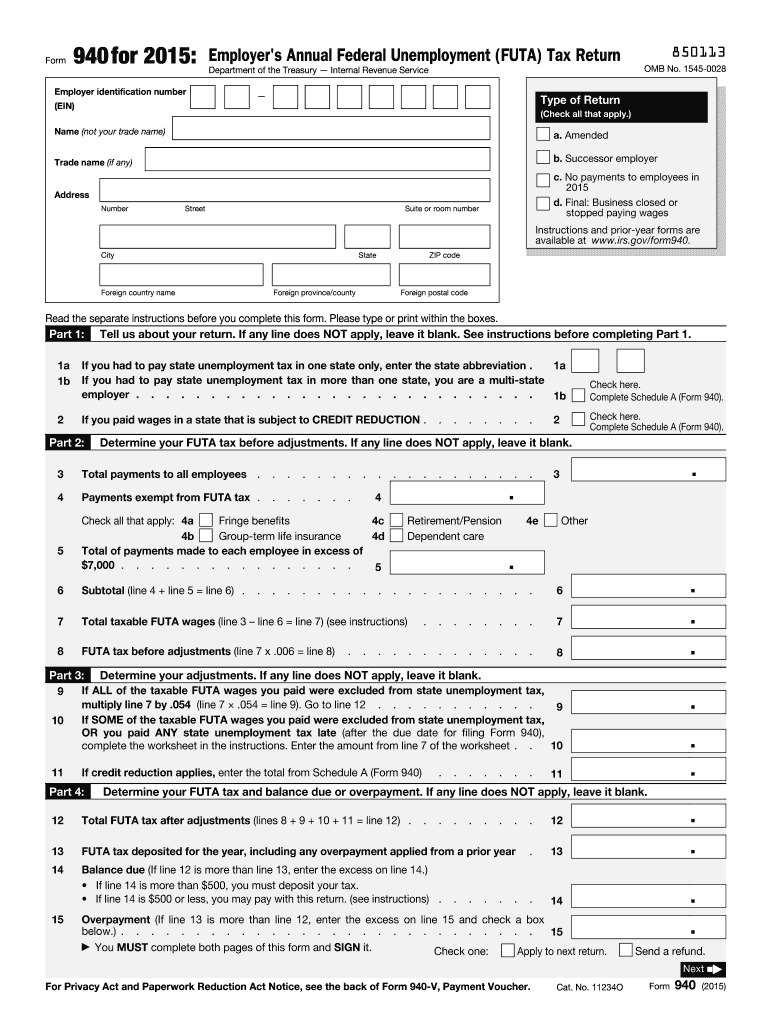

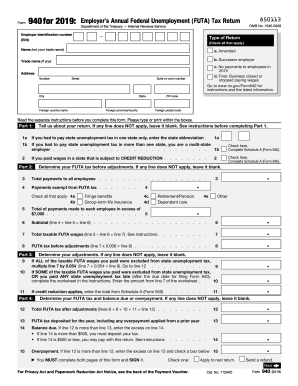

Who needs IRS Form 940?

IRS Form 940 or the Federal Unemployment Tax Return should be filled out by the business owner who has paid $20,000 or more to the employees during any calendar year quarter. Or it's a business owner who has hired 10 either part-time or full-time employees during 20 weeks of the year.

Indian tribal government employer doesn't have to fill out form 940 since no tax is applied. The organizations that belong to charity, education or scientific sphere don't have to fill out form 940.

What is IRS Form 940 for?

First, form 940 serves to define the employer's federal unemployment tax liability. Once this is done, the form calculates the amount of unemployment tax due. Another important function of the form is that it compares the paid tax and defines the amount of underpaid tax that an employer should compensate.

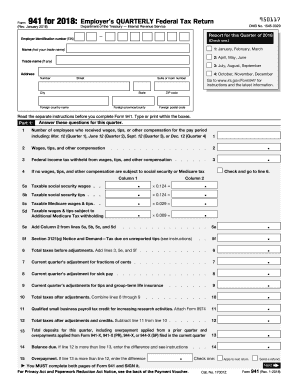

Is IRS Form 940 accompanied by other forms?

According the IRS rules, if you include household employees on your Form 940, you must also file Form 941, Employer's QUARTERLY Federal Tax Return; Form 943, Employer's Annual Federal Tax Return for Agricultural Employees; or Form 944, Employer's ANNUAL Federal Tax Return. These forms serve to report social security, Medicare, and any withheld federal income taxes for your household employees.

In general, the IRS form 940 does not require any attachments such as receipts or proof of payment.

When is IRS Form 940 due?

The due date of the form 940 is January 31, 2017. Pay attention that this form report unemployment tax for the previous year. The deadline can be moved to the next business day if January 31 is a weekend or a legal holiday.

How do I fill out IRS Form 940?

The IRS form 940 requires much information. It may vary depending on your tax status but the obligatory fields to complete are:

-

contact information

-

business tax ID, also known as EIN

-

business annual financial records

Look through the form and watch the video to get more information about how to fill out the form and what fields are necessary to complete.

Where do I send IRS Form 940?

The address where you will file form 940 depends on whether you include a payment check. See the IRS instructions to define where to send your form.