ESigning 1040 Form For Free

Users trust to manage documents on pdfFiller platform

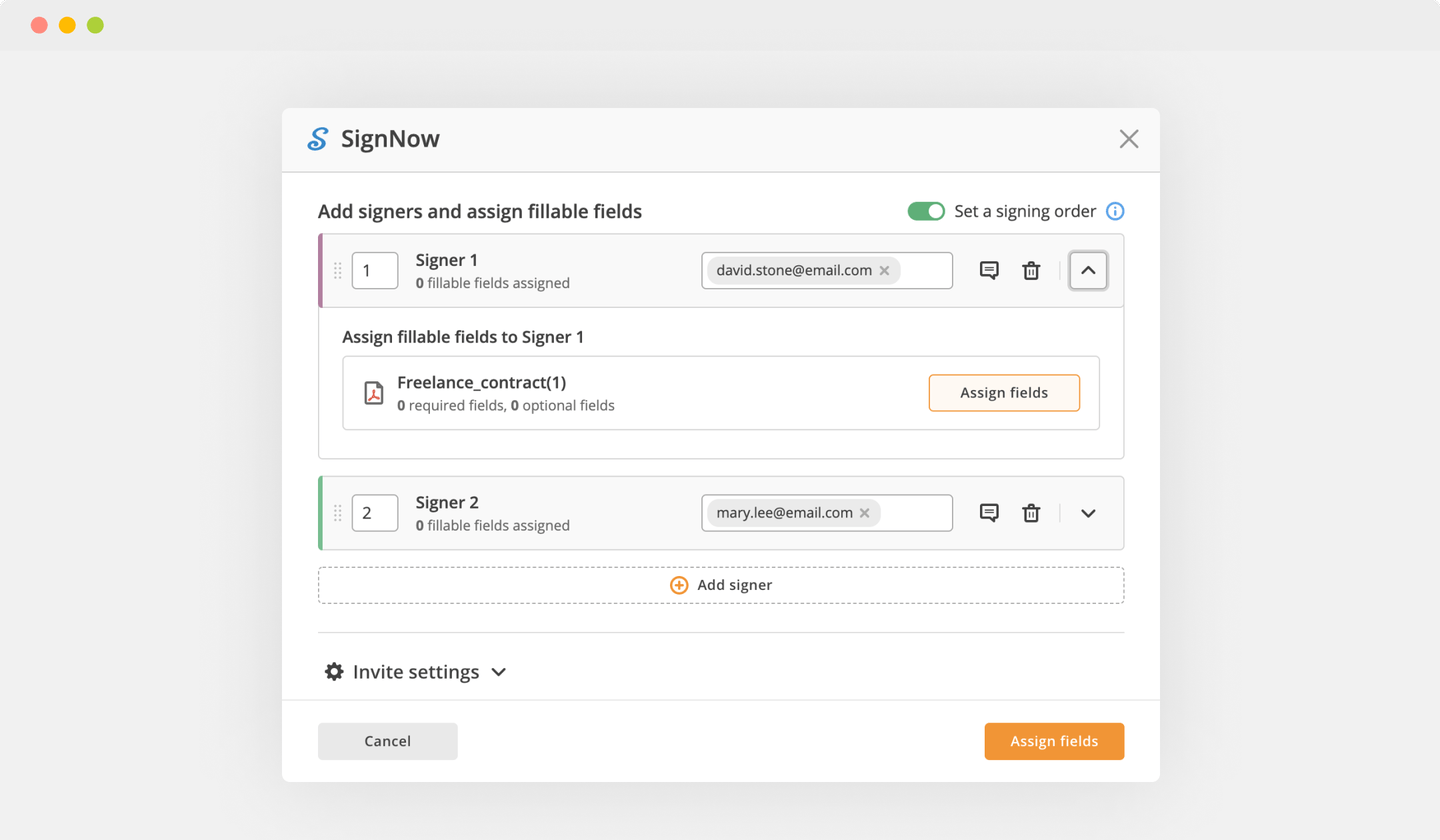

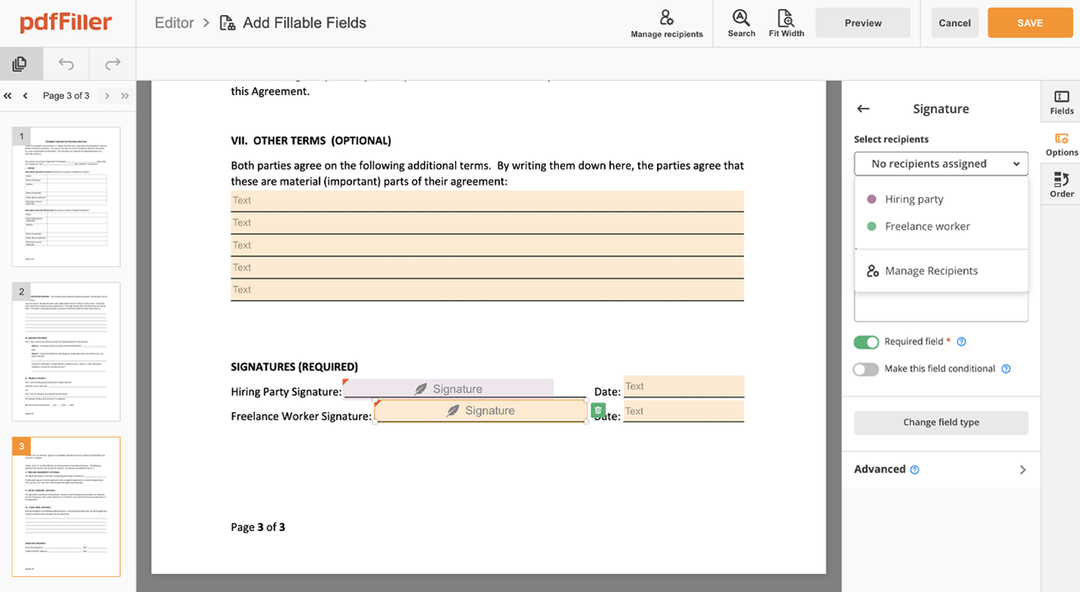

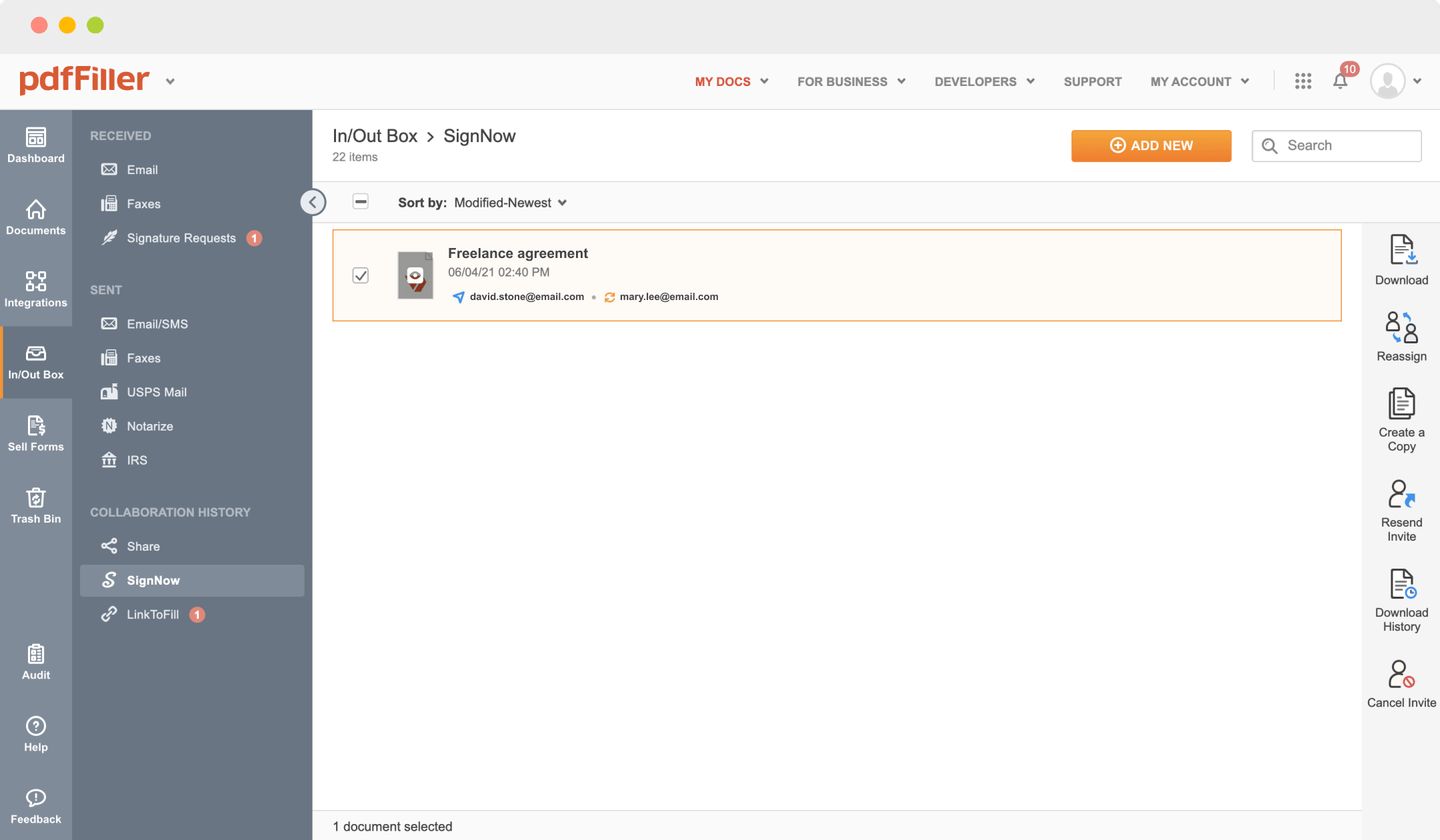

Send documents for eSignature with signNow

Watch a short video walkthrough on how to add an ESigning 1040 Form

pdfFiller scores top ratings in multiple categories on G2

Add a legally-binding ESigning 1040 Form with no hassle

pdfFiller allows you to handle ESigning 1040 Form like a pro. Regardless of the platform or device you use our solution on, you'll enjoy an intuitive and stress-free method of executing documents.

