Form 941

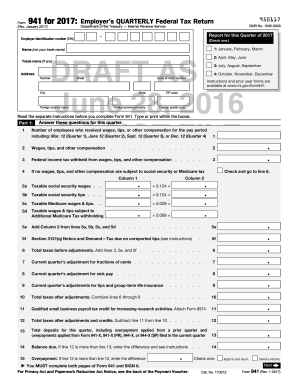

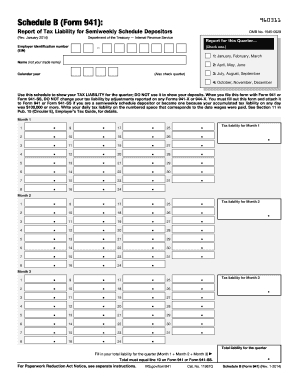

What is Form 941?

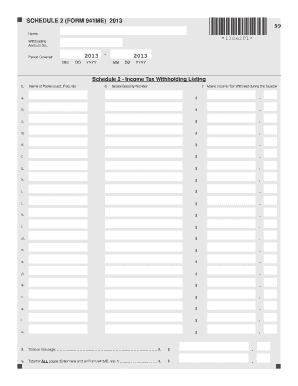

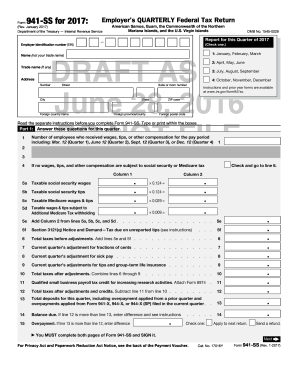

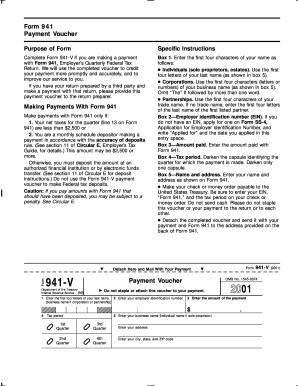

Form 941 is a tax form used by employers to report employment taxes. It is also known as the Employer's Quarterly Federal Tax Return. This form is used to report wages paid, tax withholdings, and employer contributions for social security and Medicare taxes.

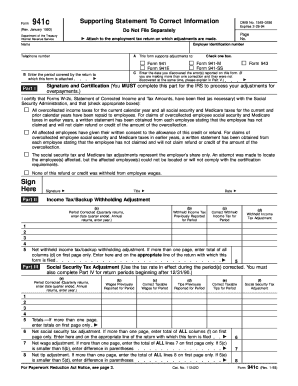

What are the types of Form 941?

There are two types of Form 941: the regular Form 941 and the Form 941-X. The regular Form 941 is used to report quarterly tax information for employers who file their taxes on a quarterly basis. On the other hand, the Form 941-X is used to amend previously filed Form 941 if there are any mistakes or changes that need to be made.

How to complete Form 941

Completing Form 941 may seem intimidating, but with the right guidance, it can be a straightforward process. Here is a step-by-step guide on how to complete Form 941:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.