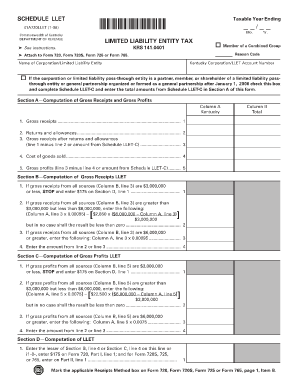

KY DoR 42A740(PKT) 2012 free printable template

Show details

COMMONWEALTH OF KENTUCKY DEPARTMENT OF REVENUE FRANKFORT KENTUCKY 40620 42A740 PKT 10-12 Kentucky Individual Income Tax Forms www. This amount is shown on wage and tax statements including Forms 1099 and W-2G which you must attach to Form 740 in the designated area. You will not be given credit for Kentucky income tax withheld unless you attach the wage and tax statements or other supporting documents reflecting Kentucky withholding. Employers ar...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR 42A740PKT

Edit your KY DoR 42A740PKT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR 42A740PKT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY DoR 42A740PKT online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KY DoR 42A740PKT. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR 42A740(PKT) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR 42A740PKT

How to fill out KY DoR 42A740(PKT)

01

Obtain the KY DoR 42A740(PKT) form from the Kentucky Department of Revenue's website or local office.

02

Begin by filling out your personal information in the designated fields, including your name, address, and social security number.

03

Enter the taxable year for which you are filing.

04

Provide details regarding your income, including any relevant schedules or attachments.

05

Calculate any deductions or credits that apply to your situation, and include this information in the respective sections.

06

Review the completed form for accuracy, ensuring all required fields are filled.

07

Sign and date the form at the designated areas.

08

Submit the completed form either by mail or electronically, following the instructions provided.

Who needs KY DoR 42A740(PKT)?

01

Individuals or businesses filing their taxes in Kentucky who are claiming certain credits or deductions.

02

Taxpayers needing to report specific types of income or expenses that require this form.

Fill

form

: Try Risk Free

People Also Ask about

What is Kentucky Department of Revenue Individual income tax?

Kentucky's individual income tax law is based on the Internal Revenue Code in effect as of December 31, 2021. The tax rate is five (5) percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141.019.

What is Kentucky form 720?

Pass-through Entities—Corporations doing business in Kentucky solely as a partner or member in a pass-through entity will file Form 720 pursuant to the provisions of KRS 141.010, KRS 141.120, and KRS 141.206.

What is a Kentucky 740 form?

Form 740 is the Kentucky income tax return for use by all taxpayers.

What is Kentucky form k5?

Form K-5. Form K-5 is used to report withholding statement information from Forms W-2, W-2G, and 1099 and is completed online with two filing methods to choose from. It may be filed electronically by clicking the submit button or the completed form may be printed and mailed to the address on the form.

What is Kentucky individual tax?

Kentucky has a flat 4.50 percent individual income tax rate. There are also jurisdictions that collect local income taxes. Kentucky has a 5.00 percent corporate income tax rate. Kentucky has a 6.00 percent state sales tax rate and does not levy any local sales taxes.

Who has to file Kentucky taxes?

Kentucky does not require you to use the same filing status as your federal return. Generally, all income of Kentucky residents, regardless of where it was earned, is subject to Kentucky income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send KY DoR 42A740PKT for eSignature?

Once you are ready to share your KY DoR 42A740PKT, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out the KY DoR 42A740PKT form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign KY DoR 42A740PKT and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out KY DoR 42A740PKT on an Android device?

Complete KY DoR 42A740PKT and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is KY DoR 42A740(PKT)?

KY DoR 42A740(PKT) is a form used by the Commonwealth of Kentucky to report specific tax information pertaining to certain transactions or tax obligations.

Who is required to file KY DoR 42A740(PKT)?

Individuals or businesses that meet certain criteria defined by Kentucky tax law are required to file KY DoR 42A740(PKT). This typically includes those engaging in activities subject to the specified tax.

How to fill out KY DoR 42A740(PKT)?

To fill out KY DoR 42A740(PKT), you need to provide accurate information as required by the form, including details about the taxpayer, the taxable activity, and any financial figures needed to calculate the tax owed.

What is the purpose of KY DoR 42A740(PKT)?

The purpose of KY DoR 42A740(PKT) is to ensure compliance with Kentucky tax laws by accurately reporting tax obligations and providing necessary information for the state's tax administration.

What information must be reported on KY DoR 42A740(PKT)?

The information that must be reported on KY DoR 42A740(PKT) includes taxpayer identification details, a description of the taxable activity, financial amounts related to the tax calculation, and any relevant deductions or credits.

Fill out your KY DoR 42A740PKT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR 42A740PKT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.