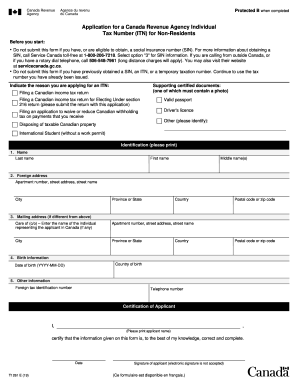

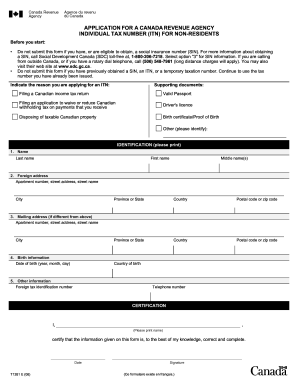

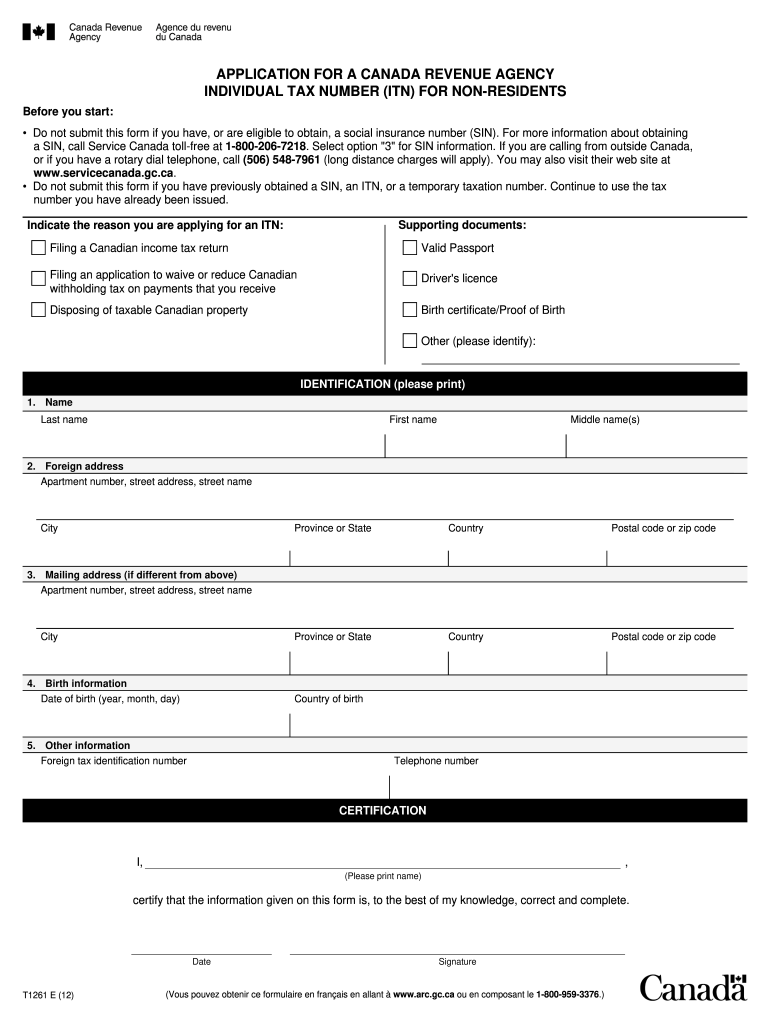

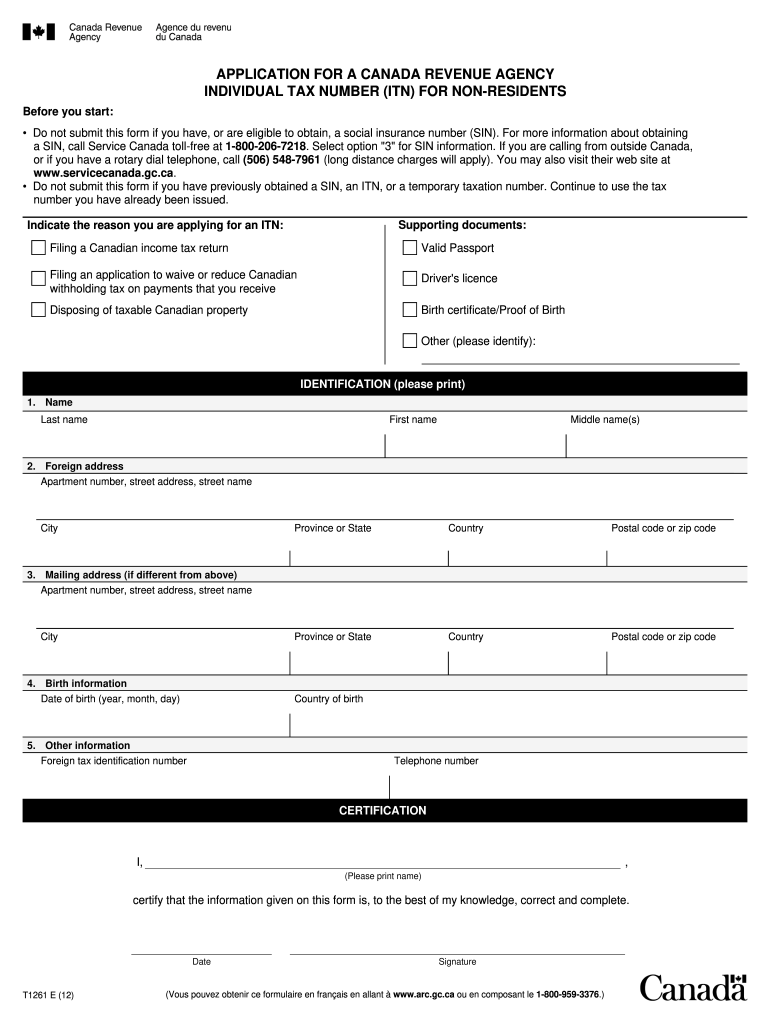

Canada T1261e 2012 free printable template

Show details

(Please print name). (Vows poured oftener CE formula ire en Fran AIs en Allan www.arc.gc.ca of en compos ant LE 1-800-959-3376.) T1261 E (12). Date ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign t1261 - cra-arc gc

Edit your t1261 - cra-arc gc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t1261 - cra-arc gc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t1261 - cra-arc gc online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit t1261 - cra-arc gc. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T1261e Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out t1261 - cra-arc gc

How to fill out Canada T1261e

01

Obtain the Canada T1261e form from the Canada Revenue Agency (CRA) website.

02

Provide your personal information including your name, address, and date of birth in the designated fields.

03

Indicate your social insurance number (SIN) or business number (BN) if applicable.

04

Specify your residency status and the applicable tax treaty country, if necessary.

05

Complete the section regarding your bank account information, including the account number and financial institution.

06

If you're filling out the form on behalf of someone else, include your representative's contact information and authorization.

07

Review all the information for accuracy and completeness.

08

Sign and date the form.

09

Submit the completed form to the CRA through the appropriate channel, either by mail or electronically if possible.

Who needs Canada T1261e?

01

Individuals or entities wishing to claim a refund on taxes withheld from Canadian income.

02

Non-residents of Canada who have income sourced in Canada and are seeking to establish residency for tax purposes.

03

Taxpayers needing to provide proof of residency or tax treaty eligibility to Canadian financial institutions.

Fill

form

: Try Risk Free

People Also Ask about

Do Canadian non residents have to file a tax return?

As a non-resident of Canada, you pay tax on income you receive from sources in Canada. The type of tax you pay and the requirement to file an income tax return depend on the type of income you receive. Generally, Canadian income received by a non-resident is subject to Part XIII tax or Part I tax.

What tax form do I need for a non-resident?

Which Form to File. Nonresident aliens who are required to file an income tax return must use Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

How do I get a Canadian tax ID number?

How Do I Get a Tax ID Number? Online using the CRA Business Registration Online (BRO) service. By phone at 1-800-959-5525; you will have to verbally answer the questions from form RC1. By filling out form RC1, Request for a Business Number (BN) and mailing or faxing it to the nearest tax service office or tax center.

