Canada GST66 E 2000 free printable template

Show details

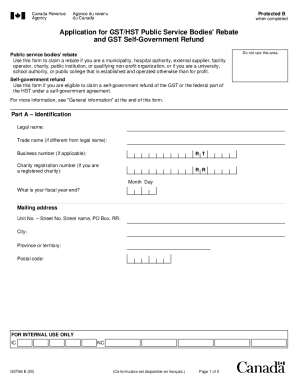

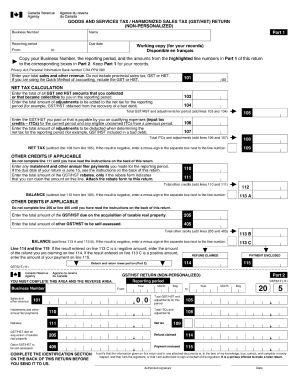

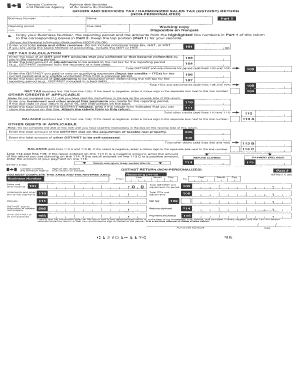

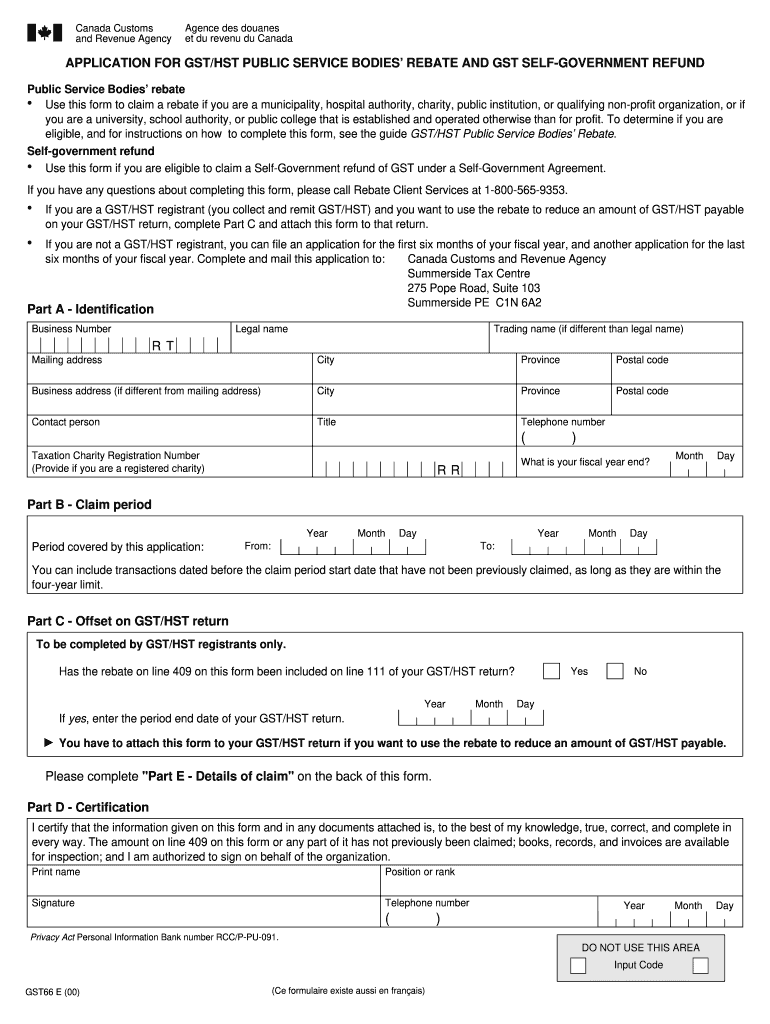

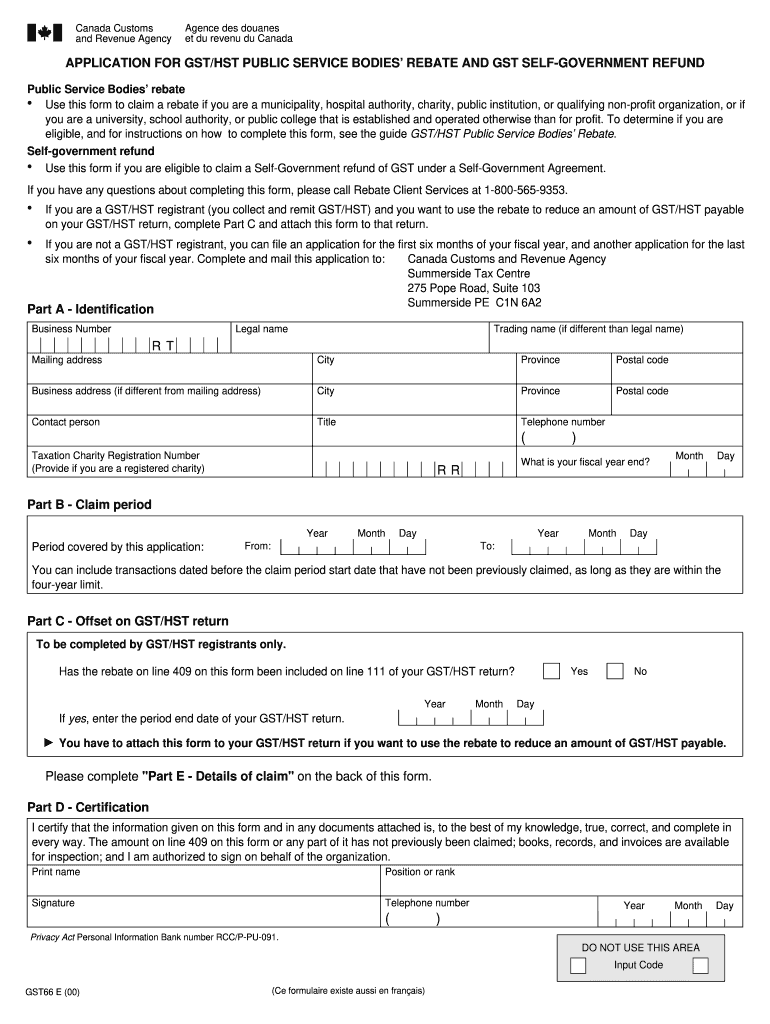

DO NOT USE THIS AREA Input Code GST66 E 00 Ce formulaire existe aussi en fran ais Part E - Details of claim Enter the amount of rebate that you are claiming for the activities that you perform on the appropriate line of the table below. Canada Customs and Revenue Agency Agence des douanes et du revenu du Canada APPLICATION FOR GST/HST PUBLIC SERVICE BODIES REBATE AND GST SELF-GOVERNMENT REFUND Public Service Bodies rebate l Use this form to claim a rebate if you are a municipality hospital...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada GST66 E

Edit your Canada GST66 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada GST66 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada GST66 E online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada GST66 E. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada GST66 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada GST66 E

How to fill out Canada GST66 E

01

Obtain the Canada GST66 E form from the Canada Revenue Agency (CRA) website or at a local CRA office.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide your Business Number (BN), if applicable.

04

Indicate whether you are applying for a GST/HST credit or for another reason.

05

Complete any relevant sections that apply to your situation, ensuring accuracy.

06

Review the filled form for any errors or missing information.

07

Sign and date the form to validate your application.

08

Submit the completed form to the CRA either by mail or online, depending on the submission method you choose.

Who needs Canada GST66 E?

01

Individuals or businesses in Canada who are registering for the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST).

02

People who wish to claim a GST/HST credit or those who have to file for a rebate.

03

Any entity that has collected GST/HST and needs to remit it to the government.

Fill

form

: Try Risk Free

People Also Ask about

What is GST66?

GST66 Application for GST/HST Public Service Bodies' Rebate and GST Self-Government Refund.

How do I claim my GST refund Canada?

To claim your rebate, use Form GST189, General Application for GST/HST Rebate. You can only use one reason code per rebate application. If you are eligible to claim a rebate under more than one code, use a separate rebate application for each reason code.

What is the HST refund in Ontario?

The goods and services tax/harmonized sales tax (GST/HST) credit is a tax-free quarterly payment that helps individuals and families with low and modest incomes offset the GST or HST that they pay. It may also include payments from provincial and territorial programs.

