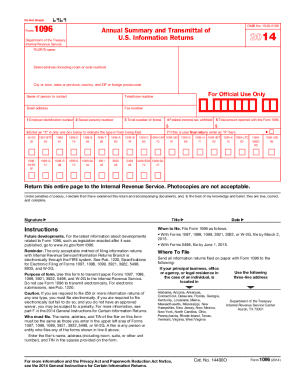

Get the free alabama form it re 2wh

Show details

Mail amended returns to Alabama Department of Revenue NOTE Form IT RE-2WH Application For Refund of Income Tax Withholding must be completed and submitted in order to receive a refund. This form will automatically be mailed to you once your overpayment has been verified by the Department of Revenue. No credit or refund will be allowed unless a credit is claimed or an IT RE-2WH is submitted within three years from the date the return was filed or ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alabama form it re

Edit your alabama form it re form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alabama form it re form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit alabama form it re online

Follow the steps down below to take advantage of the professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit alabama form it re. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alabama form it re

How to fill out alabama form it re:

01

Start by carefully reading the instructions provided with the form. It will give you a step-by-step guide on how to fill out the form correctly.

02

Gather all the necessary information and documents required to complete the form. This may include personal information, financial details, and any supporting documents needed.

03

Begin by filling out the basic information section of the form, such as your name, address, and contact details.

04

Proceed to the specific sections of the form that require information related to the purpose of the form. Follow the instructions provided to accurately provide the required details.

05

Double-check all the information you have entered to ensure accuracy. Any mistakes or omissions may lead to delays or complications in processing the form.

06

If applicable, sign and date the completed form as instructed.

07

Make copies of the filled-out form and any accompanying documents for your records.

08

Submit the completed form as directed in the instructions, either through mail or electronically, depending on the specified submission method.

09

Keep track of the submission and any confirmation or acknowledgment receipt you receive.

Who needs alabama form it re?

01

Individuals who are residents of Alabama and are required to report specific information related to a particular situation, such as income tax reporting or benefit claims, may need to fill out Alabama Form IT RE.

02

Businesses operating in Alabama that are obligated to provide certain information to the state authorities, such as sales tax reporting or employer tax withholding, may also need to complete this form.

03

In some cases, non-residents of Alabama who have earned income in the state may be required to file Alabama Form IT RE to report their earnings and fulfill their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from Alabama income tax?

Alabama income taxes Income from federal government, designated Alabama state and local government, and military retirement plans is exempt. Payments from traditional pension plans (i.e., defined benefit plans) and Railroad Retirement plans are also tax-exempt.

Who must file an Alabama tax return?

Those whose filing status is “Married Filing Joint Return” and whose gross income for the year is at least $10,500 must file an Alabama Individual Income Tax Return while an Alabama resident. Nonresidents must file a return if their Alabama income exceeds the allowable prorated personal exemption.

How to fill out Alabama state tax withholding form?

0:48 4:04 How to complete the Alabama State Tax Withholding Form - YouTube YouTube Start of suggested clip End of suggested clip You may adjust your withholdings at any time by completing new withholding forms. In line a pleaseMoreYou may adjust your withholdings at any time by completing new withholding forms. In line a please enter your full. Name line B please enter your social security.

Who is subject to Alabama state income tax?

All income is subject to Alabama income tax unless specifically exempted by state law. The term “income” includes, but is not limited to: Wages including salaries, fringe benefits, bonuses, commissions, fees, and tips.

What is the non resident form for Alabama state income tax?

ing to Reg. 810-3-15-. 21 –Nonresident individuals receiving taxable income from property owned or business transacted (including wages for personal services) within Alabama are taxable on such income from within Alabama. They should file a Nonresident Individual Income Tax Return, Form 40NR, each year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify alabama form it re without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including alabama form it re. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get alabama form it re?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the alabama form it re in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit alabama form it re straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing alabama form it re, you can start right away.

What is alabama form it re?

Alabama Form IT RE is the state's income tax return form used by individuals and entities for reporting the tax information for the state of Alabama.

Who is required to file alabama form it re?

Individuals, corporations, and other entities who earn income in Alabama or are residents of Alabama and meet the income thresholds are required to file Alabama Form IT RE.

How to fill out alabama form it re?

To fill out Alabama Form IT RE, obtain the form from the Alabama Department of Revenue website, complete all required fields with accurate information regarding income, deductions, and credits, and then submit the form by the designated filing deadline.

What is the purpose of alabama form it re?

The purpose of Alabama Form IT RE is to report state income, calculate tax liability, and ensure compliance with Alabama state tax laws.

What information must be reported on alabama form it re?

The information that must be reported on Alabama Form IT RE includes personal identification details, income earned, deductions claimed, tax credits, and other pertinent financial information.

Fill out your alabama form it re online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alabama Form It Re is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.