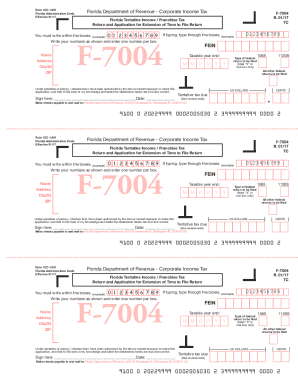

FL DoR F-7004 2013 free printable template

Get, Create, Make and Sign FL DoR F-7004

How to edit FL DoR F-7004 online

Uncompromising security for your PDF editing and eSignature needs

FL DoR F-7004 Form Versions

How to fill out FL DoR F-7004

How to fill out FL DoR F-7004

Who needs FL DoR F-7004?

Instructions and Help about FL DoR F-7004

The 13 f regulatory filings from some of Wall Street's major players were released on Thursday and traders are taking notice Warren Buffett bought an 11 million share stakes in Verizon wireless valued at 524 million dollars joined by Third Point capitals Dan lobe who also disclosed he owned three and a half million shares worth about 166 million at the end of the first quarter hedge fund manager David pepper sold his Verizon stake however big managers cut their stakes in General Motors as the automaker recalled a record number of vehicles the Oracle of Omaha reduced his position in GM by ten million shares while David Bighorn's Green light Capital unloaded all of its 17 million shares in the automaker Bighorn decreased his ownership in Apple by thirteen percent but held on to 2.1 million shares while stepping up his investment in solar energy company Sun Edison by more than eight hundred percent or ten and a half million shares he now holds more than a four percent share of the company I Word also bought into Nokia however with a three and a half million chair position prior to the closing of the company sale of its phone unit to Microsoft Dan lobe maintained a four and a half million chair position in Nokia in the first quarter the filings pertained to the investors holdings as of the end of the first quarter they don't reveal what the managers have done since the end of March in New York I'm Brittany you mark for the street

People Also Ask about

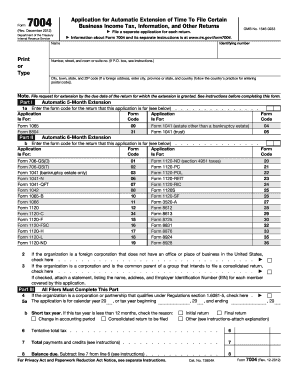

How do I print an extension form from the IRS?

How do I print form 7004?

Can I paper file form 7004?

What is IRS form 7004 used for?

How to file form 7004 electronically for free?

Do I need to attach form 7004 to tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the FL DoR F-7004 in Gmail?

How can I fill out FL DoR F-7004 on an iOS device?

How do I edit FL DoR F-7004 on an Android device?

What is FL DoR F-7004?

Who is required to file FL DoR F-7004?

How to fill out FL DoR F-7004?

What is the purpose of FL DoR F-7004?

What information must be reported on FL DoR F-7004?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.