Get the free Sample Credit Report - Experian

Show details

Oct 15, 2012 ... Experian collects and organizes information about you and your credit history from public records, your creditors and other reliable sources.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample credit report

Edit your sample credit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample credit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample credit report online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sample credit report. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample credit report

How to fill out sample credit report:

01

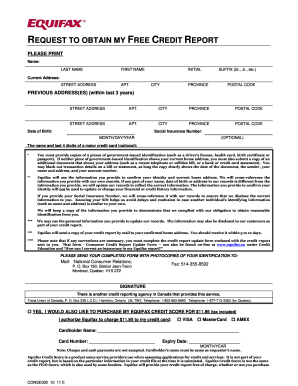

Start by gathering all the necessary information, including personal details such as your name, address, Social Security number, and date of birth.

02

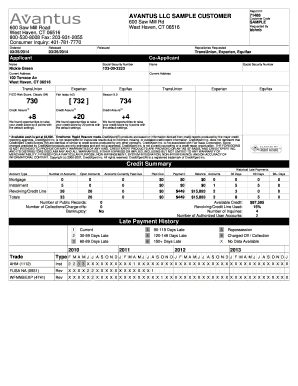

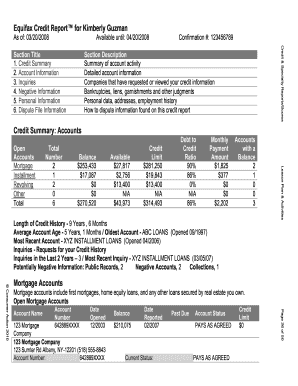

Identify the different sections of the credit report, which typically include personal information, credit accounts, payment history, public records, and inquiries.

03

Review each section and provide accurate and up-to-date information. For personal information, ensure that all the details are correct, as any errors could affect your credit score.

04

In the credit accounts section, list all your current and past credit accounts, including credit cards, loans, and mortgages. Provide details such as the creditor's name, account number, the date the account was opened, and the credit limit or loan amount.

05

Go through your payment history section and carefully report whether each payment was made on time, late, or not paid at all. Accuracy is crucial here, as this section heavily impacts your credit score.

06

Check the public records section, which includes any bankruptcies, tax liens, or judgments against you. Ensure that all information is correct, and if any inaccuracies are found, take steps to correct them.

07

Finally, review the inquiries section and verify that all the listed inquiries were authorized by you. Unauthorized inquiries can negatively impact your credit score.

Who needs sample credit report:

01

Individuals who want to monitor and maintain a good credit score.

02

People who are applying for loans, mortgages, or credit cards.

03

Those who are disputing any inaccuracies or errors on their credit report.

04

Financial institutions, lenders, and creditors who need to assess an individual's creditworthiness.

05

Landlords who are screening potential tenants.

06

Anyone who wants to understand their financial health and track their credit history effectively.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a credit report in PDF format?

How To Download And Print Your Credit Report Step 1: Log in or sign up to see your credit report. If you haven't already, you will need to sign up to checkmyfile to view your Credit Report online before you can download it. Step 2: click 'Download Printable Report' Step 3: Save or send your Credit Report as a PDF.

How do I create a PDF from Experian credit report?

From your browser, select File > Print. This should open your printer options and allow you to print or save your credit report. You can also use control + P or command + P to bring up the print window. From your computer's Print screen, you can choose to print or save as a PDF.

What is a good example of credit?

There are many different forms of credit. Common examples include car loans, mortgages, personal loans, and lines of credit. Essentially, when the bank or other financial institution makes a loan, it "credits" money to the borrower, who must pay it back at a future date.

What is considered bad on a credit report?

A bad credit score is a FICO credit score below 670 and a VantageScore lower than 661.

Is Experian a good credit report?

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

What is an example of a good credit report?

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

How do I fill out a credit dispute form?

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

What shows up on an Experian credit report?

Your credit report, sometimes referred to as your credit file or credit history, is a detailed record of all your credit and debt accounts. It contains information about how much debt you have, how often you pay your credit and debt bills on time, and how long you have been managing your credit accounts.

Is your credit score is found in your credit report?

Your credit reports give a comprehensive list of your lines of credit and payment history, but they don't contain your credit score. Three major credit-reporting companies — Equifax, Experian and TransUnion — compile the reports.

How do I build my credit score with Experian?

10 tips to improve your credit score Prove where you live. Build your credit history. Make regular payments on time. Keep your credit utilisation low. See if you could get an instant score boost. Check for errors and report any mistakes on your report. Monitor your credit file for fraudulent activity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sample credit report in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your sample credit report as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make edits in sample credit report without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing sample credit report and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out the sample credit report form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign sample credit report and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is sample credit report?

A sample credit report is a representative document that outlines an individual's credit history, including their borrowing and repayment behaviors, and other relevant financial information.

Who is required to file sample credit report?

Entities such as lenders, creditors, and financial institutions typically need to file a sample credit report when evaluating the creditworthiness of borrowers.

How to fill out sample credit report?

To fill out a sample credit report, you should include personal identification information, details about credit accounts, payment history, outstanding debts, and any public records such as bankruptcies.

What is the purpose of sample credit report?

The purpose of a sample credit report is to assess an individual's creditworthiness and provide lenders with the information needed to make informed lending decisions.

What information must be reported on sample credit report?

A sample credit report must report personal information, credit account details, payment histories, credit limits, outstanding balances, inquiries, and any legal judgments or bankruptcies.

Fill out your sample credit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Credit Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.