SC PT-401-I 2018 free printable template

Show details

1350

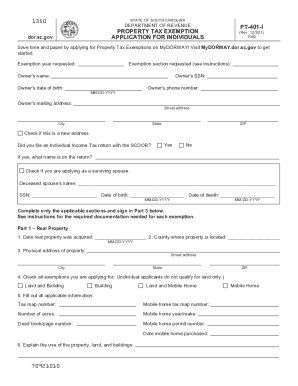

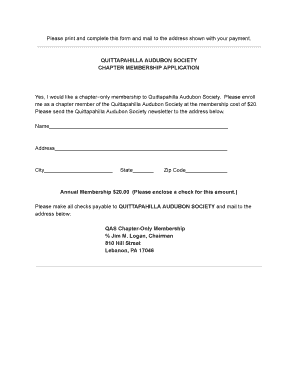

for.SC.gestate OF SOUTH CAROLINADEPARTMENT OF REVENUEPT401IPROPERTY TAX EXEMPTION

APPLICATION FOR INDIVIDUALS(Rev. 10/17/18)

7092Mail to: South Carolina Department of Revenue, Government Services

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign property tax exemption for

Edit your property tax exemption for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax exemption for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax exemption for online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property tax exemption for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC PT-401-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out property tax exemption for

How to fill out SC PT-401-I

01

Gather your personal information, including your name, address, and Social Security number.

02

Identify your filing status and the type of tax return you are submitting.

03

Complete the identification section at the top of the form.

04

Fill in the income section by reporting all income sources accurately.

05

Deduct any eligible expenses or deductions in the provided sections.

06

Calculate your total tax liability based on the provided tax tables or schedules.

07

Review the form for any errors or omissions.

08

Sign and date the form before submission.

Who needs SC PT-401-I?

01

Individuals residing in South Carolina who have to report specific types of income or claim certain deductions.

02

Taxpayers who need to report income that is not already accounted for on their regular tax returns.

03

Residents who are involved in specific tax situations that require the SC PT-401-I form for accurate reporting.

Fill

form

: Try Risk Free

People Also Ask about

What property tax exemptions are available in South Carolina?

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

At what age do you stop paying property taxes in South Carolina?

What is the Homestead Exemption benefit? The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

What is the 4% property tax rate in SC?

RESIDENTIAL PROPERTY A person's primary residence and not more than 5 contiguous acres, when owned totally, or in part, in fee or by life estate and occupied by the owner, is taxed on an assessment equal to 4% of the fair market value. A person's second home or vacation home is taxed at an assessment ratio equal to 6%.

How to apply for property tax exemption in South Carolina?

Where do I apply? You must apply for the Homestead Exemption at your County Auditor's office. If you are unable to go to the Auditor's office, you may authorize someone to apply for you. Contact the County Auditor's Office for details.

How do I get a 4% property tax in South Carolina?

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year. Only an owner-occupant is eligible to apply for the 4% special assessment.

What is the senior property tax exemption in South Carolina?

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

What is the 25 property tax exemption in SC?

South Carolina law now allows a partial exemption from taxation of up to 25% of an “ATI fair market value” that is the result of an Assessable Transfer of Interest. The exemption allowed results in a “taxable value” of either 75% of the “ATI fair market value” or the current fair market value, whichever is higher.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute property tax exemption for online?

pdfFiller has made it easy to fill out and sign property tax exemption for. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit property tax exemption for online?

The editing procedure is simple with pdfFiller. Open your property tax exemption for in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit property tax exemption for straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing property tax exemption for.

What is SC PT-401-I?

SC PT-401-I is a tax form used in South Carolina for reporting the income tax liability of pass-through entities, including partnerships and S corporations.

Who is required to file SC PT-401-I?

Pass-through entities, such as partnerships and S corporations doing business in South Carolina, are required to file SC PT-401-I.

How to fill out SC PT-401-I?

To fill out SC PT-401-I, you must provide information regarding the entity's income, deductions, and credits, as well as details about the partners or shareholders and their distribution of income.

What is the purpose of SC PT-401-I?

The purpose of SC PT-401-I is to report the income tax liabilities of pass-through entities and to facilitate the proper taxation of income that passes through to the owners.

What information must be reported on SC PT-401-I?

SC PT-401-I must report the entity's total income, deductions, credits, and the amounts distributed to each partner or shareholder, as well as their individual tax identification information.

Fill out your property tax exemption for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Exemption For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.