Virtus Tax Form 1099-R 2013 free printable template

Show details

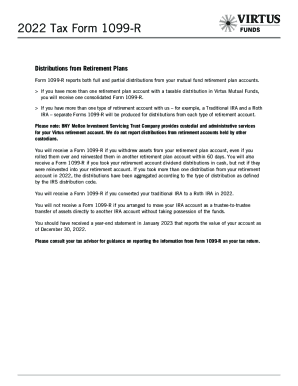

2012 Tax Form 1099-R Distributions from Retirement Plans Form 1099-R reports both full and partial distributions from your mutual fund retirement plan accounts. You have more than one retirement plan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Virtus Tax Form 1099-R

Edit your Virtus Tax Form 1099-R form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Virtus Tax Form 1099-R form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Virtus Tax Form 1099-R online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Virtus Tax Form 1099-R. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Virtus Tax Form 1099-R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Virtus Tax Form 1099-R

How to fill out Virtus Tax Form 1099-R

01

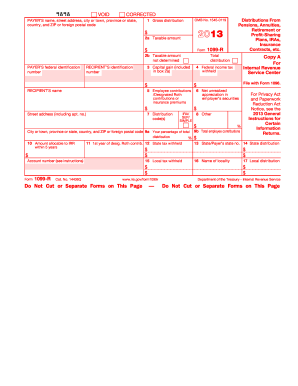

Obtain your IRS Form 1099-R from the custodian or administrator of your retirement account.

02

Locate the 'Payer's Name' section and ensure it displays the correct payer information.

03

Fill in your personal information in the 'Recipient's Name' section, including your Social Security Number.

04

Review the distribution amount in Box 1 and ensure it matches your records.

05

Verify the taxable amount in Box 2a, if applicable.

06

Check any applicable federal income tax withheld, which will be shown in Box 4.

07

Fill out any additional boxes if relevant to your situation, such as Box 7 for distribution codes.

08

Confirm the information is accurate and complete before submitting to the IRS or using for your tax returns.

Who needs Virtus Tax Form 1099-R?

01

Individuals who have received distributions from a retirement or pension plan.

02

Retirees who have taken early withdrawals from their retirement account.

03

Beneficiaries who have inherited a retirement account and taken distributions.

04

Taxpayers who have participated in a 401(k), IRA, or another retirement plan and received taxable distributions during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

Why did I get 2 1099-R forms?

Multiple 1099-R Forms Each distribution code requires a separate 1099-R form. If you received more than one distribution type, you will receive more than one 1099-R.

What distributions are received from Form 1099-R?

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans.

What is the 1099-R form used for?

IRS Form 1099-R provides information on benefits paid and amounts withheld for federal income tax. A copy of the form should be included with federal income tax filings if any federal tax is withheld. PERS will report the same information to the IRS for each retiree who is sent a form.

What is the difference between 1099-R code 1 and 2?

Even if the taxpayer has two 1099-R from the same payer, they are each entered separately with a distribution code 1 for each 1099-R. Use code 2 only if the employee/taxpayer hasn't reached age 59 & 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA).

Why do I have 2 different 1099-R forms?

Multiple 1099-R Forms Each distribution code requires a separate 1099-R form. If you received more than one distribution type, you will receive more than one 1099-R.

What is Form 1099-R distributions from pensions annuities retirement or profit sharing?

Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. You should receive a copy of Form 1099-R, or some variation, if you received a distribution of $10 or more from your retirement plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get Virtus Tax Form 1099-R?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific Virtus Tax Form 1099-R and other forms. Find the template you need and change it using powerful tools.

Can I sign the Virtus Tax Form 1099-R electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit Virtus Tax Form 1099-R on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute Virtus Tax Form 1099-R from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is Virtus Tax Form 1099-R?

Virtus Tax Form 1099-R is an IRS tax form used to report distributions from pensions, annuities, retirement plans, or insurance contracts.

Who is required to file Virtus Tax Form 1099-R?

Entities that make distributions from retirement accounts, such as financial institutions or employers providing retirement plans, are required to file Virtus Tax Form 1099-R.

How to fill out Virtus Tax Form 1099-R?

To fill out Virtus Tax Form 1099-R, start by entering the recipient's information including name, address, and Social Security number. Then, indicate the total distribution amount, any taxable amount, and the distribution code that applies to the transaction.

What is the purpose of Virtus Tax Form 1099-R?

The purpose of Virtus Tax Form 1099-R is to report income received from retirement accounts and to ensure that the taxpayer includes this income on their tax return.

What information must be reported on Virtus Tax Form 1099-R?

Virtus Tax Form 1099-R must report the recipient's identification information, total distribution amount, taxable amount, distribution codes, and any federal income tax withheld.

Fill out your Virtus Tax Form 1099-R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Virtus Tax Form 1099-R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.