Get the free teacher pay stub example

Show details

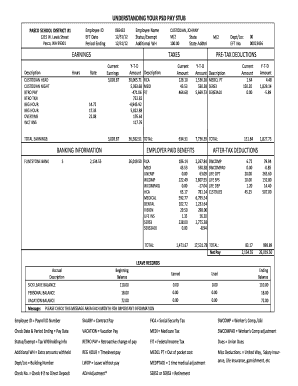

This document provides detailed instructions on how to interpret a teacher's pay stub, outlining salary calculations, deductions, and benefits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign teacher pay stub form

Edit your teacher pay stub example form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your teacher pay stub example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing teacher pay stub example online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit teacher pay stub example. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out teacher pay stub example

01

To fill out a teacher paystub, start by gathering all the necessary information such as your personal details, employment information, and relevant financial data.

02

Begin by entering your full name, contact information, and employee identification number (if applicable) at the top of the paystub.

03

Next, provide your employer's name, address, and contact details in the designated section.

04

Specify the pay period for which the paystub is being issued. This typically includes the start and end date of the pay period.

05

Record your gross income or salary within the designated field. This is the total amount you earn before any deductions.

06

Deductions such as taxes, insurance premiums, retirement contributions, and other withholdings need to be subtracted from your gross income. Enter each deduction separately, along with the corresponding amount.

07

Subtract the total deductions from your gross income to calculate your net pay or take-home pay. This is the amount you will receive after all deductions have been applied.

08

If applicable, include additional details such as overtime hours, bonuses, or other extra earnings in their respective sections.

09

Ensure that all calculations are accurate and double-check for any errors or discrepancies. This step is crucial to guarantee the accuracy of your paystub.

10

Review the completed paystub to verify that all information is correct and properly documented. It is essential to ensure that all necessary deductions and earnings have been accurately recorded.

11

If everything is in order, securely save or print the paystub for your records.

Who needs teacher paystub?

01

Teachers themselves: A teacher paystub serves as a detailed record of their earnings, deductions, and contributions. It provides them with a clear overview of their income and helps them track their financial progress.

02

School administration and finance departments: School administrators and finance departments require teacher paystubs to maintain accurate records of employees' earnings, taxes, and other relevant financial information. These records are essential for tax purposes and ensuring compliance with payroll regulations.

03

Tax authorities: Teacher paystubs are necessary for individuals to file their annual tax returns. Tax authorities may request copies of paystubs to verify income, deductions, and taxes paid during a specific period.

04

Banks and financial institutions: Paystubs are often required when applying for loans, mortgages, or other financial services. Banks and financial institutions may request paystubs as proof of income and employment to assess an individual's creditworthiness.

05

Insurance providers and retirement plans: Teacher paystubs are also important for managing insurance coverage and retirement plans. Insurance providers and retirement plans often require paystubs to determine eligibility, contribution amounts, or to process claims accurately.

In summary, filling out a teacher paystub involves gathering the necessary information, accurately recording income and deductions, and reviewing the completed documents. Teacher paystubs are needed by teachers themselves, school administration, tax authorities, banks, insurance providers, and retirement plans for various purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I look up my pay stubs?

Contact the Human Resource Department Depending on the company or staffing, some employers require that employees submit a formal request to get copies of pay stubs. Employers may charge a fee for copies of paystubs, provide the service for free, or require an employee to set up an appointment to pick up copies.

How do I check my pay stub for NYC DOE?

This is available through the “Employee Self Service” tab in the payroll portal. If the “Employee Self Service” Options are inaccessible, it is because you have not yet logged into THIS page. The LOGIN tab can be found below the “Employee Self Service” tab.

How can I see my pay stub online?

Through your employee website Ask your employer where you can find your pay stub. Find out where you can search for your pay stubs online. Access the website. Once you know where to find your pay stubs online, locate the website. Locate your pay stubs.

How to get pay stubs?

Pay stubs are usually generated every pay period and sent out with paychecks. If your paycheck is deposited directly into your bank account, you may need to take a few extra steps to get a pay stub. You can get a copy of your pay stub online or by contacting the payroll department in your company.

How do I get my pay stubs if I have direct deposit?

You get pay stubs if you have direct deposit by accessing them online or contacting human resources. If you have direct deposit, you should be able to access your pay stubs online by logging into your company portal. Pay stubs are usually generated every pay period and sent out with paychecks.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send teacher pay stub example for eSignature?

Once your teacher pay stub example is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute teacher pay stub example online?

With pdfFiller, you may easily complete and sign teacher pay stub example online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an eSignature for the teacher pay stub example in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your teacher pay stub example and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is teacher pay stub example?

A teacher pay stub example is a sample document that shows the breakdown of a teacher's salary, including deductions, taxes, and net pay for a specific pay period.

Who is required to file teacher pay stub example?

Employers, specifically school districts and educational institutions, are required to provide teacher pay stubs to their employees, detailing the earnings and deductions for each pay period.

How to fill out teacher pay stub example?

To fill out a teacher pay stub example, include the teacher's name, pay period dates, gross pay, deductions (such as taxes, health insurance, retirement contributions), and net pay. Ensure all calculations are accurate and reflect the correct amounts.

What is the purpose of teacher pay stub example?

The purpose of a teacher pay stub example is to provide a detailed record of a teacher's earnings and deductions, ensuring transparency and helping teachers understand their paycheck and tax obligations.

What information must be reported on teacher pay stub example?

A teacher pay stub example must report the teacher's name, employee ID, pay period dates, gross earnings, itemized deductions (taxes, insurance, retirement), and the final net pay amount.

Fill out your teacher pay stub example online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Teacher Pay Stub Example is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.