OH SD 101 Short 2008 free printable template

Show details

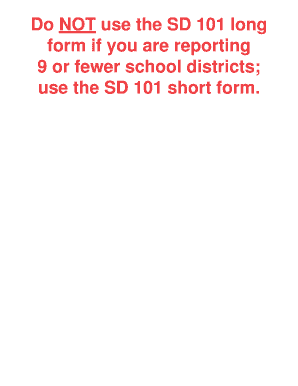

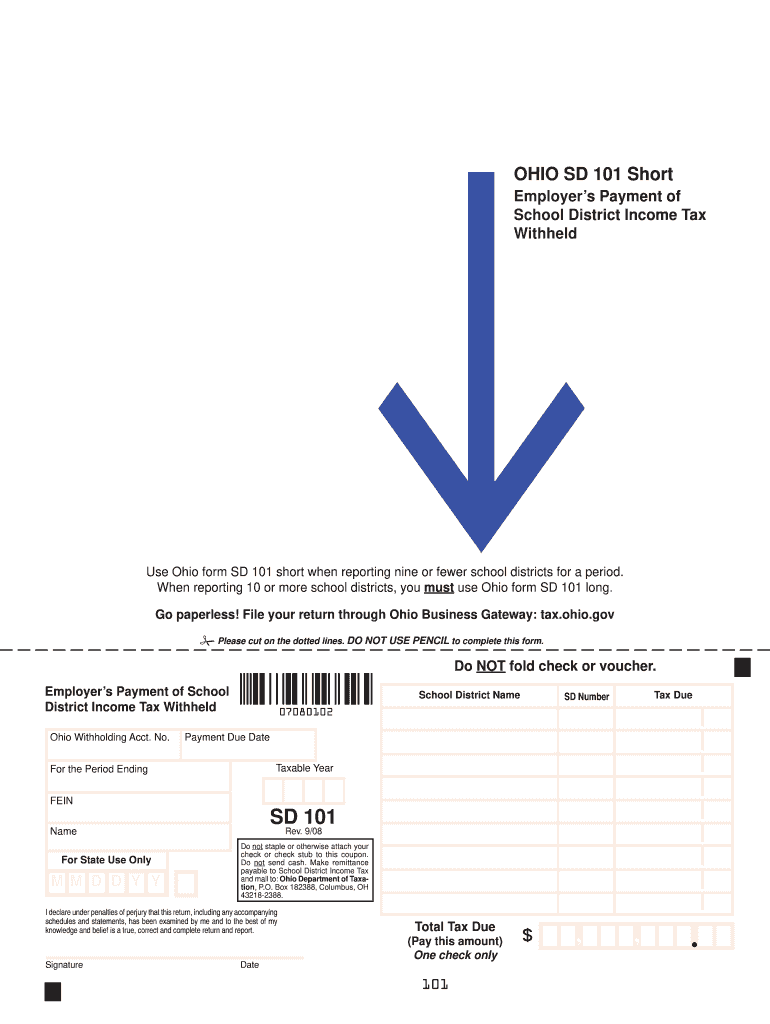

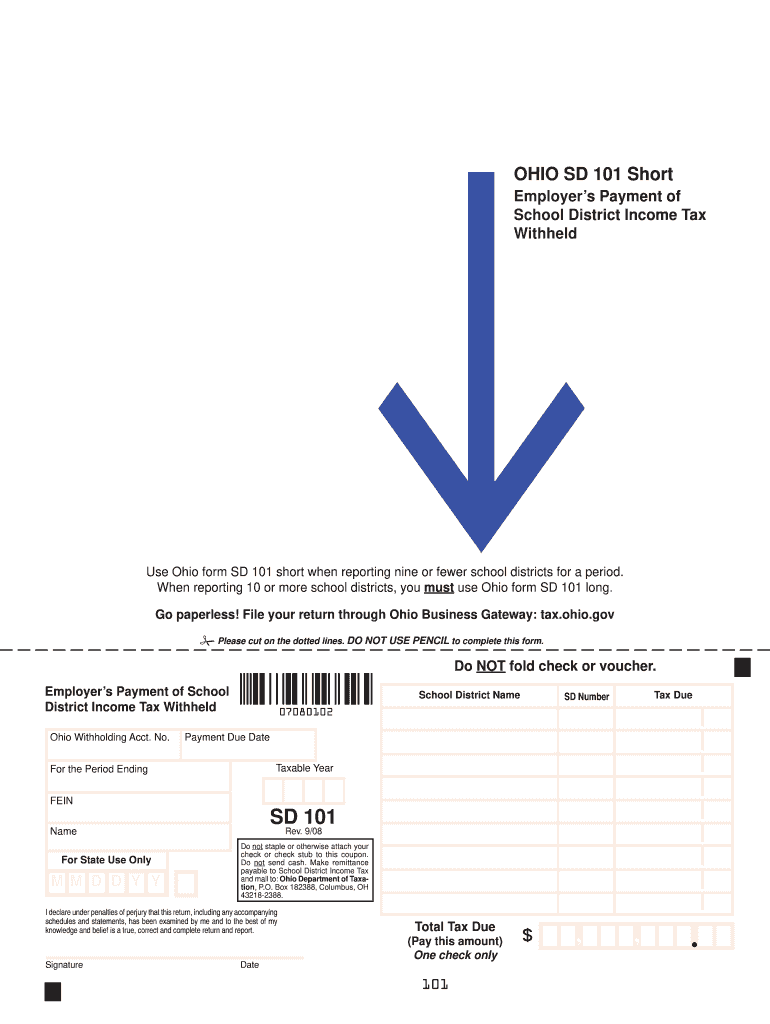

OHIO SD 101 Short Employer's Payment of School District Income Tax Withheld Use Ohio form SD 101 short when reporting nine or fewer school districts for a period. When reporting 10 or more school

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH SD 101 Short

Edit your OH SD 101 Short form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH SD 101 Short form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OH SD 101 Short online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OH SD 101 Short. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH SD 101 Short Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH SD 101 Short

How to fill out OH SD 101 Short

01

Start by gathering your personal information, including your name, address, and contact details.

02

Fill out any required identification numbers, such as Social Security Number or driver's license number.

03

Provide relevant details about the purpose of the form, including any applicable dates or events.

04

Review the instructions provided on the form to ensure all sections are completed accurately.

05

Check for any required signatures and dates at the bottom of the form before submission.

06

Submit the completed form as directed, either electronically if applicable or by mailing it to the specified address.

Who needs OH SD 101 Short?

01

Individuals residing in Ohio who need to report specific information for tax purposes.

02

Employers who are required to submit employment documentation or tax-related information.

03

Anyone applying for social services or benefits that require documentation of residence or employment.

Fill

form

: Try Risk Free

People Also Ask about

How much should I withhold for Ohio taxes?

Withholding Formula (Effective Pay Period 19, 2021) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $5,0000.5%Over $5,000 but not over $10,000$25.00 plus 1.0% of excess over $5,000Over $10,000 but not over $15,000$75.00 plus 2.0% of excess over $10,0005 more rows • Oct 4, 2021

Is Ohio school district tax mandatory?

Any individual (including retirees, students, minors, etc.) or estate that receives income while a resident of a taxing school district is subject to school district income tax. Individuals who work, but do not live, in a taxing school district are not subject to the district's income tax.

How do I register for school district tax in Ohio?

The Department offers free options to file and pay electronically. To have school district income tax withheld from your pay, submit an IT 4 with the school district name and number to your employer. Please note, your school district withholding is not the same as your city income tax withholding.

Can you view IRS forms online?

You can view your tax records now in your Online Account. This is the fastest, easiest way to: Find out how much you owe.

