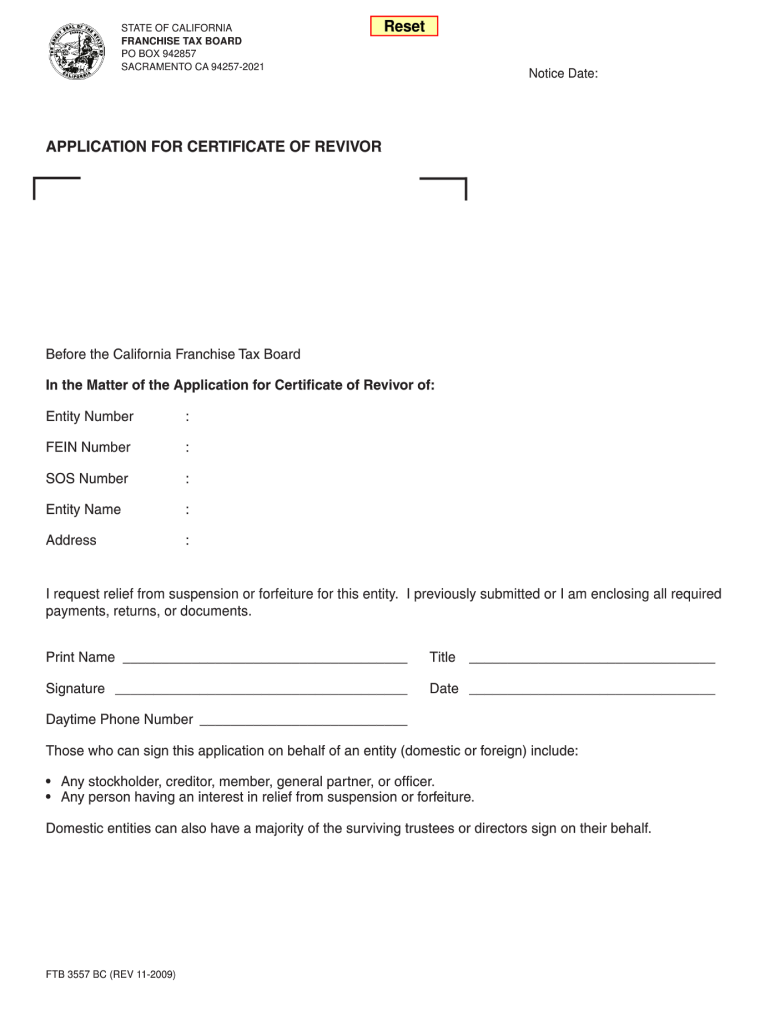

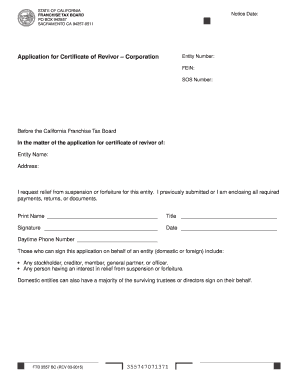

Who needs a FT 3557 form?

This form is used by owners of a corporation in California to revive their business entity.

What is the purpose of the FT 3557 form?

This form is an application for a certificate of reviver, which is required to get relief from suspension or forfeiture of the corporation. The California Secretary of State and/or the Franchise Tax Board must certify that your business entity is ready for revival and all the important documents are in order. The application form is the first step in this process.

What other documents must accompany the FT 3557 form?

The FT 3557 form must be accompanied by all the required documents certifying that the corporation can be revived. Among these documents are tax returns for the specified years, evidence of the paid penalty and filing fees, and a statement of information. The California Secretary of State and/or the Franchise Tax Board may ask the owner to provide other documents if needed.

When is the FT 3557 form due?

This form should be completed and filed when there is a need. Keep in mind that usually the processing takes eight weeks. The estimated time for completing the form is 15 minutes.

What information should be provided in the FT 3557 form?

The owner of the corporation or the person acting on his behalf (stockholder, creditor, general partner, officer or any person having an interest in relief) should indicate the following:

- Number of business entity and its name

- Federal Identification Number

- Secretary of State number

- Name of the owner, phone number, title

The applicant should also sign the application and date it.

Where do I send the Application for Certificate of Reviver?

The completed application is forwarded to the Franchise Tax Board of California, Sacramento.