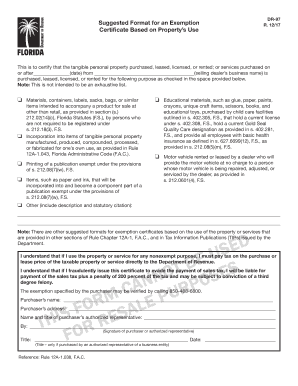

FL DoR DR-97 2001 free printable template

Show details

Certificate Based on Property's Use. DR-97. R. 05/01 does not supply. Suggested Format Blanket Exemption Certificate. In Accordance with Rule 12A-1.038, ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DoR DR-97

Edit your FL DoR DR-97 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DoR DR-97 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL DoR DR-97 online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL DoR DR-97. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR DR-97 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DoR DR-97

How to fill out FL DoR DR-97

01

Obtain the FL DoR DR-97 form from the Florida Department of Revenue website.

02

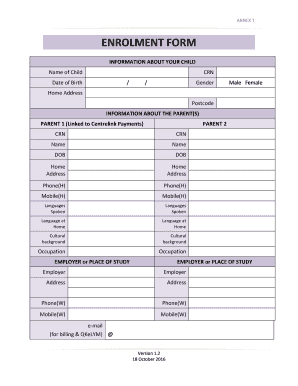

Fill in your name and address in the designated fields at the top of the form.

03

Indicate the tax year for which you are filing by entering the appropriate year.

04

Provide your Social Security number or federal employer identification number.

05

Complete the section that describes the nature of your claim, including details about the property in question.

06

Calculate any taxes owed or refunds due based on the information provided.

07

Sign and date the form at the bottom to certify the accuracy of the information.

08

Submit the completed form to the relevant address provided in the instructions.

Who needs FL DoR DR-97?

01

Individuals or businesses who need to claim a refund or make an adjustment related to Florida sales and use tax.

02

Those who have previously filed a tax return and need to correct errors or dispute assessments.

03

Anyone applying for tax exemptions or seeking to establish non-profit status.

Fill

form

: Try Risk Free

People Also Ask about

Does Florida accept out of state tax exempt certificates?

Florida is one of nine U.S. states that do not allow out-of-state resale certificates. The registration number from your sales tax permit must be included on your Florida Resale Certificate.

How do I verify a Florida sales tax certificate?

Phone: 877-FL-RESALE (877-357-3725) and enter the customer's Annual Resale Certificate number. Online: Go to the Seller Certificate Verification application and enter the required seller information for verification.

Who qualifies for sales tax exemption in Florida?

Florida law grants governmental entities, including states, counties, municipalities, and political subdivisions (e.g., school districts or municipal libraries), an exemption from Florida sales and use tax.

Who is required to collect sales tax in Florida?

Any person making taxable sales in Florida must separately state Florida sales tax on each customer's invoice, sales slip, receipt, billing, or other evidence of sale. The sales tax and discretionary sales surtax may be shown as one total, or the sales tax and surtax may be shown separately.

Does Florida require a resale certificate?

If you run a business that buys products and resells them, then you most likely have a reseller's certificate. This certificate is required when buying items specifically at a resale price. As a registered seller, you can avoid paying sales tax as long as you have proper documentation.

Do I need a sellers permit and resale certificate in Florida?

Generally, if your business is involved in the wholesale, retail sale, or repair of products, you need a seller's permit in Florida. Selling services and renting or leasing commercial property also requires a Florida sales tax permit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get FL DoR DR-97?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the FL DoR DR-97 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my FL DoR DR-97 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your FL DoR DR-97 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit FL DoR DR-97 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing FL DoR DR-97, you need to install and log in to the app.

What is FL DoR DR-97?

FL DoR DR-97 is a form used in Florida for reporting information related to certain tax liabilities, specifically aimed at documenting sales and use tax obligations.

Who is required to file FL DoR DR-97?

Businesses and individuals who are registered for sales and use tax in Florida and have tax liabilities that need to be reported are required to file FL DoR DR-97.

How to fill out FL DoR DR-97?

To fill out FL DoR DR-97, you need to provide your taxpayer identification information, detail the sales and use tax amounts owed, and any applicable deductions or exemptions, in accordance with the guidance provided by the Florida Department of Revenue.

What is the purpose of FL DoR DR-97?

The purpose of FL DoR DR-97 is to ensure that businesses and individuals accurately report and remit their sales and use tax liabilities to the Florida Department of Revenue.

What information must be reported on FL DoR DR-97?

The information that must be reported on FL DoR DR-97 includes the taxpayer's identification number, total sales, taxable sales, exempt sales, and the total amount of sales and use tax due.

Fill out your FL DoR DR-97 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DoR DR-97 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.