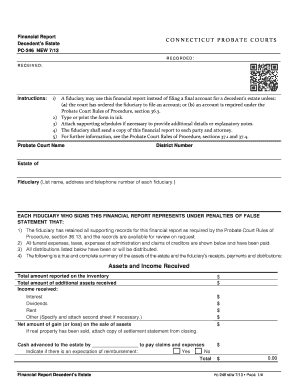

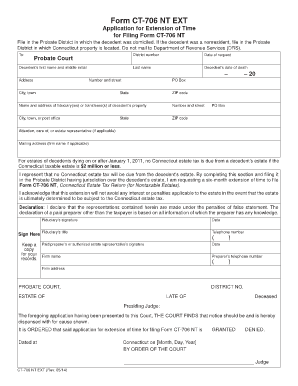

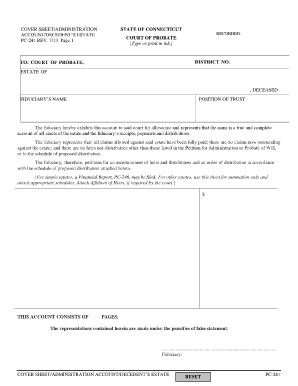

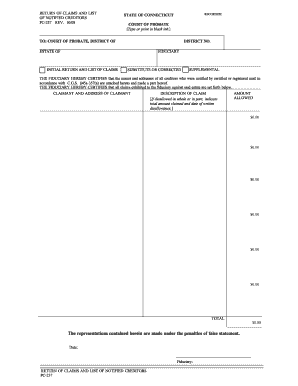

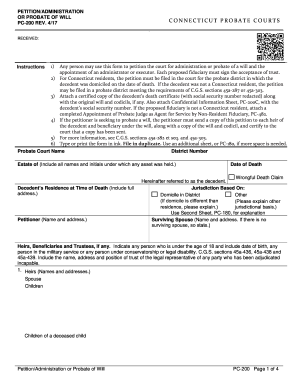

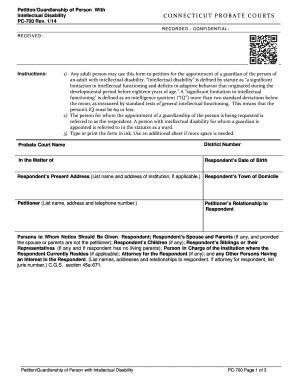

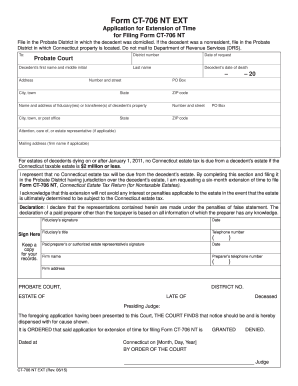

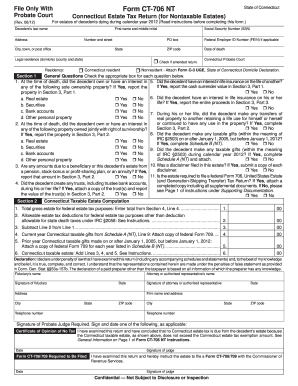

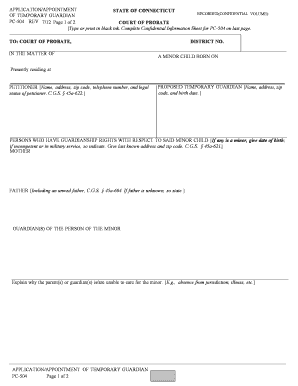

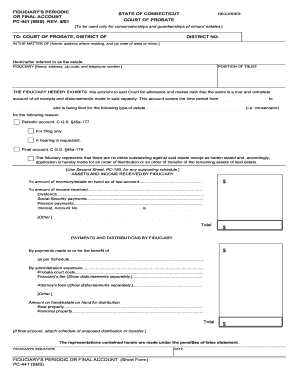

Probate court forms ct refer to the official documents that individuals need to fill out and submit to the probate court in the state of Connecticut. These forms are necessary for various probate court proceedings, such as the administration of an estate or the appointment of a guardian. By providing the required information and details, individuals can initiate legal processes and ensure their compliance with the law.

What are the types of probate court forms ct?

Probate court forms ct encompass a range of documents that serve different purposes within the probate court system. Some common types of probate court forms in Connecticut include: 1. Application for Administration 2. Application for Probate of Will 3. Application for Appointment of Guardian 4. Inventory, Appraisal, and List of Claim Form 5. Application for Assignment of Rights to Real Property These are just a few examples, and the specific forms required may vary depending on the nature of the legal proceedings.

How to complete probate court forms ct

Completing probate court forms ct may seem daunting, but with proper guidance, it can be a straightforward process. Here are the steps to follow: 1. Obtain the necessary forms: Visit the official website of the probate court or contact the court clerk to obtain the required forms for your specific situation. 2. Read the instructions: Carefully review the instructions provided with each form to understand the information required and the proper way to fill it out. 3. Gather relevant information: Collect all the necessary information and documentation needed to complete the forms accurately. 4. Fill out the forms: Use clear and legible handwriting or type the information directly into the digital forms. Ensure that all fields are filled out correctly. 5. Review and double-check: Carefully review the completed forms for any errors or missing information. Double-check the accuracy of names, dates, and other essential details. 6. Sign and submit: Sign the forms where required and submit them to the probate court as instructed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.