What is the ITN for non residents?

An ITN is a 9-digit number issued to non-resident individuals who need an identification number. The ITN is for people who are not eligible for a social insurance number (SIN) and are considered a non-resident for tax purposes.

What form do I need to declare non residency in Canada?

If you are still not sure whether you were a non-resident of Canada for tax purposes in 2022, complete Form NR74, Determination of Residency Status (entering Canada), or Form NR73, Determination of Residency Status (leaving Canada), whichever applies, and send it to the CRA as soon as possible.

What form do I need to declare non-resident Canada?

Pros and Cons of Form NR73 If you are leaving Canada, you have the option of filling out the Determination of Residency Status form (Form NR73) with the CRA. Pros: By completing this form, the CRA can provide you with a notice of determination on your residency status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit t1261 - cra-arc gc in Chrome?

Install the pdfFiller Google Chrome Extension to edit t1261 - cra-arc gc and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit t1261 - cra-arc gc straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing t1261 - cra-arc gc.

How do I fill out t1261 - cra-arc gc using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign t1261 - cra-arc gc and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is Canada T1261e?

Canada T1261e is a tax form used by individuals who are deemed to be non-residents of Canada for tax purposes. It is primarily used to report certain financial and tax-related information.

Who is required to file Canada T1261e?

Individuals who have received certain payments from Canadian sources and are considered non-residents for tax purposes are required to file Canada T1261e.

How to fill out Canada T1261e?

To fill out Canada T1261e, individuals must provide their personal information, details of the payments received, and any relevant deductions or claims. It is important to follow the instructions provided with the form carefully.

What is the purpose of Canada T1261e?

The purpose of Canada T1261e is to provide the Canada Revenue Agency (CRA) with information about non-residents receiving payments from Canadian sources, ensuring proper tax reporting and withholding.

What information must be reported on Canada T1261e?

Information that must be reported on Canada T1261e includes the individual's name, address, social insurance number (if applicable), details of the payments received, and any taxes withheld.

Fill out your t1261 - cra-arc gc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

t1261 - Cra-Arc Gc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.