WV DoR IT-140W 2011 free printable template

Show details

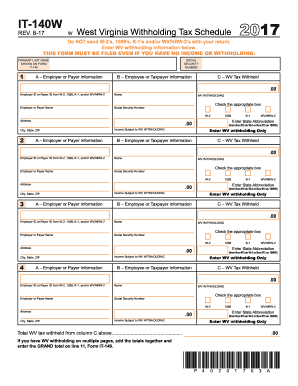

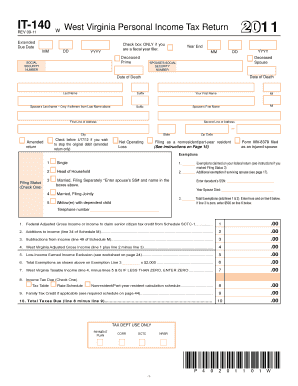

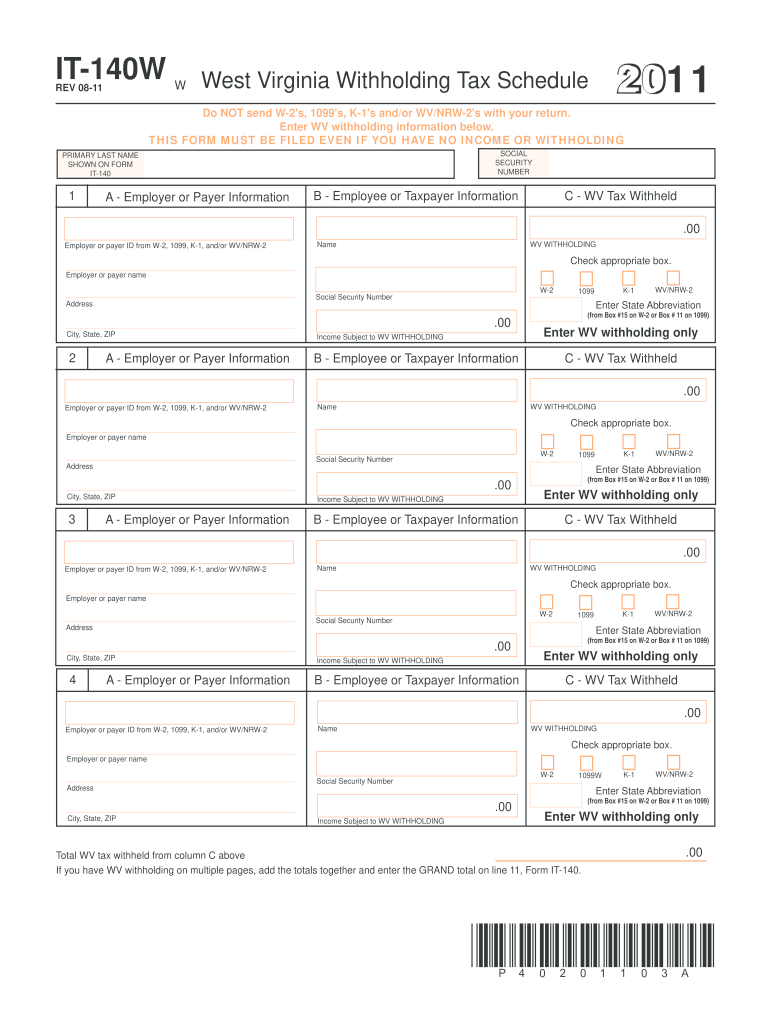

IT-140W W REV 08-11 West Virginia Withholding Tax Schedule Do NOT send W-2 s 1099 s K-1 s and/or WV/NRW-2 s with your return. Enter WV withholding information below. T H I S FORM M U ST BE FI LED EV EN I F YOU H AV E N O I N COM E OR WI T H H OLDI N G SOCIAL SECURITY NUMBER PRIMARY LAST NAME SHOWN ON FORM A - Employer or Payer Information B - Employee or Taxpayer Information C - WV Tax Withheld Employer or payer ID from W-2 1099 K-1 and/or WV/NRW-2 WV WITHHOLDING Name Check appropriate box....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign it140w form 2011

Edit your it140w form 2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it140w form 2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it140w form 2011 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit it140w form 2011. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV DoR IT-140W Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out it140w form 2011

How to fill out WV DoR IT-140W

01

Gather your personal information including your Social Security number.

