Get the free PA-40 2012 - FileYourTaxes.com

Show details

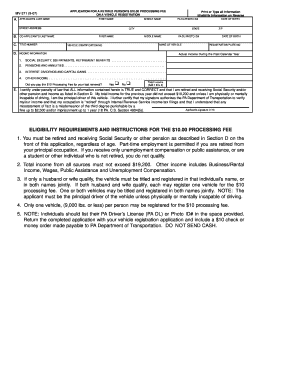

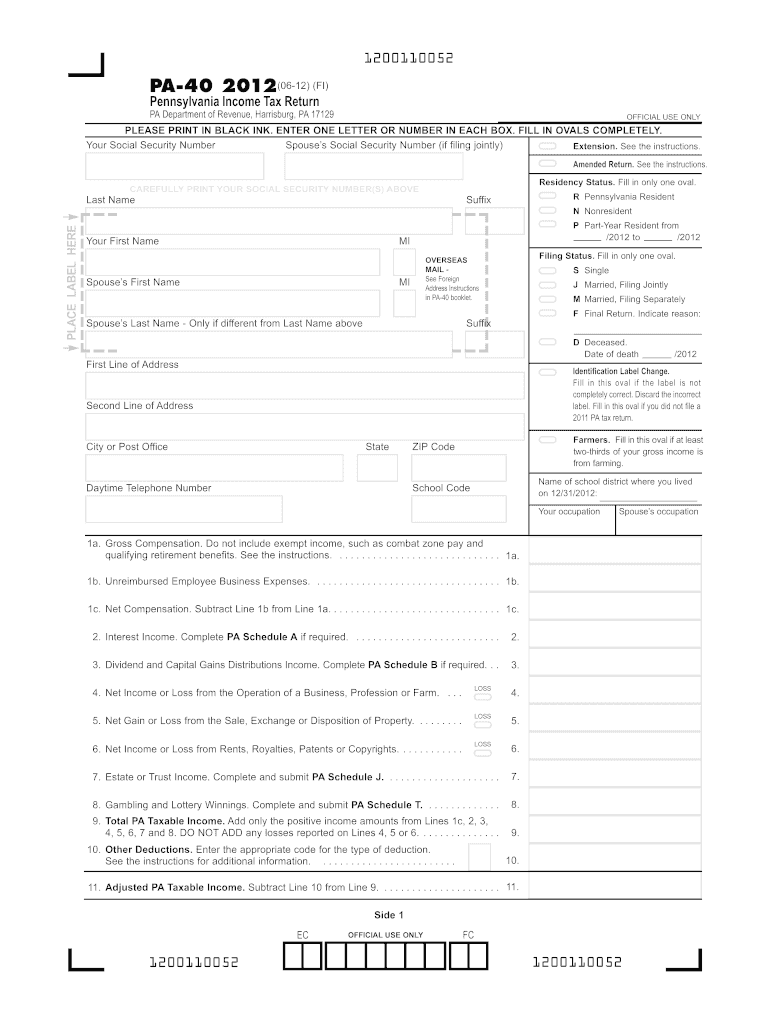

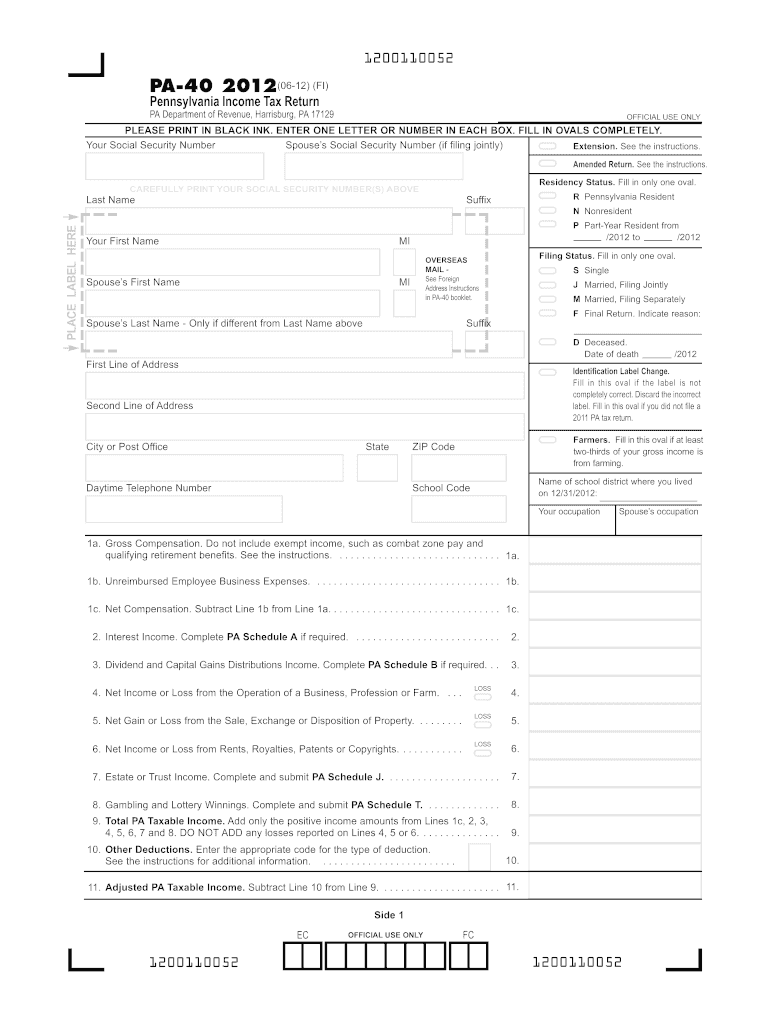

1200110052 PA-40 2012 06-12 FI Pennsylvania Income Tax Return PA Department of Revenue Harrisburg PA 17129 OFFICIAL USE ONLY PLEASE PRINT IN BLACK INK. ENTER ONE LETTER OR NUMBER IN EACH BOX. FILL IN OVALS COMPLETELY. Your Social Security Number Spouse s Social Security Number if filing jointly Extension. See the instructions. Amended Return. See the instructions. Residency Status. Fill in only one oval. CAREFULLY PRINT YOUR SOCIAL SECURITY NUMBE...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your pa-40 2012 - fileyourtaxescom form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa-40 2012 - fileyourtaxescom form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pa-40 2012 - fileyourtaxescom online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pa-40 2012 - fileyourtaxescom. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out pa-40 2012 - fileyourtaxescom

How to fill out pa-40 2012 - fileyourtaxescom:

01

Gather all necessary documents: Before starting to fill out the pa-40 2012 form, make sure you have all the required documents, including your W-2 forms, 1099 forms, receipts for deductions, and any other relevant financial information.

02

Download the form: Visit the fileyourtaxescom website and search for the pa-40 2012 form. Download and print out a copy of the form to fill it out manually.

03

Provide personal information: Begin by filling out the personal information section of the form, including your name, address, social security number, and filing status.

04

Report income: Enter your income details on the appropriate lines of the form. This may include wages, self-employment income, rental or investment income, and any other sources of income.

05

Deductions and credits: Deductions and credits can help reduce your tax liability. Fill out the relevant sections of the form to claim deductions such as mortgage interest, student loan interest, and charitable contributions. Additionally, claim any tax credits you may be eligible for, such as the Child Tax Credit or Earned Income Credit.

06

Calculate tax liability: Use the provided instructions or a tax calculator to determine your tax liability based on your income, deductions, and credits. Fill in the calculated tax amount on the appropriate line of the form.

07