The whole signing process is carefully safeguarded: from uploading a file to storing it.

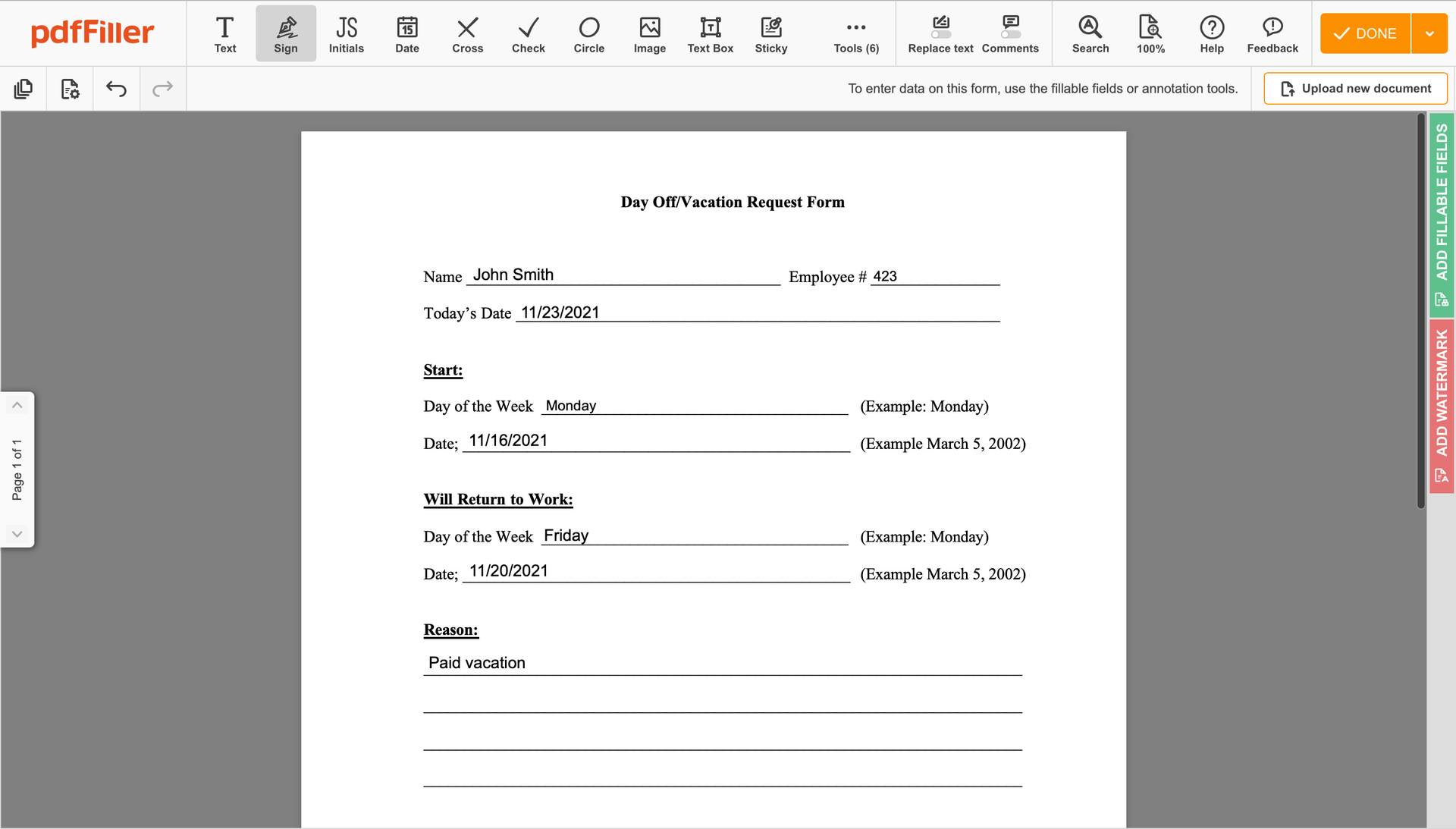

Here's how you can create ESigning 1040 Form with pdfFiller:

