SC PT-401-I 2019 free printable template

Show details

1350

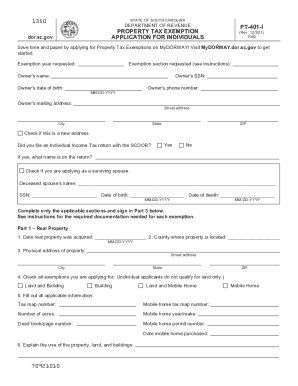

for.SC.gestate OF SOUTH CAROLINADEPARTMENT OF REVENUEPT401IPROPERTY TAX EXEMPTION

APPLICATION FOR INDIVIDUALSExemption year requested:(Rev. 11/4/19)

7092SID #:

Office Use OnlyExemption section

pdfFiller is not affiliated with any government organization

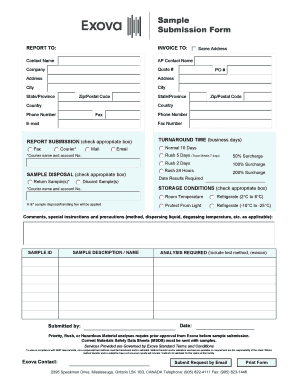

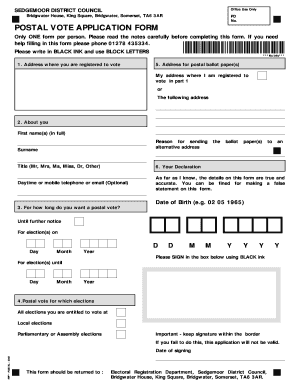

Get, Create, Make and Sign SC PT-401-I

Edit your SC PT-401-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC PT-401-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC PT-401-I online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SC PT-401-I. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC PT-401-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC PT-401-I

How to fill out SC PT-401-I

01

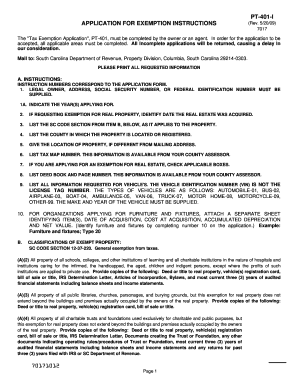

Obtain the SC PT-401-I form from the South Carolina Department of Revenue website or a local office.

02

Fill in your name, address, and Social Security number in the appropriate fields.

03

Provide your filing status (single, married, etc.) as specified in the instructions.

04

Report your income as required, including wages, dividends, and any other sources of income.

05

Deduct any applicable exemptions and credits to calculate your taxable income.

06

Complete the tax computation section based on the instructions provided in the form.

07

Attach any required supporting documents, such as W-2 forms or 1099 forms.

08

Review your completed form for accuracy and sign where indicated.

09

Submit the form by the deadline specified by the South Carolina Department of Revenue.

Who needs SC PT-401-I?

01

Individuals who have earned income in South Carolina and need to file their state income tax return.

02

Residents of South Carolina who wish to report their income and calculate their state tax liability.

03

Non-residents who have income sourced from South Carolina.

Fill

form

: Try Risk Free

People Also Ask about

At what age do you stop paying property taxes in North Carolina?

North Carolina defers a portion of the property taxes on the appraised value of a permanent residence owned and occupied by a North Carolina resident who has owned and occupied the property at least five years, is at least 65 years of age or is totally and permanently disabled, and whose income does not exceed $50,700.

Who is exempt from property tax in NC?

All taxable personal property in North Carolina is appraised at its true value in money. The two main exceptions are inventories owned by manufacturers, retailers, wholesalers, and contractors as well as non-business personal property. These types of personal property have been exempted by statute in North Carolina.

What are the tax advantages for seniors in North Carolina?

One of the benefits of retiring in North Carolina is that the state offers tax breaks for seniors. If you're over 65, you can exempt up to $35,000 of your retirement income from state taxes. In addition, Social Security income is not taxed, and income taxes have been lowered to a flat rate, to 4.9% in 2022.

At what age do seniors stop paying property taxes in Florida?

Senior Exemption Information The Senior Exemption is an additional property tax benefit available to home owners who meet the following criteria: The property must qualify for a homestead exemption. At least one homeowner must be 65 years old as of January 1.

How do I get a 4% property tax in South Carolina?

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year. Only an owner-occupant is eligible to apply for the 4% special assessment.

How to apply for property tax exemption in South Carolina?

Where do I apply? You must apply for the Homestead Exemption at your County Auditor's office. If you are unable to go to the Auditor's office, you may authorize someone to apply for you. Contact the County Auditor's Office for details.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify SC PT-401-I without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including SC PT-401-I, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit SC PT-401-I in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your SC PT-401-I, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the SC PT-401-I electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your SC PT-401-I in seconds.

What is SC PT-401-I?

SC PT-401-I is a tax form used in South Carolina for reporting the income and tax liability of certain pass-through entities, such as partnerships and S corporations.

Who is required to file SC PT-401-I?

Pass-through entities doing business in South Carolina or having income sourced in South Carolina are required to file SC PT-401-I.

How to fill out SC PT-401-I?

To fill out SC PT-401-I, entities must provide their basic information, report income and expenses, compute tax liability, and ensure all required attachments are included before submitting to the South Carolina Department of Revenue.

What is the purpose of SC PT-401-I?

The purpose of SC PT-401-I is to report the tax liabilities of pass-through entities and ensure that income is properly taxed at the entity level, allowing for the income to be passed through to individual members or shareholders.

What information must be reported on SC PT-401-I?

Information that must be reported on SC PT-401-I includes the entity's income, deductions, credits, and the total tax owed, along with pertinent details about the entity and its members.

Fill out your SC PT-401-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC PT-401-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.