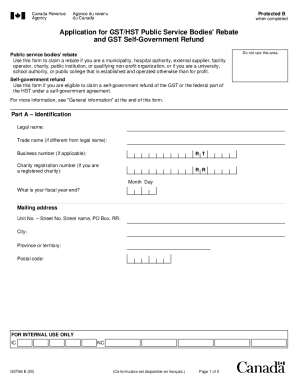

Canada GST66 E 2013 free printable template

Show details

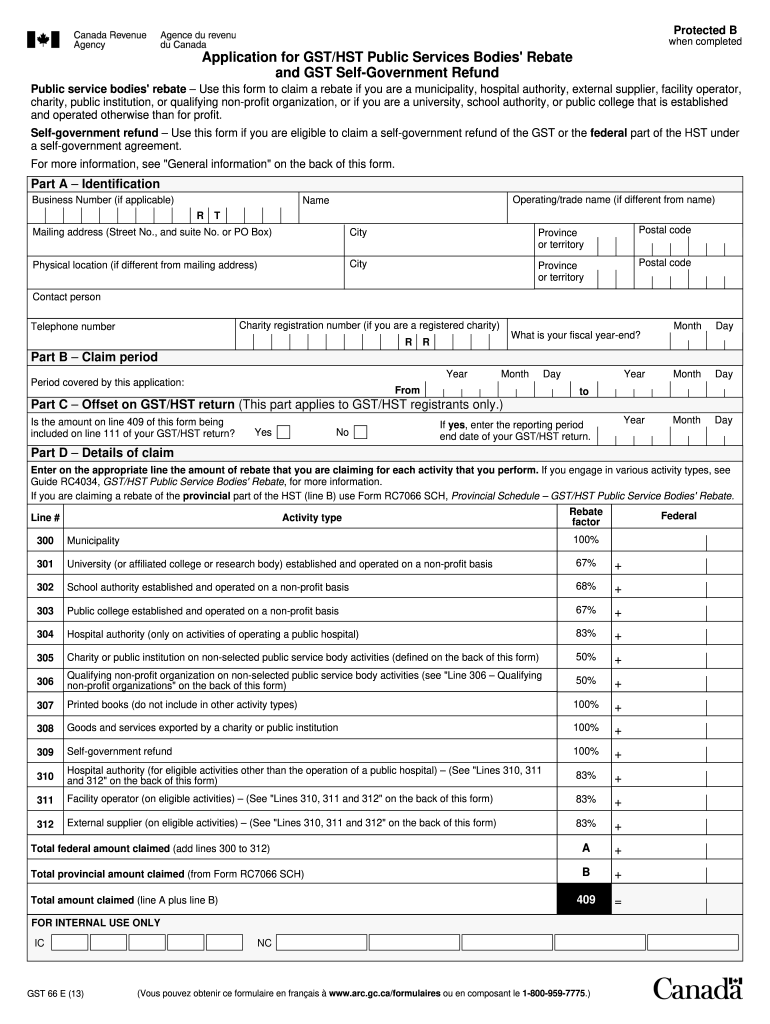

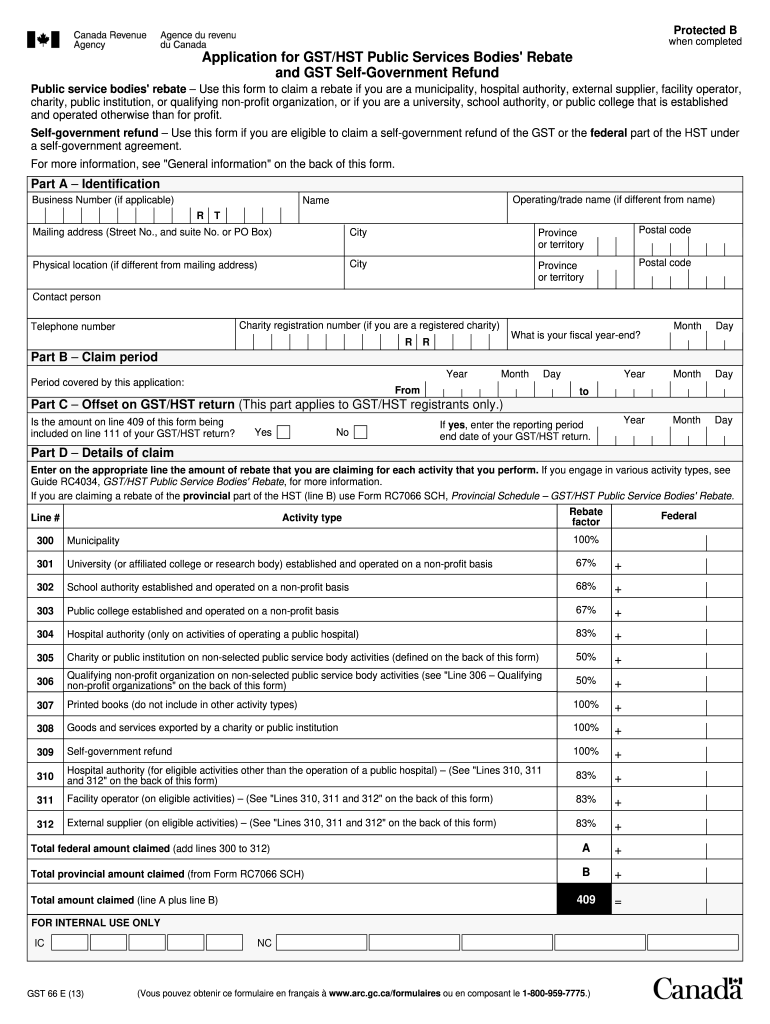

Rebate Line Federal Activity type factor Municipality University or affiliated college or research body established and operated on a non-profit basis e School authority established and operated on a non-profit basis Public college established and operated on a non-profit basis Hospital authority only on activities of operating a public hospital Charity or public institution on non-selected public service body activities defined on the back of this form Qualifying non-profit organization on...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada GST66 E

Edit your Canada GST66 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada GST66 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada GST66 E online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada GST66 E. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada GST66 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada GST66 E

How to fill out Canada GST66 E

01

Obtain the Canada GST66 E form from the official Canada Revenue Agency (CRA) website.

02

Start by filling out your personal information, including your name, address, and contact information.

03

Indicate whether you are applying for the GST/HST registration as an individual or a business.

04

Provide details of your business activity, including your business number if you have one.

05

Complete the sections regarding your estimated sales and any other required financial information.

06

Review the declarations section and ensure you understand the responsibilities if registered.

07

Sign and date the form at the bottom.

08

Submit the completed form either by mail or online as specified by the CRA.

Who needs Canada GST66 E?

01

Businesses that have taxable sales exceeding the small supplier threshold.

02

New businesses that plan to make taxable sales.

03

Individuals needing to register to collect GST/HST for their products or services.

04

Non-resident businesses making sales in Canada.

Instructions and Help about Canada GST66 E

Fill

form

: Try Risk Free

People Also Ask about

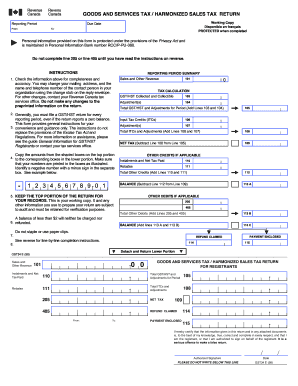

How do I claim my GST refund Canada?

To claim your rebate, use Form GST189, General Application for GST/HST Rebate. You can only use one reason code per rebate application. If you are eligible to claim a rebate under more than one code, use a separate rebate application for each reason code.

What is the municipal rebate for HST in Ontario?

Municipal rebate – is a public service bodies' rebate available for municipalities at a rate of 100% of the GST and the federal part of the HST. Municipalities in New Brunswick and Nova Scotia are also entitled to a municipal rebate at a rate of 57.14% for the provincial portion of the HST.

How much is HST rebate in Ontario?

