SC DoR PT-401 2009 free printable template

Show details

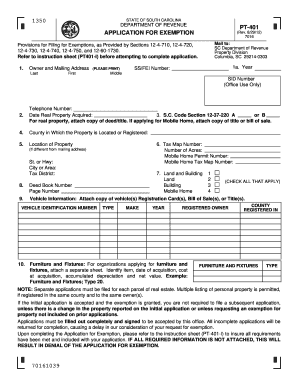

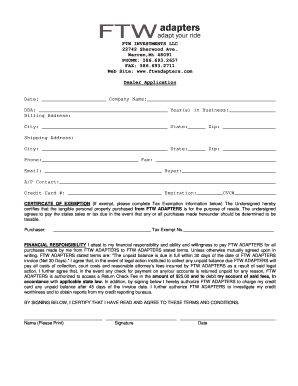

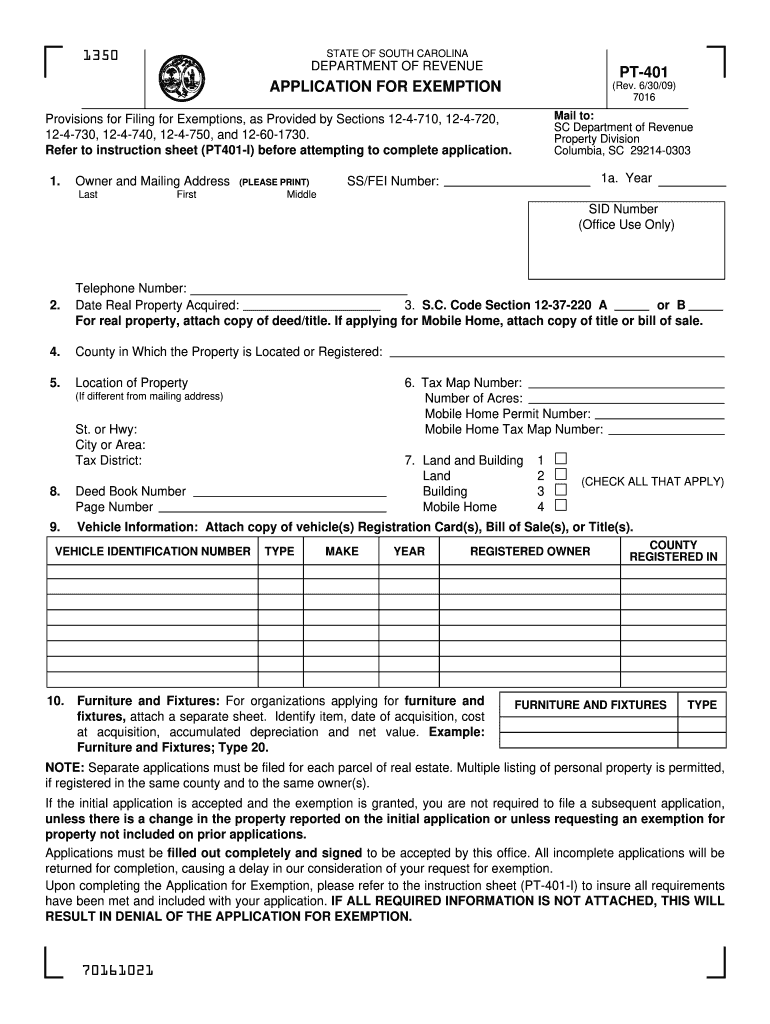

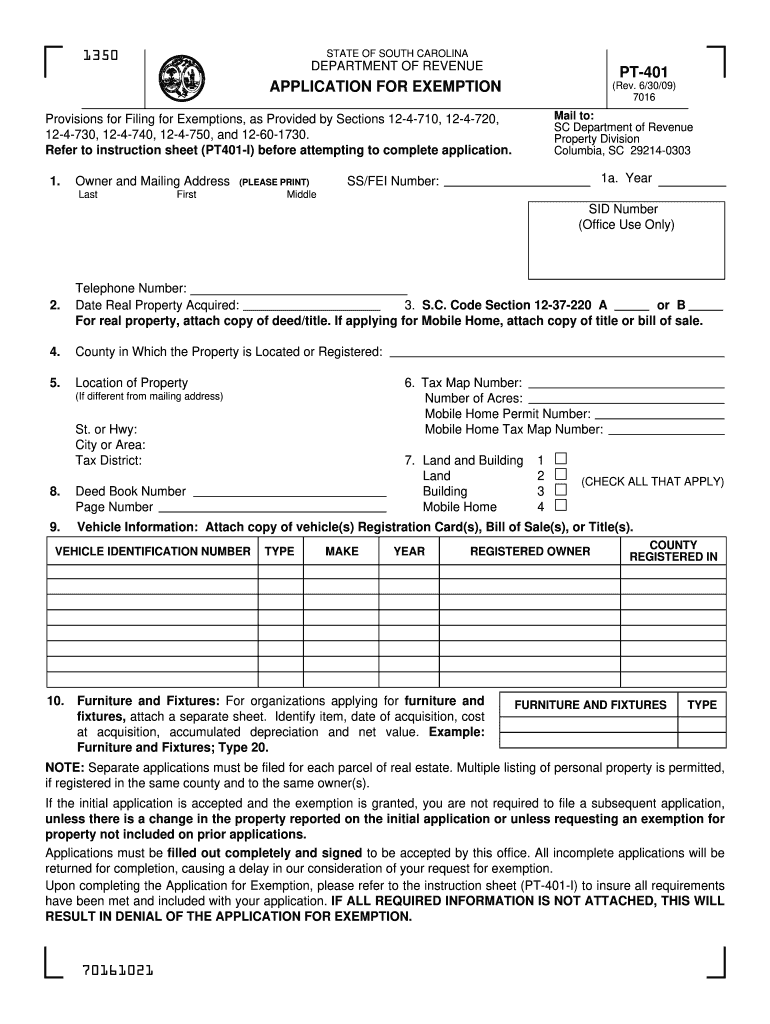

STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE PT-401 APPLICATION FOR EXEMPTION (Rev. 6/30/09) 7016 Mail to: SC Department of Revenue Property Division Columbia, SC 29214-0303 Provisions for Filing

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR PT-401

Edit your SC DoR PT-401 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR PT-401 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR PT-401 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC DoR PT-401. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR PT-401 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR PT-401

How to fill out SC DoR PT-401

01

Gather necessary personal and financial information.

02

Obtain the SC DoR PT-401 form from the official website or office.

03

Fill in your name, address, and contact information at the top of the form.

04

Provide details about the property in question, including its location and description.

05

State the reason for the request in the appropriate section.

06

Include any required attachments or supporting documentation.

07

Review the form for accuracy and completeness.

08

Sign and date the form before submission.

09

Submit the form to the relevant department either in person or through the specified submission method.

Who needs SC DoR PT-401?

01

Property owners seeking to resolve tax issues.

02

Individuals applying for property tax exemptions.

03

Anyone involved in property disputes or assessments in South Carolina.

Fill

form

: Try Risk Free

People Also Ask about

How do I get exempt from SC taxes?

Most property tax exemptions are found in South Carolina Code Section 12-37-220. For any real property exemptions taxation is a year in arrears, meaning to be exempt for the current year, you must be the owner of record and your effective date of disability must be on or before December 31 of the previous year.

How do I get a 4% property tax in South Carolina?

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year. Only an owner-occupant is eligible to apply for the 4% special assessment.

What is the SC ATI exemption?

What is the definition of an ATI Exemption? South Carolina law now allows a partial exemption from taxation of up to 25% of an "ATI fair market value" that is the result of an Assessable Transfer of Interest.

What is the 4% property tax rate in SC?

