Get the free Leave-based donation programs to aid victims of the - irs

Show details

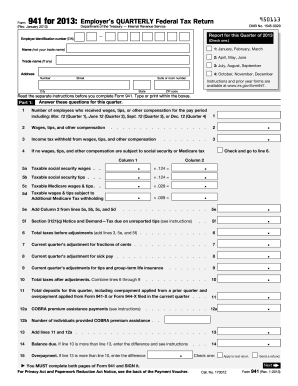

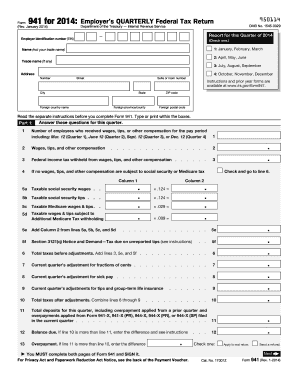

Jan 1, 2016 ... of Services and Payments, in section 15 of Pub. 15, Employer's Tax ... notify the IRS if they want to file quarterly Forms 941 instead of annual Form 944. ... IRS at 1-800-829-4933

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign leave-based donation programs to

Edit your leave-based donation programs to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your leave-based donation programs to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing leave-based donation programs to online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit leave-based donation programs to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out leave-based donation programs to

How to fill out leave-based donation programs:

01

Review the program guidelines: Start by carefully reading the program guidelines provided by your employer or the organization administering the program. Understand the eligibility criteria, donation limits, and any specific requirements.

02

Check your available leave balance: Determine the amount of leave you have available for donation. Typically, leave-based donation programs allow employees to donate their unused leave, such as vacation or sick days, to support colleagues facing personal or medical emergencies.

03

Choose the recipient(s): Identify the colleague(s) you want to support through your leave donation. It could be someone who is experiencing a serious illness, caregiving responsibilities, or any other qualifying circumstances outlined in the program guidelines.

04

Submit a donation request: Contact the HR department or the designated program administrator to express your intention to donate leave. Provide the necessary details, including the recipient's name, the number of days you wish to donate, and any additional information required.

05

Seek supervisor approval: In many cases, your immediate supervisor or manager will need to approve your leave donation request. This step ensures that your absence from work due to donation doesn't disrupt the workflow or cause any inconvenience.

06

Complete the necessary paperwork: Fill out any required forms or documentation related to the leave-based donation program. This may include a formal leave donation request form or a written agreement outlining the terms of your donation.

07

Confirm your donation: Once your donation has been approved and processed, confirm the details with the program administrator or HR department. Ensure that your leave balance has been appropriately adjusted, reflecting the donated days.

Who needs leave-based donation programs:

01

Employees facing personal emergencies: Leave-based donation programs provide crucial support to colleagues who encounter unexpected personal emergencies, such as a serious illness, injury, or natural disaster. These individuals benefit greatly from the generosity of their colleagues who contribute their unused leave.

02

Employees with caregiving responsibilities: Those who have to care for a family member with a severe illness or special needs often require additional time off work. Leave-based donation programs allow their co-workers to come together and offer much-needed assistance during difficult times.

03

Individuals awaiting major medical procedures: Leave-based donation programs can be invaluable for employees who need extended time off to undergo significant medical procedures. These programs alleviate financial burdens by allowing colleagues to donate their leave, giving the recipient an opportunity to focus on their health and recovery.

Overall, leave-based donation programs serve as a meaningful way for employees to support and uplift their colleagues who are facing challenging circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get leave-based donation programs to?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific leave-based donation programs to and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I sign the leave-based donation programs to electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your leave-based donation programs to.

Can I create an electronic signature for signing my leave-based donation programs to in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your leave-based donation programs to and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Fill out your leave-based donation programs to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Leave-Based Donation Programs To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.