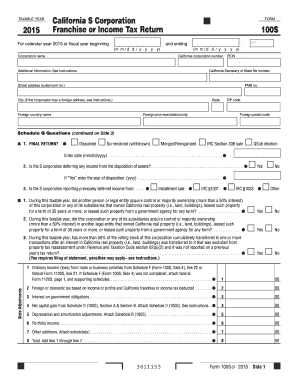

Form 1120s 2016

What is form 1120s 2016?

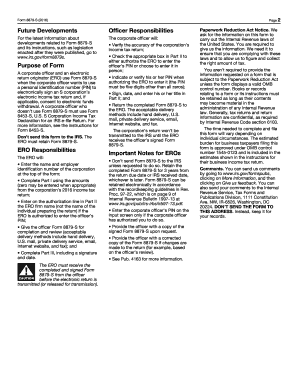

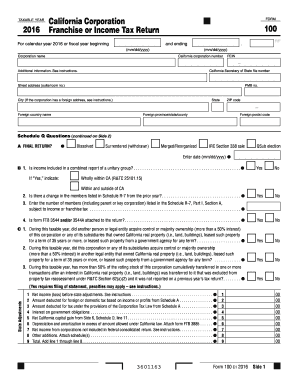

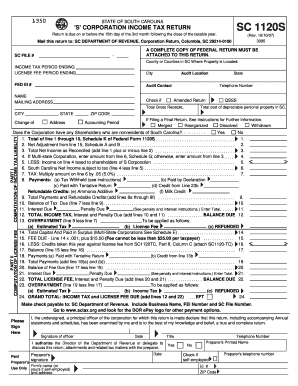

Form 1120S 2016 is a tax form used by S corporations to report their income, deductions, and credits for the year 2016. This form is specifically designed for small businesses that have chosen to be treated as S corporations for tax purposes. By filing this form, S corporations can report their business income separately from their personal income, which can help them take advantage of certain tax benefits and avoid double taxation on their earnings.

What are the types of form 1120s 2016?

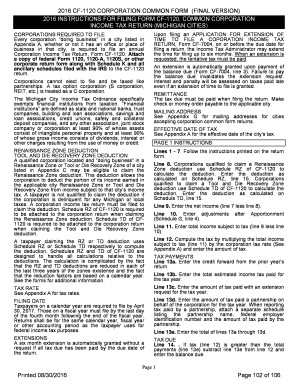

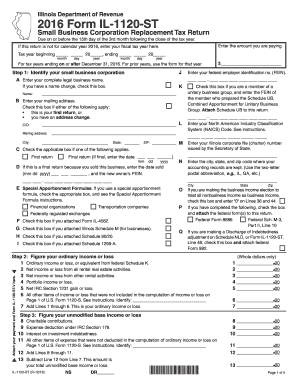

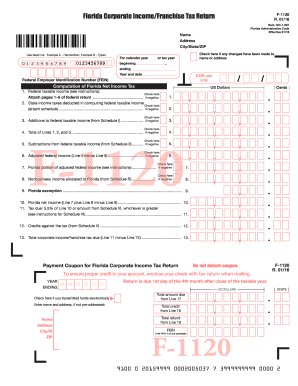

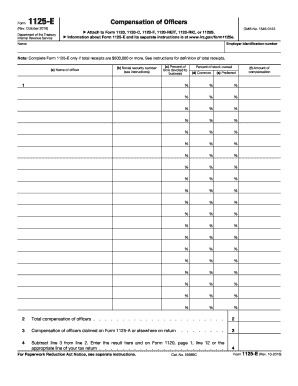

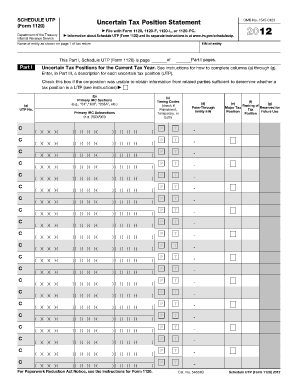

There are several types of form 1120S 2016, each serving a specific purpose. The most common types include: 1. Form 1120S: This is the main form used to report the income, deductions, and credits of the S corporation. 2. Schedule K-1: This form is used to report each shareholder's share of the S corporation's income, deductions, and credits. Each shareholder receives a copy of Schedule K-1 to report on their own individual tax returns. 3. Schedule B: This form is used to report the S corporation's total assets, liabilities, and capital accounts at the beginning and end of the tax year. 4. Schedule M-2: This form is used to reconcile the S corporation's accumulated adjustments account (AAA) to the ending AAA reported on the S corporation's tax return.

How to complete form 1120s 2016

Completing form 1120S 2016 may seem daunting, but with the right guidance, it can be a smooth process. Here's a step-by-step guide to help you navigate through: 1. Gather all necessary information: Collect all financial records, expense receipts, and other relevant documents needed to accurately report your income and deductions. 2. Fill out the basic information: Provide the S corporation's name, address, Employer Identification Number (EIN), and other required details. 3. Report income and deductions: Use Schedule K-1 to report each shareholder's share of the S corporation's income, deductions, and credits. Ensure all figures are accurate and supported by appropriate documentation. 4. Complete the remaining schedules: Fill out Schedule B to report total assets, liabilities, and capital accounts, and Schedule M-2 to reconcile the accumulated adjustments account. 5. Review and submit: Double-check all information, make any necessary corrections, and sign the form before submitting it to the appropriate tax authority.

pdfFiller is a powerful online platform that empowers users to create, edit, and share documents effortlessly. With pdfFiller's unlimited fillable templates and robust editing tools, users can easily complete and file their Form 1120S 2016. Whether you're a small business owner or a tax professional, pdfFiller is the trusted PDF editor you need for all your document needs.