California Probate Forms Small Estate

What is california probate forms small estate?

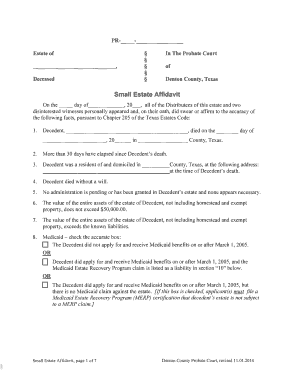

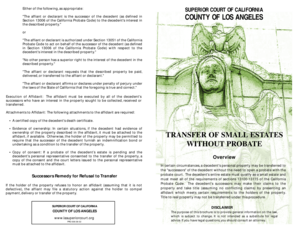

California probate forms small estate refers to the collection of legal documents used in the probate process for small estates in California. When a person passes away, their assets and debts need to be addressed. For smaller estates, these forms provide a streamlined way to transfer assets and settle debts without the need for a full probate proceeding.

What are the types of california probate forms small estate?

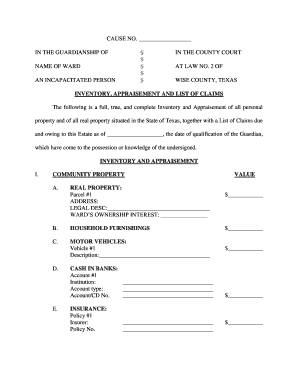

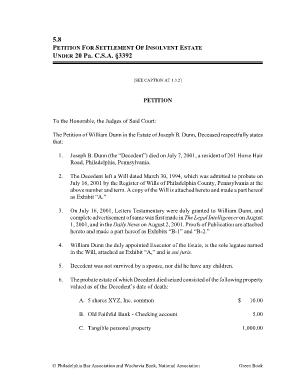

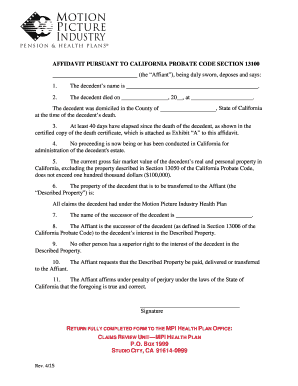

There are several types of California probate forms for small estates. These include: - Affidavit for Transfer of Personal Property Worth $166,250 or Less - Spousal Property Petition - Petition to Determine Succession to Real Property - Summary Probate Proceeding - Inventory and Appraisal Each form serves a specific purpose in the probate process and must be completed accurately and according to California probate laws.

How to complete california probate forms small estate

Completing California probate forms for small estates involves several steps. Here is a guide to help you navigate the process: 1. Gather all required information and documents, including the deceased person's assets, debts, and relevant legal documents. 2. Identify which forms are applicable to your specific situation. 3. Fill out each form accurately, providing all necessary information. 4. Review and double-check the completed forms for any errors or missing information. 5. Sign and date the forms where required. 6. File the completed forms with the appropriate California court. 7. Serve copies of the filed forms to all interested parties. 8. Follow up with the court to ensure the forms are processed and approved. Remember, it's essential to consult with an attorney or seek legal advice if you have any questions or concerns throughout the process.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.