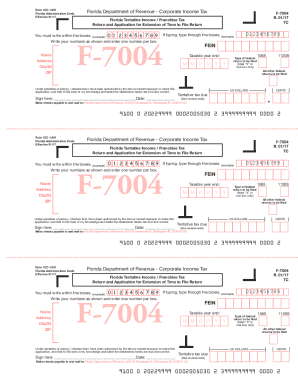

FL DoR F-7004 2012 free printable template

Show details

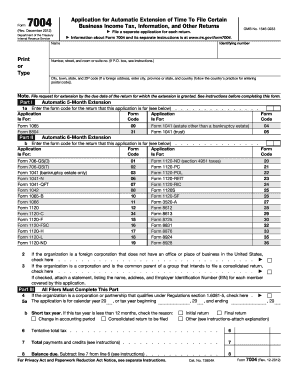

Rule 12C-1.051 Florida Administrative Code Effective 01/11 Florida Department of Revenue Corporate Income Tax Florida Tentative Income / Franchise and Emergency Excise Tax Return and Application for

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your florida department of revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida department of revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit florida department of revenue online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit florida department of revenue. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

FL DoR F-7004 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out florida department of revenue

How to fill out florida department of revenue:

01

Visit the official website of the Florida Department of Revenue.

02

Locate the form that needs to be filled out, whether it is for income tax, sales tax, or a specific type of business.

03

Carefully read the instructions provided alongside the form to understand the requirements and gather all necessary information and documents.

04

Fill out the form accurately, ensuring that all sections are completed correctly and legibly.

05

Double-check the form for any errors or missing information before submitting.

06

If required, attach any supporting documents or additional forms that are needed.

07

Submit the completed form either electronically, by mail, or in person, following the instructions provided by the Florida Department of Revenue.

Who needs florida department of revenue:

01

Individuals residing in Florida who are required to file an income tax return.

02

Businesses operating in Florida, including sole proprietors, partnerships, corporations, and limited liability companies, that are liable for paying sales tax or other business taxes.

03

Non-profit organizations that are exempt from federal income tax, but may still have obligations to file with the Florida Department of Revenue, depending on their activities.

Fill form : Try Risk Free

People Also Ask about florida department of revenue

What is the form for Florida personal income tax extension?

Does an LLC have to file a tax return in Florida?

Does an LLC in Florida need to file a tax return?

What taxes does an LLC pay in Florida?

What comes from the Florida Department of Revenue?

Where do I mail f7004?

Why am I getting a letter from the Florida Department of Revenue?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is florida department of revenue?

The Florida Department of Revenue is a government agency in the state of Florida responsible for managing and regulating the state's revenue, including taxes, licenses, and other revenue sources.

Who is required to file florida department of revenue?

Various entities and individuals are required to file with the Florida Department of Revenue, including businesses, organizations, and individuals who are liable for taxes or hold licenses issued by the state. This can include individuals with income from Florida sources, businesses with a physical presence in the state, and others who meet specific criteria.

How to fill out florida department of revenue?

Filling out forms and submitting information to the Florida Department of Revenue can be done online through their official website, where taxpayers can access the necessary forms, instructions, and resources to complete the process. The department also provides assistance through their customer service channels.

What is the purpose of florida department of revenue?

The purpose of the Florida Department of Revenue is to ensure compliance with state tax laws and regulations, collect and manage revenue for the state, administer various tax programs and incentives, and provide support and assistance to taxpayers in meeting their obligations.

What information must be reported on florida department of revenue?

The specific information that must be reported to the Florida Department of Revenue can vary depending on the type of tax or license being addressed. This can include details such as income sources, deductions, sales and use tax information, employment information, and other relevant financial data.

When is the deadline to file florida department of revenue in 2023?

The exact deadline to file with the Florida Department of Revenue in 2023 will be determined by the specific tax or license being addressed. It is recommended to refer to the department's official website or consult with their customer service for the most up-to-date information.

What is the penalty for the late filing of florida department of revenue?

Penalties for late filing with the Florida Department of Revenue can vary depending on the specific circumstances and taxes involved. These penalties can include monetary fines, interest charges, and other consequences. It is advised to consult the department's official guidelines and regulations for detailed information on penalties and consequences.

How do I complete florida department of revenue online?

Easy online florida department of revenue completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I edit florida department of revenue on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing florida department of revenue.

How do I edit florida department of revenue on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share florida department of revenue from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your florida department of revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.