Form 1120 2016

What is form 1120 2016?

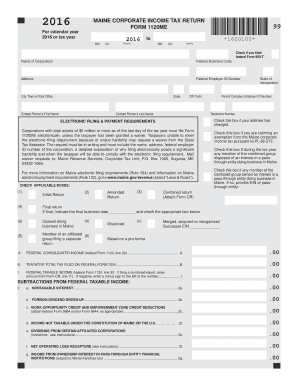

Form 1120 2016 is a tax form used by corporations to report their income, deductions, and tax liabilities for the year 2016. This form is specifically designed for corporations and is filed with the Internal Revenue Service (IRS) in the United States. It helps the IRS assess the corporation's tax liability and ensures compliance with tax laws.

What are the types of form 1120 2016?

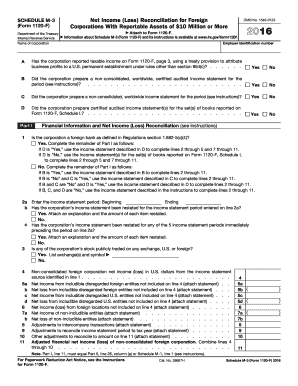

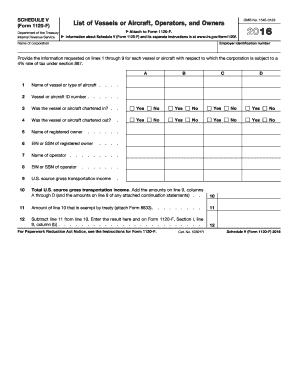

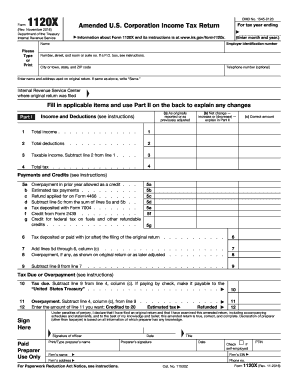

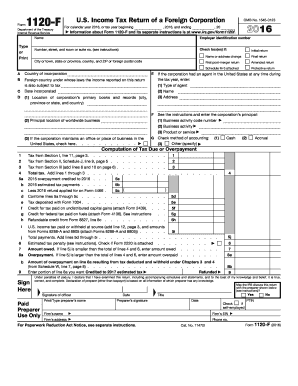

There are different types of form 1120 2016, depending on the type of corporation and its tax status. The most common types include: 1. Form 1120: This is the general form used by domestic corporations to report their income and taxes. 2. Form 1120-F: This is used by foreign corporations engaged in a trade or business within the United States. 3. Form 1120S: This is used by S corporations, which are small corporations with a limited number of shareholders.

How to complete form 1120 2016?

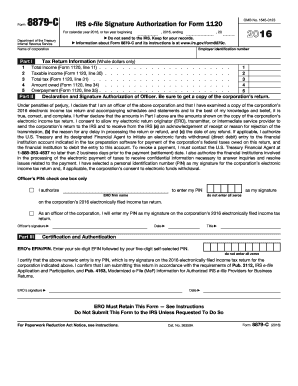

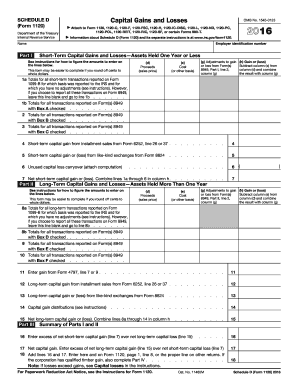

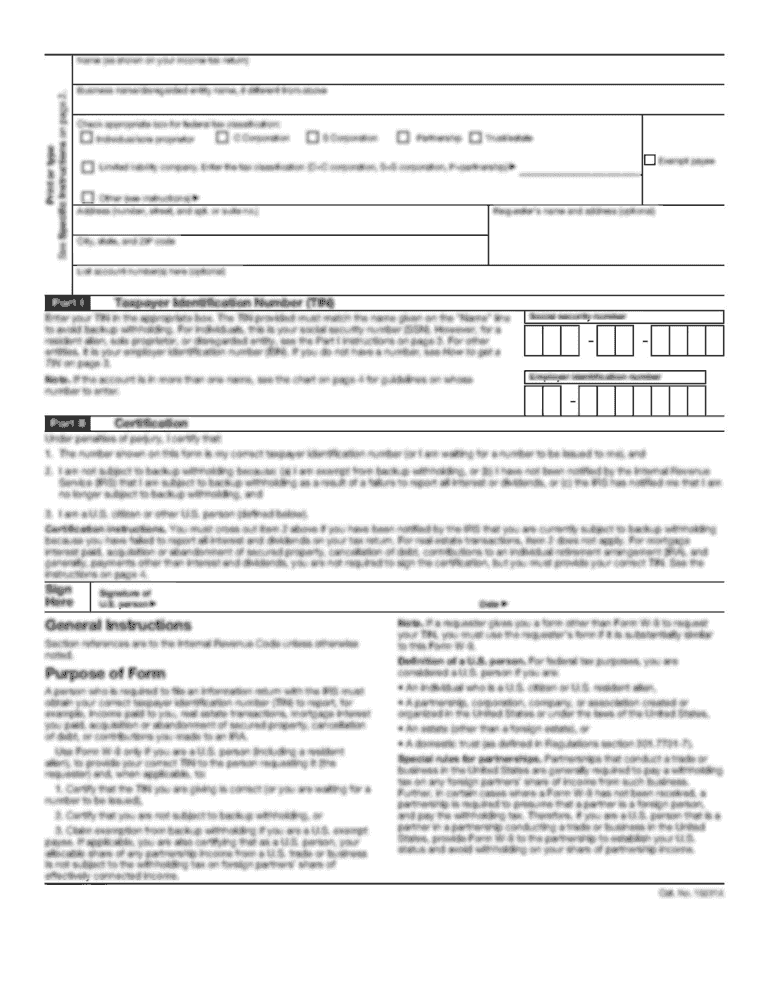

Completing form 1120 2016 may seem overwhelming, but with the right guidance, it can be done efficiently. Here are the steps to complete the form: 1. Gather all necessary documents, such as financial statements, receipts, and records of income and expenses. 2. Enter the corporation's basic information, including its name, address, and tax identification number. 3. Report the corporation's income by filling out the appropriate sections of the form. 4. Deduct allowable expenses, such as business expenses, salaries, and rental fees. 5. Calculate the corporation's taxable income and apply the appropriate tax rates. 6. Fill out any additional schedules or forms required by the IRS. 7. Review the completed form for accuracy and make sure all necessary attachments are included. 8. Sign and date the form before submitting it to the IRS.

With the help of pdfFiller, completing form 1120 2016 has never been easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.