SC DoR PT-401 2003 free printable template

Show details

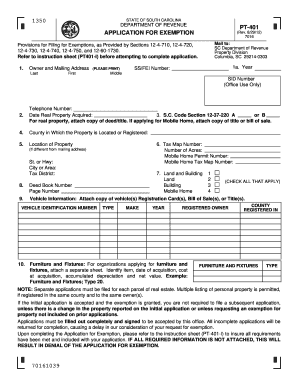

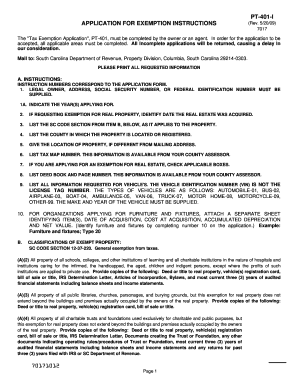

PT-401 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE Rev. 7/8/03 APPLICATION FOR EXEMPTION Provisions for Filing for Exemptions as Provided by Sections 12-4-710 12-4-720 12-4-730 12-4-740 12-4-750 and 12-60-1730. Mail to SC Department of Revenue Property Division Columbia SC 29214-0303 Refer to instruction sheet PT401-I before attempting to complete application. Owner and Mailing Address Last PLEASE PRINT First 1a. Year SS/FEI Number Middle SID Number Office Use Only Telephone Number Date...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR PT-401

Edit your SC DoR PT-401 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR PT-401 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR PT-401 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC DoR PT-401. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR PT-401 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR PT-401

How to fill out SC DoR PT-401

01

Obtain a copy of the SC DoR PT-401 form.

02

Fill out the taxpayer's personal information, including name, address, and Social Security number.

03

Provide details of the property being described, including its location and type of property.

04

Indicate the specific purpose for which the form is being submitted.

05

Complete any additional sections as required by your particular situation.

06

Review the form for accuracy and completeness.

07

Sign and date the form.

08

Submit the form to the appropriate department as specified in the instructions.

Who needs SC DoR PT-401?

01

Individuals or entities that are filing for a particular property tax exemption in South Carolina.

02

Property owners who are seeking to claim certain tax responsibilities or benefits associated with their property.

Fill

form

: Try Risk Free

People Also Ask about

What is the ATI exemption in South Carolina?

What is the definition of an ATI Exemption? South Carolina law now allows a partial exemption from taxation of up to 25% of an "ATI fair market value" that is the result of an Assessable Transfer of Interest.

Who qualifies for Homestead Exemption in South Carolina?

What is the Homestead Exemption benefit? The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

When can I apply for Homestead Exemption in SC?

Apply between July 16th and before the first penalty date of the tax year that the exemption can first be claimed. If you apply during the post-application period and you qualify, you may be eligible for a refund for the preceding year.

How much does the Homestead Exemption save you in South Carolina?

The Homestead Exemption Program is a State funded program authorized under Section 12-37-250 of the South Carolina Code of Laws. The program exempts the first $50,000 fair market value of primary residence from all property taxes.

How to apply for property tax exemption in South Carolina?

Where do I apply? You must apply for the Homestead Exemption at your County Auditor's office. If you are unable to go to the Auditor's office, you may authorize someone to apply for you. Contact the County Auditor's Office for details.

How do I get a 4% property tax in South Carolina?

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year. Only an owner-occupant is eligible to apply for the 4% special assessment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my SC DoR PT-401 in Gmail?

SC DoR PT-401 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I execute SC DoR PT-401 online?

pdfFiller makes it easy to finish and sign SC DoR PT-401 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my SC DoR PT-401 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your SC DoR PT-401 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is SC DoR PT-401?

SC DoR PT-401 is a tax form used in South Carolina for reporting income and withholding for individuals and businesses.

Who is required to file SC DoR PT-401?

Individuals and businesses in South Carolina that have income subject to state withholding are required to file SC DoR PT-401.

How to fill out SC DoR PT-401?

To fill out SC DoR PT-401, taxpayers need to provide their identification information, income details, withholding amounts, and any applicable deductions or credits.

What is the purpose of SC DoR PT-401?

The purpose of SC DoR PT-401 is to report the amount of state income tax withheld from employees or other payments to the South Carolina Department of Revenue.

What information must be reported on SC DoR PT-401?

SC DoR PT-401 requires reporting information such as the taxpayer's name, address, Social Security number or federal employer identification number, total income, and total state tax withheld.

Fill out your SC DoR PT-401 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR PT-401 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.