02

Obtain your income documents, such as W-2s or 1099 forms.

03

Download the WV DoR IT-140W form from the West Virginia Division of Revenue website.

04

Fill in your personal details in the designated fields.

05

Report your total income and deductions accurately.

06

Calculate your tax liability using the provided tables or formulas.

07

Include any applicable credits or adjustments.

08

Review the form for accuracy before signing and dating it.

09

Submit the completed form to the West Virginia Division of Revenue either electronically or via mail.

Who needs WV DoR IT-140W?

01

West Virginia residents who are filing their state income tax returns and meet the eligibility criteria, including certain income thresholds and tax credit qualifications.

Fill

form

: Try Risk Free

People Also Ask about

What is the exemption allowance for West Virginia?

§ 110-21-16 - West Virginia Personal Exemptions Of A Resident Individual. 16.1. In General. - A resident individual is allowed a West Virginia exemption of two thousand dollars ($2,000) for each exemption for which said individual is entitled to a deduction for the taxable year for federal income tax purposes.

What is the surviving spouse deduction in West Virginia?

- A surviving spouse shall be allowed one additional exemption of two thousand dollars ($2,000) for each of the two (2) taxable years which follow the year in which the death of the spouse occurred.

Who must file a West Virginia tax return?

If you are domiciled in West Virginia and spent more than 30 days in the state, you must file a resident return and report all of your income to West Virginia.

Is West Virginia phasing out tax on Social Security?

West Virginia had previously taxed Social Security payments but started phasing out the tax in 2020, and will not be charged in the 2022 tax year.

What is the WV income tax rate?

How does West Virginia's tax code compare? West Virginia has a graduated individual income tax, with rates ranging from 3.00 percent to 6.50 percent. There are also jurisdictions that collect local income taxes. West Virginia has a flat 6.50 percent corporate income tax rate and permits local gross receipts taxes.

How do I register for withholding tax in WV?

Apply online at the Business for West Virginia portal to receive an Employer Account Number within 3 days. Find an existing Employer Account Number: on Form WV /IT-101Q, Employer's Quarterly Return of Income Tax Withheld. visit the WV State Tax Department via the contact page.

How do I pay my West Virginia state income tax?

You can use the Pay Personal Income Tax link on the MyTaxes Website. website to begin remitting payments electronically using the ACH Debit method. Credit Cards – All major credit cards accepted. You can visit the Credit Card Payments page for more information.

How do I file a state tax extension in WV?

Complete WV Form 4868, include a Check or Money Order, and mail both to the address on WV Form 4868. Even if you filed an extension, you will still need to file your WV tax return either via eFile or by paper by Oct.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete it140w form 2011 online?

pdfFiller has made it simple to fill out and eSign it140w form 2011. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my it140w form 2011 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your it140w form 2011 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out it140w form 2011 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign it140w form 2011 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is WV DoR IT-140W?

WV DoR IT-140W is a tax form used in West Virginia for reporting income tax withheld from employees.

Who is required to file WV DoR IT-140W?

Employers who withhold West Virginia income tax from employee wages are required to file WV DoR IT-140W.

How to fill out WV DoR IT-140W?

To fill out WV DoR IT-140W, employers need to provide information regarding total wages paid, total state tax withheld, and other relevant payroll information for the tax year.

What is the purpose of WV DoR IT-140W?

The purpose of WV DoR IT-140W is to report and reconcile state income tax withheld from employees' wages and ensure compliance with state tax laws.

What information must be reported on WV DoR IT-140W?

WV DoR IT-140W requires reporting of total wages paid, total income tax withheld, employer identification details, and any other necessary payroll information.

Fill out your it140w form 2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

it140w Form 2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.