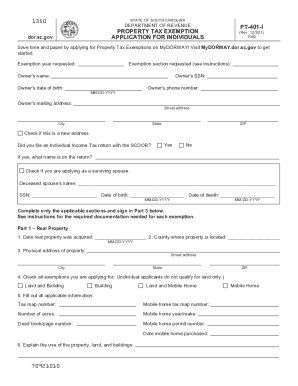

SC PT-401-I 2022 free printable template

Get, Create, Make and Sign sc homestead exemption form

How to edit sc homestead exemption form online

Uncompromising security for your PDF editing and eSignature needs

SC PT-401-I Form Versions

How to fill out sc homestead exemption form

How to fill out SC PT-401-I

Who needs SC PT-401-I?

Instructions and Help about sc homestead exemption form

ELIMINATE AN ANNUAL PROPERTY TARBELL FOR EVERYONE IN SOUTHCAROLINA OUR MANDY GATHER HAS MORE IN SOUTH CAROLINA 38 TAXES PAID COME FROM PROPERTYTAXES ACCORDING TO FORMER STATEHOUSE REPRESENTATIVES PHILLIPOWENS AND DON BOWEN FOR THE PAST TWO YEARS THE MOHAVE WORKED ON A PLAN THAT WOULDCHANGE THE WAY TAXES ARE PAID PEOPLE HAVE NO CONTROL OVERCOAT PROPERTY TAXES THEY PAY YOU-- BUT PROPERTY TAXES THEY PAY YOU PAY A PRICE FOR A HOUSE ANOTHER THEY ASSESS YOUR HOUSEMEN THEY REASSESS YOUR HOUSE AND THEY CAN MOVE THE MILLAGE-- THE MILLAGE UNDER THE EQUITABLE TAXATION IN SOUTH CAROLINA Plans A SALESMAN WOULD BE PAID UP FRONT WHEN PROPERTY IS BOUGHT THEN THE PROPERTY OR BUSINESSWEEK WOULDN'T HAVE TO PAY TAXES ON THAT PROPERTY AGAIN OWNER OCCUPIED HOMES WITH OWNERS WHO HAVE LIVED IN THE STATE FOR5 YEARS THAT ARE 100000 ORL ESS WOULD BE EXEMPT MEANING NO TAXES WOULD BE PAID THERE WOULD BE A 10 SALES TAXON THE SELLING PRICE AFTER THE100000 DOLLAR EXEMPTION IF YOU DON'T WANT TO PAY THE10 UP FRONT YOU HAVE TO THINKABLE IT THIS WAY OVER THE LIFE OF A NORMAL LOAN25 YEARS YOU WILL SAVE 16245IN PROPERTY TAXES SO YEAH ARE PAYING THAT 15000 UPFRONT BUT YOU'RE GOING TO PROPERTY TAXES THROUGH THE LIFE OF THAT 25-YEAR LOAN THERE WOULD ALSO BE A 5SALES TAX AT POINT OF SALE VEHICLES OVER 10000 VEHICLESUNDER THAT AMOUNT WOULD NOT Betray AND A 10 SALES TAX ADDED ONTOINTERNET SALES LIKE A PURCHASE ON AMAZON SERVICES LIKEATTORNEYS FEES AND ON GOODS BUT NOT ON GROCERIES MEDICAL UTILITIES WERE ALLOWING THE TAXPAYER TO DECIDE WHERE THEY WANT TO Partake WITH THE EXEMPTIONS WHAT THEY ACTUALLY HAVE TO HAVE-- HAVE TO HAVE BOWEN AND OWENS NOW HOPING ROGET SUPPORT FOR THEIR PLAN AND GET LAWMAKERS IN COLUMBIA ON

People Also Ask about

What is the 4% property tax rate in SC?

How much is the Homestead Exemption in SC?

How to apply for property tax exemption in South Carolina?

What is the 25 property tax exemption in SC?

How do I get a 4% property tax in South Carolina?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sc homestead exemption form without leaving Google Drive?

How do I execute sc homestead exemption form online?

Can I create an electronic signature for signing my sc homestead exemption form in Gmail?

What is SC PT-401-I?

Who is required to file SC PT-401-I?

How to fill out SC PT-401-I?

What is the purpose of SC PT-401-I?

What information must be reported on SC PT-401-I?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.