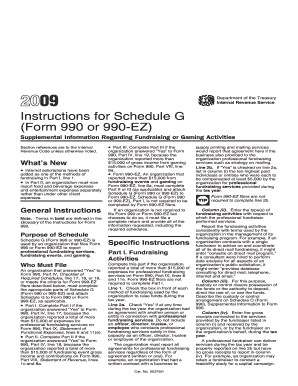

Form 1120 Schedule G

What is form 1120 schedule g?

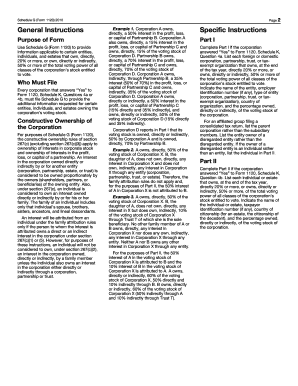

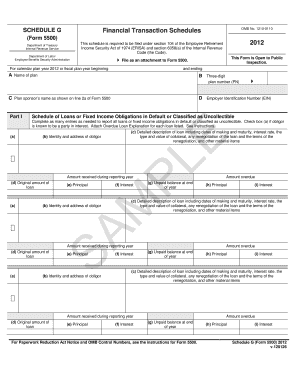

Form 1120 Schedule G is a supplementary form that provides essential information about any foreign operations of a corporation filing Form 1120, the U.S. Corporation Income Tax Return. It is used to report any controlled foreign corporations (CFCs) or any foreign partnerships in which the corporation has an interest.

What are the types of form 1120 schedule g?

There are two types of Form 1120 Schedule G: 1. Part I - Controlled Foreign Corporations: This section requires the corporation to report information about any CFCs it controls. It includes details such as the name of the CFC, its country of incorporation, and the percentage of ownership. 2. Part II - Other Foreign Partnerships: In this section, the corporation must provide information about any foreign partnerships in which it has an interest. This includes the name, address, and country of incorporation of the partnership, as well as the percentage of ownership.

How to complete form 1120 schedule g

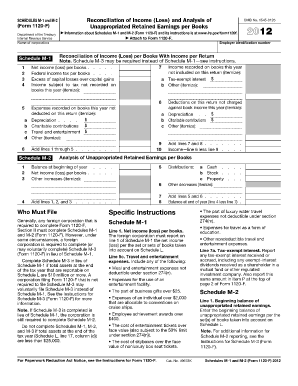

Completing Form 1120 Schedule G may seem daunting, but with the right information, it can be done easily. Here's a step-by-step guide:

With pdfFiller, completing Form 1120 Schedule G becomes even more convenient. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.