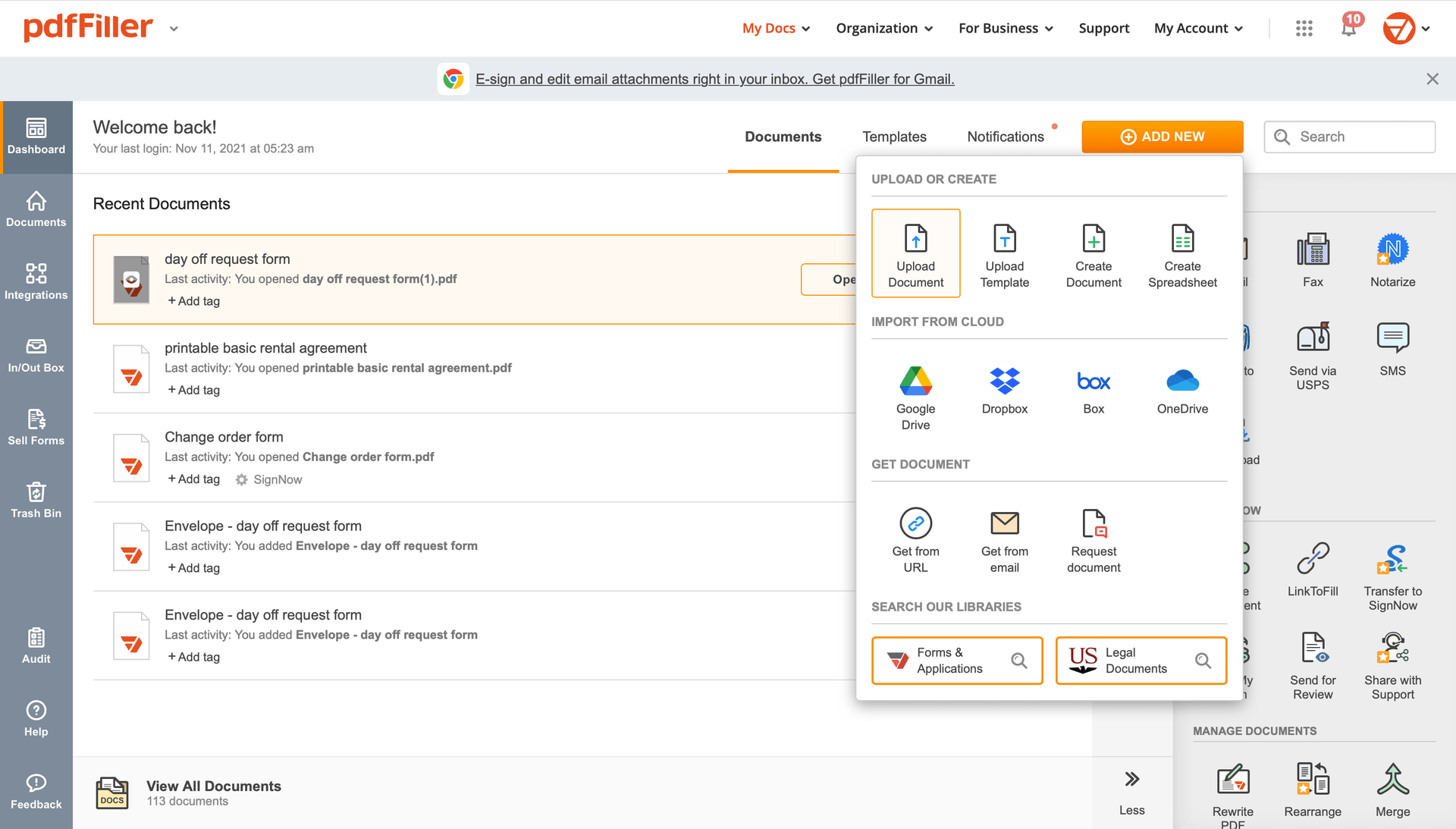

Choose any available option to add a PDF file for completion.