HST New Home Rebate An eligible new home buyer can claim a rebate of the PST & GST, calculated as follows: 75% of PST up to a maximum of $24,000 (reached at $424,850) 36% of GST if the price is <$350k up to a maximum of $6,300. Between $350k-$450k, a reduced sliding scale applies and above $450k, the rebate is $0.

Who qualifies for HST rebate in Ontario?

To receive the GST/HST credit you have to be a resident of Canada for tax purposes, and at least 1 of the following applies, you: Are 19 years of age or older; Have (or previously had) a spouse or common-law partner; or. Are (or previously were) a parent and live (or previously lived) with your child.

What is the HST rebate for small business in Ontario?

You can claim a rebate of 5/105 of the eligible expenses on which you paid the GST. The rebate amounts of the eligible expenses on which you paid the HST are: 13/113 for expenses on which you paid 13% HST. 15/115 for expenses on which you paid 15% HST.

What is GST66?

GST66 Application for GST/HST Public Service Bodies' Rebate and GST Self-Government Refund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Canada GST66 E in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your Canada GST66 E and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make edits in Canada GST66 E without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit Canada GST66 E and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the Canada GST66 E in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your Canada GST66 E and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is Canada GST66 E?

Canada GST66 E is a form used for businesses to apply for a GST/HST registration number in Canada. It is specifically designed for businesses that are not already registered for GST/HST and need to apply.

Who is required to file Canada GST66 E?

Businesses that make taxable supplies in Canada and meet specific revenue thresholds or those that want to claim input tax credits are required to file Canada GST66 E to obtain a GST/HST registration number.

How to fill out Canada GST66 E?

To fill out Canada GST66 E, you need to provide information such as your business name, address, type of business, and the anticipated taxable sales. Ensure all sections are completed accurately and submit the form to the Canada Revenue Agency.

What is the purpose of Canada GST66 E?

The purpose of Canada GST66 E is to register businesses for the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST), allowing them to collect tax on sales and claim input tax credits.

What information must be reported on Canada GST66 E?

The information that must be reported on Canada GST66 E includes the business name, address, contact information, type of business activities, expected annual revenues, and details on any partners or directors if applicable.

Fill out your Canada GST66 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada gst66 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.