Get the free mn rev 184

Show details

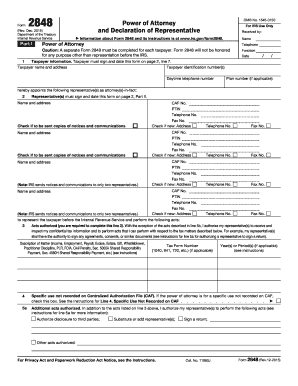

Mn.us by fax to 651-556-5210 or by mail to Minnesota Revenue Mail Station 4123 St. Paul MN 55146-4123 Rev. 12/14 Form REV184 Instructions What is a Power of Attorney POA A power of attorney POA is a legal document authorizing someone to act as your representative or appointee. It grants your appointee power to act on your behalf. It also allows your appointee to discuss your private tax and nontax debt matters with the Minnesota Department of Rev...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mn rev 184

Edit your mn rev 184 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mn rev 184 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mn rev 184 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mn rev 184. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mn rev 184

How to fill out MN DoR REV184

01

Start by downloading the MN DoR REV184 form from the Minnesota Department of Revenue website.

02

Fill out the top section with your name, address, and Social Security number.

03

Indicate the tax year for which you are filing.

04

Complete the income section with accurate figures from your tax documents.

05

Provide any deductions or credits that apply to your situation.

06

Review your entries for accuracy to ensure there are no mistakes.

07

Sign and date the form at the bottom.

08

Submit the completed form to the Minnesota Department of Revenue via mail or electronically.

Who needs MN DoR REV184?

01

Individuals who need to report their income tax for the applicable tax year.

02

Taxpayers seeking to claim deductions or credits in Minnesota.

03

Anyone who has received income or tax documents relevant to Minnesota tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is a power of attorney for Minnesota income tax?

A power of attorney (POA) is a legal document that grants an attorney, accountant, agent, tax return preparer, or other person authority to access the business taxpayer's account information and represent the taxpayer before the Minnesota Department of Revenue.

What is Minnesota Rev 184 power of attorney?

A Minnesota tax power of attorney form (REV184), otherwise known as Minnesota Department of Revenue Power of Attorney, is a form you can fill out to appoint an agent to represent you before the Department of Finance and Administration.

Why am I getting a letter from MN Dept of Revenue?

You may receive a letter from the Minnesota Department of Revenue indicating we received a suspicious Minnesota income tax or property tax refund return. In these cases, we stop processing the return to safeguard your information.

What happens if I can't pay my state taxes in MN?

If you cannot pay your debt in full, you may call us at 651-556-3003 or 1-800-657-3909 (toll- free) to request a payment agreement. Payment agreements that include tax debt must pay a nonrefundable $50 fee. If you cannot afford a payment agreement or the $50 fee, you may apply for a financial hardship.

How do I pay my Minnesota Department of Revenue?

Call 651-556-3000 or 1-800-657-3666 (toll-free) at least three business days before the scheduled payment date. An Automated Clearing House (ACH) credit is when you request a bill payment through your bank. Some banks charge a fee for this service. For details, see Paying by ACH Credit.

How to avoid Minnesota state income tax?

You do not need to pay Minnesota income tax if either of these apply: You are a full-year Minnesota resident who is not required to file a federal income tax return. You are a part-year resident or nonresident whose Minnesota gross income is below the minimum filing requirement ($12,900 for 2022).

Why am I getting a letter from the Minnesota Department of Revenue?

We notify you by mail 60 days before we file an offset claim with the U.S. Treasury Department to take your federal tax refunds or government payments. This letter informs you: Which agency is filing an offset claim.

What does MN Department of Revenue do?

The Minnesota Department of Revenue manages the state's revenue system and administers state tax laws. The department manages over 30 different taxes and collects $26.7 billion annually.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mn rev 184 for eSignature?

Once your mn rev 184 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the mn rev 184 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your mn rev 184 in minutes.

How do I edit mn rev 184 on an Android device?

You can make any changes to PDF files, such as mn rev 184, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is MN DoR REV184?

MN DoR REV184 is a form used by the Minnesota Department of Revenue for reporting certain tax-related information, typically related to the taxation of income or financial transactions.

Who is required to file MN DoR REV184?

Individuals or entities that have specific tax obligations in Minnesota and meet certain criteria as defined by the Department of Revenue are required to file MN DoR REV184.

How to fill out MN DoR REV184?

To fill out MN DoR REV184, taxpayers must provide accurate information regarding their financial or tax-related data as requested on the form, following the provided instructions carefully.

What is the purpose of MN DoR REV184?

The purpose of MN DoR REV184 is to ensure proper reporting of taxable income and transactions to the Minnesota Department of Revenue for compliance with state tax laws.

What information must be reported on MN DoR REV184?

The information that must be reported on MN DoR REV184 includes identification details such as the taxpayer's name, address, tax identification number, and details regarding the taxable transactions or income.

Fill out your mn rev 184 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mn Rev 184 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.