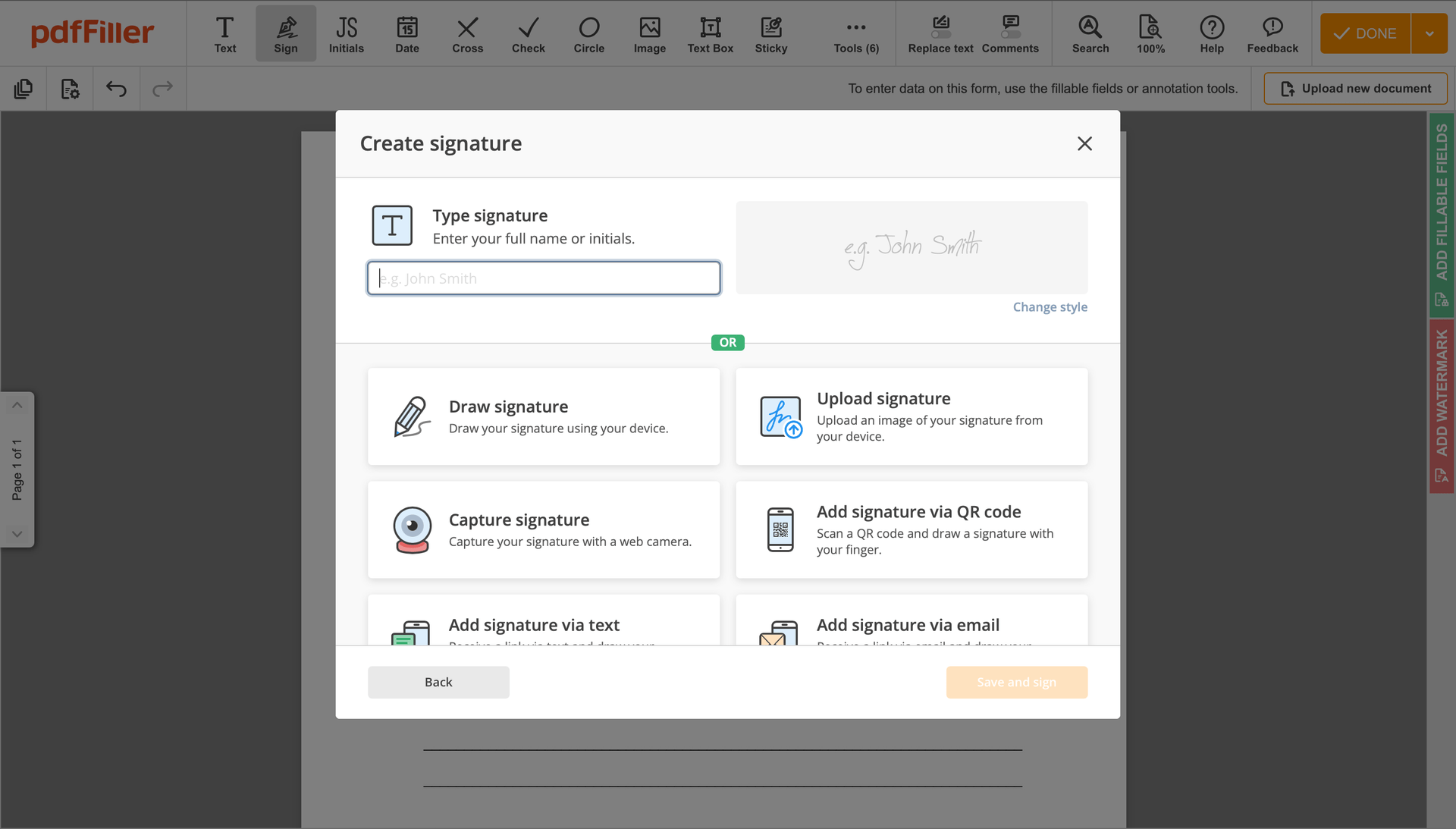

Use the toolbar at the top of the page and choose the Sign option.

You can mouse-draw your signature, type it or upload a photo of it - our tool will digitize it in a blink of an eye. As soon as your signature is created, hit Save and sign.

