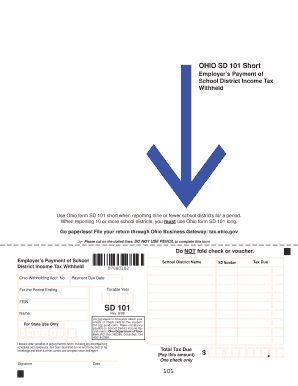

OH SD 101 Short 2015-2024 free printable template

Get, Create, Make and Sign

How to edit sd 101 tax fill online

OH SD 101 Short Form Versions

How to fill out sd 101 tax fill

How to fill out sd 101 tax fill:

Who needs sd 101 tax fill?

Video instructions and help with filling out and completing sd 101 tax fill

Instructions and Help about sd101 short employer income form

Have you ever wondered if you watch this no long enough what story is it myself there is someone who has done it his name is Billy bah I spell up small DIY wall B arr some people call him the snail guardian it was in a cabin out in the woods picture this it's a snowy day it's dark and cold, and you make a fire you're sitting by the fire, and you're reading with a cup of tea, and it goes on for nine months Billy lives alone in this house he helped build here he grows his garden has an impressive hat collection drew tickets and dreams of Hollywood every couple of weeks he sees fast into the nearest town supply he's been doing this for more than 14 winters, but Billy does a little more than just read and drink tea for those forty winters Billy has kept a meticulous record of snow in his little parts of the world hey watch it says pleasure e 26 1978 ten passengers snow that day January 20, 2011, and a half April 28, 1940, on 1997 1/2 inch means now a weasel was roaming around inside the shack damn the birds were back I lived in an 8 by 10 foot old shack and had no electricity no water and I had nothing to them rebuilt the main thing I interacted with was the weather in the animal, so I started in courting things just because it was something to do I had nothing to prove no goals or anything actually a researcher the lab wanted to look at it and then once he started looking at it scientifically then all of a sudden like the decade's worth of data to being used from with my in Chile off here we have Thomas every day twice again all parents song I keep going until the snow is gone if it still does record that no matter what the trends I see is that we're getting a permanent snowpack later, and we get to bare ground sooner we'll have years when there was a lot of snow on the ground, and then we lost no sooner than years that had a lot less snow district of it's a lot warmer now in a normal winter you'd expect to have four to five record high temperatures last year Lily recorded 36 not only is it a lot warmer we're getting low dust blowing see he gets dusting of snow it belts like that you're talking about the snowpack the waters most of the southwest I'm not real hopeful just because I don't know how you reverse something like that as we leave Colorado behind billion parts one last bit of advice it's like anything else you know I learned you ski to get around I learned how to ski better, so I would fall down all with me over a period of time I kinda learned how to survive in this environment actually learning to fall probably the most important thing you could have false it a lot easier falling on your buttons on the face [Music] you [Music] you

Fill ohio sd101 district tax : Try Risk Free

People Also Ask about sd 101 tax fill

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your sd 101 tax fill online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.