Sign and date: Finally, review your completed form for accuracy and sign and date it to validate your submission. Include any additional required documentation, such as supporting schedules or worksheets.

Who needs pa-40 2012 - fileyourtaxescom?

01

Individuals residing in Pennsylvania who earned income, whether from wages, self-employment, or other sources, during the tax year of 2012.

02

Taxpayers who are required to file a state income tax return in Pennsylvania.

03

Those who seek to claim deductions and credits specific to Pennsylvania on their tax return for the year 2012.

Remember, it is always recommended to consult a tax professional or refer to the official instructions provided with the form for accurate and personalized guidance when filling out your taxes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pa-40 - fileyourtaxescom?

A PA-40 is a tax form used in Pennsylvania for filing state income taxes, and FileYourTaxes.com is a website that provides online tax filing services.

Who is required to file pa-40 - fileyourtaxescom?

Residents and non-residents with income from Pennsylvania sources are required to file a PA-40 form.

How to fill out pa-40 - fileyourtaxescom?

You can fill out a PA-40 form either manually or online through tax preparation software or websites like FileYourTaxes.com.

What is the purpose of pa-40 - fileyourtaxescom?

The purpose of the PA-40 form is to report and pay state income taxes to the Pennsylvania Department of Revenue.

What information must be reported on pa-40 - fileyourtaxescom?

Information such as income, deductions, credits, and tax payments must be reported on the PA-40 form.

When is the deadline to file pa-40 - fileyourtaxescom in 2023?

The deadline to file a PA-40 form for the tax year 2023 is April 15, 2024.

What is the penalty for the late filing of pa-40 - fileyourtaxescom?

The penalty for late filing of a PA-40 form in Pennsylvania is 5% of the tax due per month, up to a maximum of 25%.

How do I modify my pa-40 2012 - fileyourtaxescom in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your pa-40 2012 - fileyourtaxescom along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get pa-40 2012 - fileyourtaxescom?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific pa-40 2012 - fileyourtaxescom and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the pa-40 2012 - fileyourtaxescom in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your pa-40 2012 - fileyourtaxescom and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Fill out your pa-40 2012 - fileyourtaxescom online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.