WI D-101A 2012 free printable template

Show details

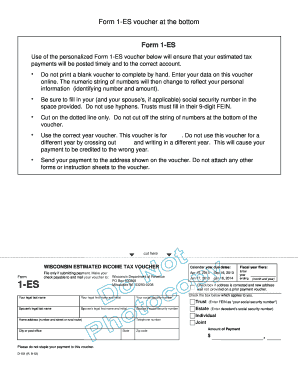

2013 Form 1 ES Instructions Estimated Income Tax for Individuals Estates and Trusts Who Must Pay Estimated Tax Tax including the Wisconsin alternative minimum tax and economic development surcharge is required to be paid on income as it is earned or constructively received. Withholding tax and estimated tax are the two methods used to make those required tax payments. Use your 2012 tax return as a guide but be sure to consider any law changes for 2013. Law changes are published in the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI D-101A

Edit your WI D-101A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI D-101A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI D-101A online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI D-101A. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI D-101A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI D-101A

How to fill out WI D-101A

01

Obtain the WI D-101A form from the Wisconsin Department of Revenue website or a local office.

02

Fill in your personal details at the top of the form, including your name, address, and tax identification number.

03

Indicate the tax year for which you are filing.

04

Complete the sections regarding income, deductions, and credits as applicable to your situation.

05

Review the form for accuracy to ensure all information is correctly entered.

06

Sign and date the form where indicated.

07

Submit the completed form either electronically or via mail to the appropriate address as specified in the instructions.

Who needs WI D-101A?

01

Individuals or businesses filing for a tax refund or correction in Wisconsin.

02

Taxpayers who have received a notice from the Wisconsin Department of Revenue requesting additional information.

03

Anyone who has filed a tax return and needs to amend it for any reason.

Fill

form

: Try Risk Free

People Also Ask about

What is Wisconsin form 1 ES?

Form 1 is the general income tax return (long form) for Wisconsin residents. It can be efiled or sent by mail. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Estimated tax payments must be sent to the Wisconsin Department of Revenue on a quarterly basis.

Does Wisconsin have an efile form?

Wisconsin e-File is the system almost any full-year, part-year, or non-resident of Wisconsin can use to electronically file a Wisconsin income tax return. Wisconsin e-File is free and available 24 hours a day, seven days a week.

How do I pay my estimated income tax in Wisconsin?

How do I make estimated tax payments? Payments can be made via Quick Pay or in My Tax Account. Complete and print the interactive Form 1-ES Voucher. Call us at (608) 266-2486 to request vouchers.

What is an e-file authorization form?

Form 8879 is the declaration document and signature authorization for an e-filed return filed by an electronic return originator (ERO).

Does Wisconsin have an e file authorization form?

If you prepared 50 or more 2021 Wisconsin individual income tax returns in 2022, you are required to file 2022 Wisconsin individual income tax returns electronically. Section Tax 2.08, Wis. Adm. Code, gives the department authorization to require electronic filing of individual income tax returns.

How does Wisconsin withholding exemption work?

You may claim exemption from withholding of Wisconsin income tax if you had no liability for income tax last year, and you expect to incur no liability for income tax this year. To claim complete exemption from withholding use Wisconsin Form WT-4, Employee's Wisconsin Withholding Exemption Certificate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit WI D-101A from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including WI D-101A. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an eSignature for the WI D-101A in Gmail?

Create your eSignature using pdfFiller and then eSign your WI D-101A immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit WI D-101A on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit WI D-101A.

What is WI D-101A?

WI D-101A is a form used in Wisconsin for reporting information regarding certain types of income and withholding.

Who is required to file WI D-101A?

Individuals and businesses that have received income subject to Wisconsin withholding tax are required to file WI D-101A.

How to fill out WI D-101A?

To fill out WI D-101A, gather the necessary income and withholding information, complete each section of the form, and ensure that all relevant details are correctly reported before submitting.

What is the purpose of WI D-101A?

The purpose of WI D-101A is to report the income earned and the amount of Wisconsin income tax withheld from that income.

What information must be reported on WI D-101A?

The form requires reporting personal information, details of the income received, amounts withheld, and any applicable tax credits.

Fill out your WI D-101A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI D-101a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.