RESIDENTIAL PROPERTY A person's primary residence and not more than 5 contiguous acres, when owned totally, or in part, in fee or by life estate and occupied by the owner, is taxed on an assessment equal to 4% of the fair market value. A person's second home or vacation home is taxed at an assessment ratio equal to 6%.

What is 100 disabled veteran tax exemption in SC?

Veteran residents who have a 100% permanent and total service-connected disability rating from the VA – qualify for a tax exemption on: Home and land up to 5 acres (Exemption passes to the Surviving Spouse if they maintain sole ownership)

How to apply for property tax exemption in South Carolina?

Where do I apply? You must apply for the Homestead Exemption at your County Auditor's office. If you are unable to go to the Auditor's office, you may authorize someone to apply for you. Contact the County Auditor's Office for details.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit SC DoR PT-401 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including SC DoR PT-401, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit SC DoR PT-401 online?

The editing procedure is simple with pdfFiller. Open your SC DoR PT-401 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I fill out SC DoR PT-401 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your SC DoR PT-401 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is SC DoR PT-401?

SC DoR PT-401 is a tax form used in South Carolina for reporting income and other related tax information for individuals and businesses.

Who is required to file SC DoR PT-401?

Individuals and businesses in South Carolina that meet certain income thresholds or other tax liabilities are required to file SC DoR PT-401.

How to fill out SC DoR PT-401?

To fill out the SC DoR PT-401, taxpayers should gather their income documentation, complete the form according to the instructions provided by the South Carolina Department of Revenue, and ensure all required fields are filled correctly.

What is the purpose of SC DoR PT-401?

The purpose of SC DoR PT-401 is to report personal income tax information and facilitate assessment of tax liabilities in South Carolina.

What information must be reported on SC DoR PT-401?

Information that must be reported on SC DoR PT-401 includes total income, deductions, credits, and any other relevant tax information as specified in the form instructions.

Fill out your SC DoR PT-401 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR PT-401 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.