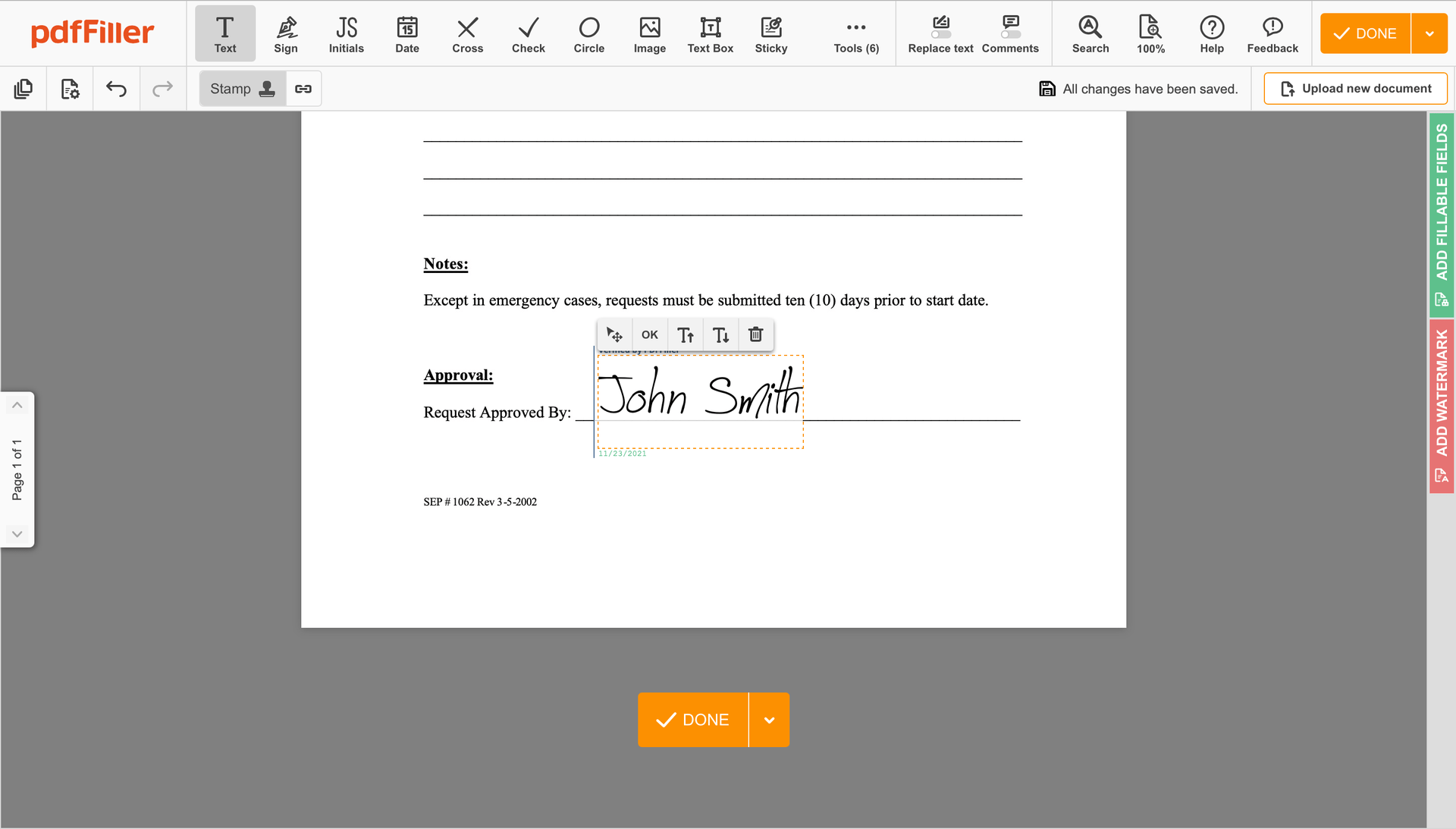

Click on the document place where you want to put an ESigning 1040 Form. You can drag the newly created signature anywhere on the page you want or change its configurations. Click OK to save the adjustments.

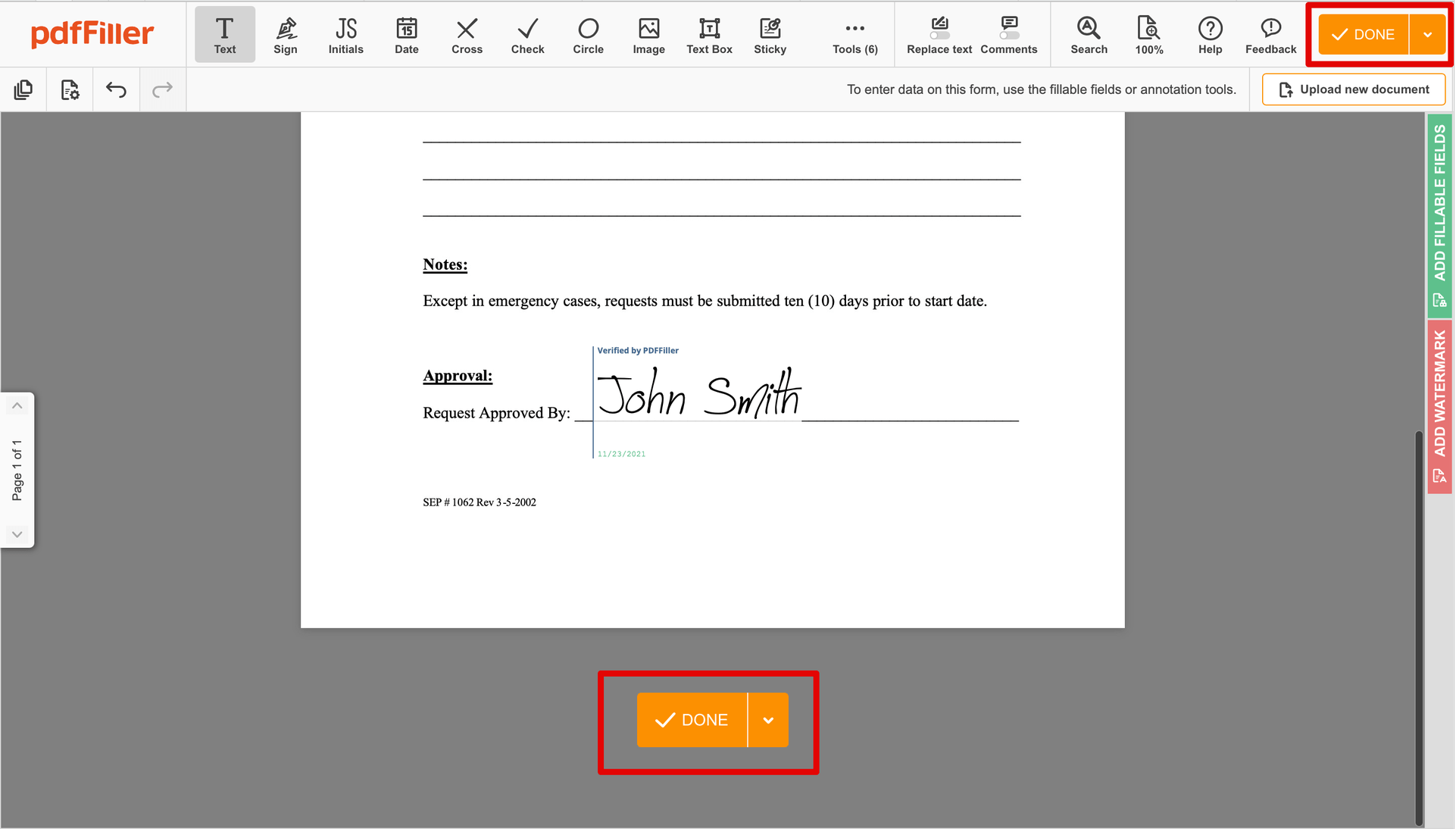

Once your form is good to go, hit the DONE button in the top right corner.