Can you claim GST back when leaving Canada?

Place of final departure from Canada If yes, send us your original validated receipts. Use this form to claim a refund of goods and services tax / harmonized sales tax (GST/HST) if: • you are an individual and a non-resident of Canada; and • the total of your eligible purchases, before taxes, is CAN$200 or more.

What is the HST rebate for small business in Ontario?

You can claim a rebate of 5/105 of the eligible expenses on which you paid the GST. The rebate amounts of the eligible expenses on which you paid the HST are: 13/113 for expenses on which you paid 13% HST. 15/115 for expenses on which you paid 15% HST.

What is the GST refund for tourists in Canada?

You can claim up to 50% of the amount of GST/HST you paid for the eligible tour package. The refund calculation is based on the number of nights of short-term accommodation in Canada included in the package.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Canada GST66 E?

The editing procedure is simple with pdfFiller. Open your Canada GST66 E in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out Canada GST66 E using my mobile device?

Use the pdfFiller mobile app to complete and sign Canada GST66 E on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete Canada GST66 E on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your Canada GST66 E. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is Canada GST66 E?

Canada GST66 E is a form used by businesses to apply for a refund of Goods and Services Tax (GST) or Harmonized Sales Tax (HST) paid on expenses related to commercial activities.

Who is required to file Canada GST66 E?

Businesses that are registered for GST/HST and have incurred eligible expenses can file Canada GST66 E to claim a refund for overpaid taxes.

How to fill out Canada GST66 E?

To fill out Canada GST66 E, you need to provide your business details, include information about the expenses for which you are claiming a refund, and calculate the total amount of GST/HST eligible for refund.

What is the purpose of Canada GST66 E?

The purpose of Canada GST66 E is to allow businesses to reclaim GST/HST that they have paid on their expenses, ensuring they do not incur unnecessary tax burdens.

What information must be reported on Canada GST66 E?

Canada GST66 E requires reporting business identification details, amounts of GST/HST paid on eligible expenses, and a breakdown of the types of expenses for which refunds are being claimed.

Fill out your Canada GST66 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada gst66 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.