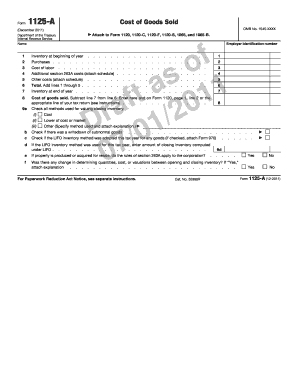

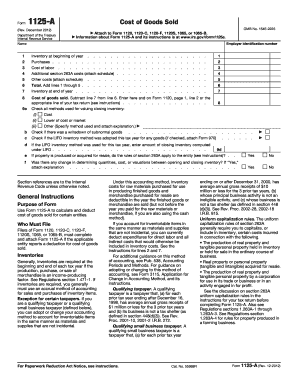

Form 1125-a

What is form 1125-a?

Form 1125-A is a tax form used by businesses to report cost of goods sold and other expenses related to production that are deductible under the Internal Revenue Code. It provides a detailed breakdown of these expenses for accurate tax reporting.

What are the types of form 1125-a?

There are two types of form 1125-A: 1. Form 1125-A (Schedule A) - This is used by manufacturing, mining, wholesale trade, and transportation businesses to report the cost of goods sold and other expenses. 2. Form 1125-A (Schedule B) - This is used by farmers to report the cost of goods sold and other expenses related to agricultural production.

How to complete form 1125-a

Completing form 1125-A can seem daunting, but by following these steps you can easily navigate through the process:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.