Once you're through with certifying your paperwork, you will be taken back to the Dashboard.

Use the Dashboard settings to get the completed form, send it for further review, or print it out.

Stuck working with numerous applications for editing and signing documents? Use this all-in-one solution instead. Use our document editor to make the process efficient. Create document templates completely from scratch, edit existing form sand more useful features, within one browser tab. You can use eSigning 1040 Form right away, all features are available instantly. Pay as for a basic app, get the features as of pro document management tools. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How to edit a PDF document using the pdfFiller editor:

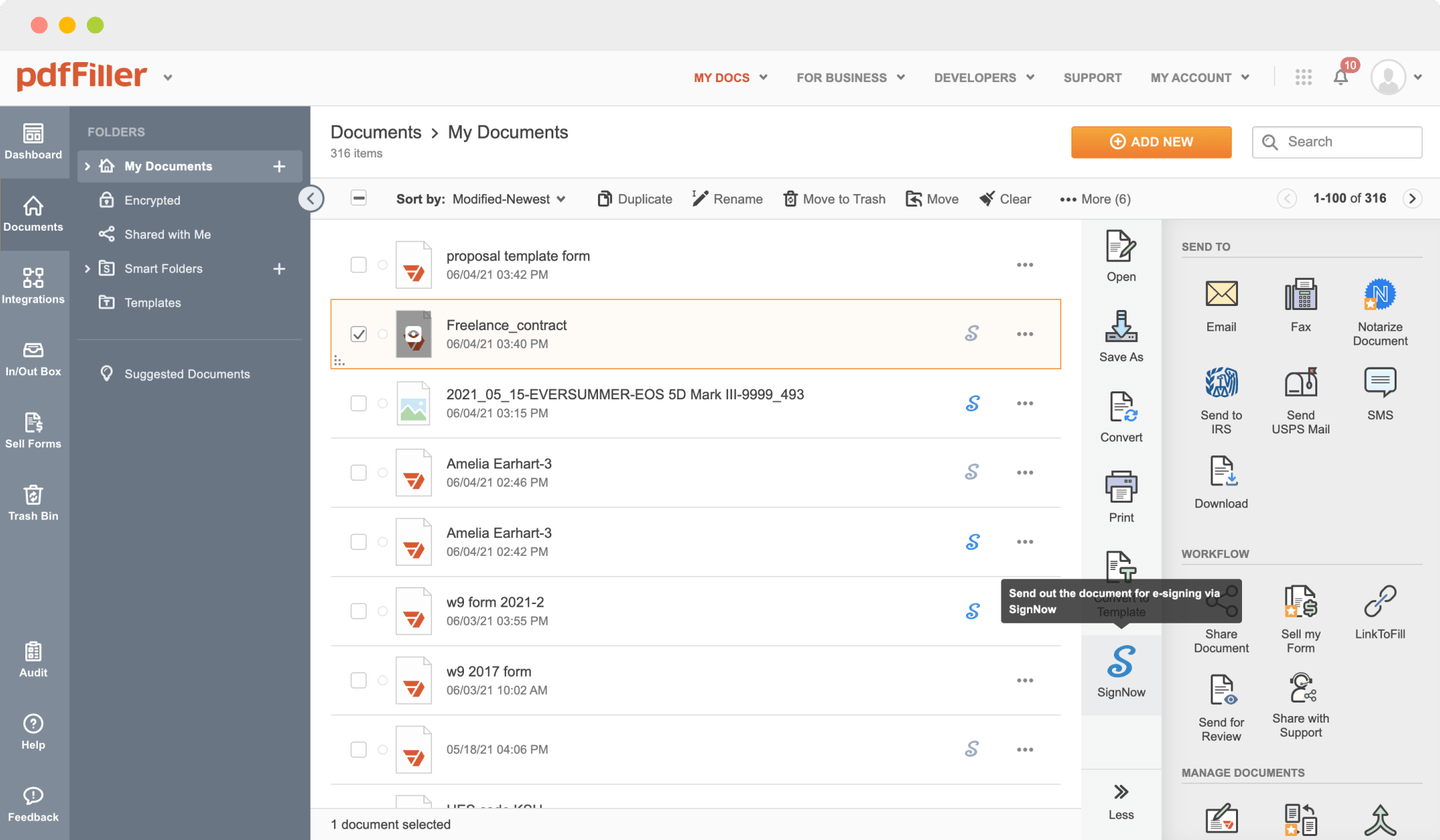

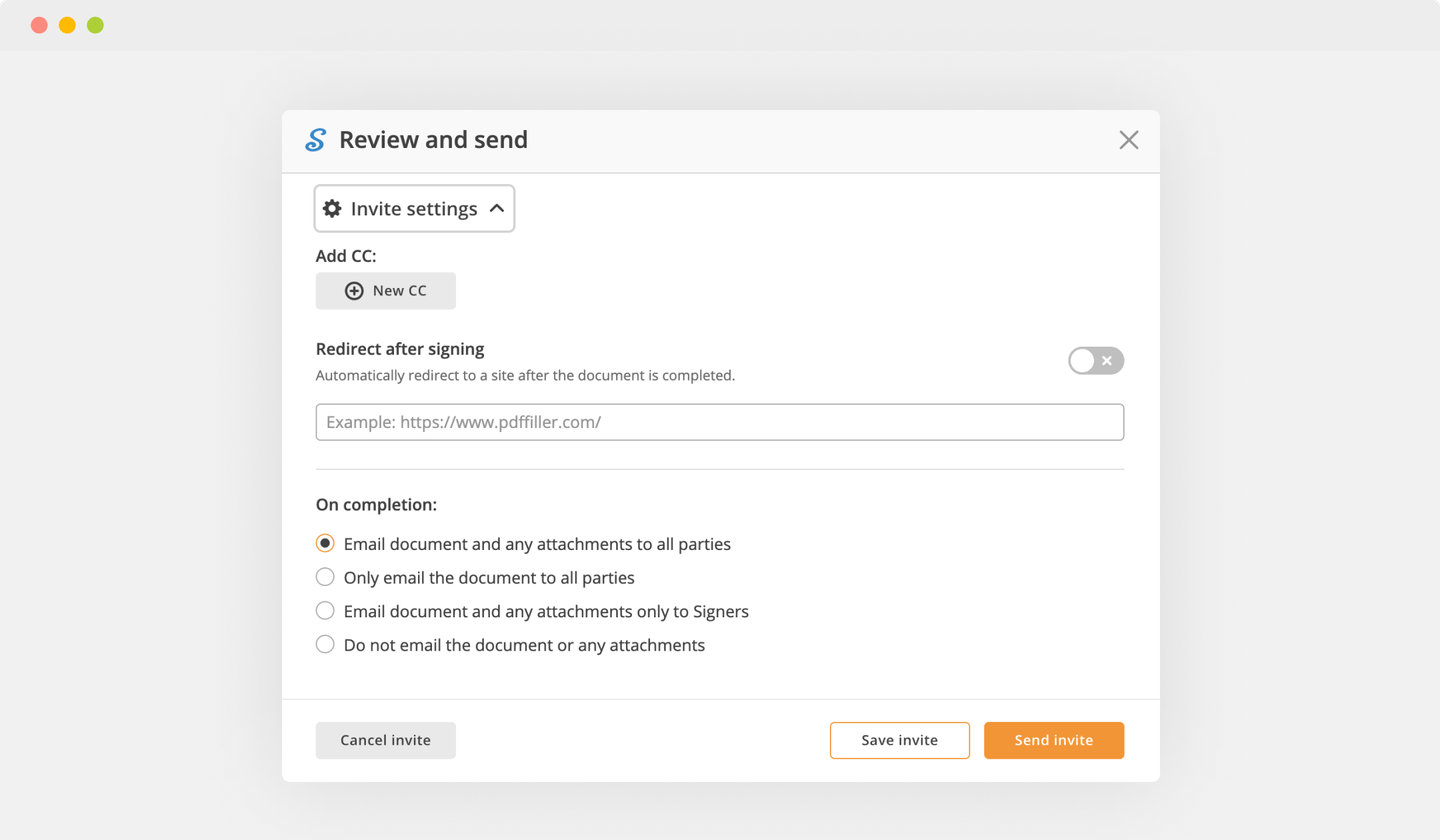

How to Send a PDF for eSignature

What our customers say about pdfFiller

PDF Filler was a Game changer for me! All my files are saved as a PDF now, I can sign documents and send back via fax or email to customers. Its also very handy with my touch screen laptop. I use a stylist pen and clients can sign just 1 time and I can use it over the course of all their documents. Clients can come in and sign without dealing with paper and copying. All I need is 1 signature and that's it!!! My whole team loves it, and I have had other Agents ask me what I use, so I have referred several of my friends to PDF FILLER.

What do you dislike?

Wish they had more fonts and color texts. Also it would be great if we could capture a signature and send it in to use. Perhaps a bigger data base for signatures as well, and more documents to be saved. Overall this program is very useful in my line of business. I use it multiple times a day, even on the weekends when necessary.

Recommendations to others considering the product:

Easy to use and saves time and money

What problems are you solving with the product? What benefits have you realized?

So much less paperwork! Saves time, money, paper and ink. 90% of my documents are saved on my computer. So no more bulky filing cabinets and paper records. Less $ on ink, and paper which is very expensive. Its actually safer to save to a hard drive anyway. Very pleased with everything PDF Filler has to offer my business.