What is the federal income tax withholding rate for 2022?

For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing status and taxable income.

Are Ohio employers required to withhold school district taxes?

Ohio law requires employers to collect the school district of residence for each employee by providing the Ohio form IT 4. Employers are required to withhold school district income tax from compensation for any employee who resides in a taxing school district.

How do I withhold my school district tax in Ohio?

The Department offers free options to file and pay electronically. To have school district income tax withheld from your pay, submit an IT 4 with the school district name and number to your employer. Please note, your school district withholding is not the same as your city income tax withholding.

Do I have to file an SD 100 for Ohio?

must file an SD 100 if all of the following are true: S/he was a resident of a school district with an income tax for any portion of the tax year; While a resident of the district, s/he received income; AND. Based on that income, s/he has a school district income tax liability (SD 100, line 2).

Can I download IRS forms?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

How much percent should you withhold for taxes?

The federal withholding tax has seven rates for 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether you're filing as single, married jointly or married separately, or head of household.

How much federal income tax should be withheld 2022?

When it comes to federal income tax rates and brackets, the tax rates themselves aren't changing from 2022 to 2023. The same seven tax rates in effect for the 2022 tax year – 10%, 12%, 22%, 24%, 32%, 35% and 37% – still apply for 2023.

Who pays school taxes in Ohio?

Ohio residents who lived/resided within a school district with an income tax in effect for all or part of the taxable year are subject to Ohio's school district income tax.

What is employer withholding tax in Ohio?

In this tax, both employees and employers have to pay a percentage of their wages which is currently set at 6.2%. It is applicable for a certain amount ing to the tax year. For the year 2022, in Ohio, have to contribute 147,000$ of the employee's annual earnings.

Does Ohio require a separate tax extension?

Ohio does not have a separate extension request form. The automatic extension only applies to filing a return; no extensions are granted for payment of taxes due. All tax payments are due by the original due date of the return.

Who is exempt from Ohio withholding tax?

The exemptions include: Reciprocity Exemption: If you are a resident of Indiana, Kentucky, Pennsylvania, Michigan or West Virginia and you work in Ohio, you do not owe Ohio income tax on your compensation. Instead, you should have your employer withhold income tax for your resident state. R.C. 5747.05(A)(2).

What percentage should I withhold for Ohio state taxes?

The state of Ohio requires you to pay taxes if you're a resident or nonresident that receives income from an Ohio source. The 2021 state income tax rates range from 2.765% to 3.99%, and the sales tax rate is 5.75%.

What form do I need to file Ohio state taxes?

Revised on 12/21. 2021 Ohio IT 1040 Individual Income Tax Return - Includes Ohio IT 1040, Schedule of Adjustments, IT BUS, Schedule of Credits, Schedule of Dependents, IT WH, and IT 40P.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my OH SD 101 Short in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your OH SD 101 Short as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit OH SD 101 Short on an iOS device?

Create, edit, and share OH SD 101 Short from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete OH SD 101 Short on an Android device?

Complete your OH SD 101 Short and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is OH SD 101 Short?

OH SD 101 Short is a simplified version of the Ohio School District Income Tax Return form used by individuals to report school district income taxes.

Who is required to file OH SD 101 Short?

Individuals who have earned income within a school district that imposes an income tax are required to file the OH SD 101 Short.

How to fill out OH SD 101 Short?

To fill out the OH SD 101 Short, gather your income information, complete the personal information sections, report your income, calculate the tax owed, and submit the form to the appropriate school district.

What is the purpose of OH SD 101 Short?

The purpose of OH SD 101 Short is to allow taxpayers to report and pay their school district income taxes in a straightforward manner.

What information must be reported on OH SD 101 Short?

The OH SD 101 Short requires reporting of personal information, total income earned, any credits or deductions applicable, and the amount of school district income tax due.

Fill out your OH SD 101 Short online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH SD 101 Short is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.