Virtus Tax Form 1099-R 2022-2025 free printable template

Show details

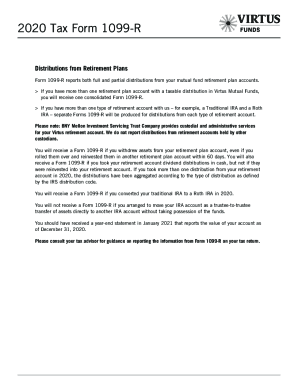

2022 Tax Form 1099RDistributions from Retirement Plans Form 1099R reports both full and partial distributions from your mutual fund retirement plan accounts. If you have more than one retirement plan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1099 r mutual form

Edit your virtus 1099 r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your virtus mutual funds 1099 r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing virtus 1099r online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit virtus form 1099r fillable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Virtus Tax Form 1099-R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out virtus 1099r plans sample form

How to fill out Virtus Tax Form 1099-R

01

Gather necessary documents: Collect any previous tax forms, 1099 statements, and identification numbers.

02

Identify the payer: Enter the name and address of the institution or company that issued the 1099-R.

03

Fill in recipient information: Enter your name, address, and Social Security number in the appropriate boxes.

04

Report distribution amounts: Input the total distribution amount received during the tax year in Box 1.

05

Complete taxable amount: Fill out Box 2a for the taxable amount of the distribution, if applicable.

06

Indicate distribution type: Mark the box in Box 7 to indicate the type of distribution (e.g., regular distribution, rollover, etc.).

07

Include tax withheld: If applicable, enter any federal tax withheld in Box 4.

08

Review and double-check: Ensure all information is accurate and complete before submission.

09

Submit the form: File the completed 1099-R form with both the IRS and your state tax authority if required.

Who needs Virtus Tax Form 1099-R?

01

Individuals who receive distributions from retirement accounts, pensions, or annuities are required to file Form 1099-R.

02

Financial institutions or plan administrators that manage retirement plans must issue Form 1099-R to applicable recipients.

03

Taxpayers who rolled over funds from one retirement account to another may use this form to report the rollover.

Fill

virtus 1099r plans form

: Try Risk Free

People Also Ask about virtus 1099r plans edit

How do I print my 1099-R?

How to access your 1099-R tax form Sign in to your online account. Go to OPM Retirement Services Online. Click 1099-R Tax Form in the menu to view your most recent tax form. Select a year from the dropdown menu to view tax forms from other years. Click the save or print icon to download or print your tax form.

How can I get a copy of my 1099 from the IRS online?

Get a copy of your Social Security 1099 (SSA-1099) tax form online. Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

How do I request a 1099-R?

1099-R and W-2 Tax Statement Requests Via Fax or the U.S. Mail. Customers may also send a letter including their name, Social Security number, date and signature. Requests may be either faxed or mailed. Fax number: 1-800-469-6559. Via the telephone. Automated Phone System: Call 800-321-1080.

Can I print my 1099-R online?

6. Can my Form 1099-R be faxed or emailed? No, your form cannot be emailed or faxed. You can view and print your form by logging in to your ERS OnLine account.

Is there a printable 1099 form?

Can I print 1099 forms myself? If you didn't e-file your 1099s: You can print copies to mail to the federal and state governments, plus print and send a copy to each of your contractors. For more info about IRS and state requirements, consult your accountant, and see: IRS' instructions for Forms 1099-MISC and 1099-NEC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get virtus 1099 r download?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the virtus funds 1099r make in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute mutual 1099r online?

pdfFiller has made it simple to fill out and eSign mutual tax form 1099r. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I complete virtus 1099r retirement download on an Android device?

Use the pdfFiller app for Android to finish your virtus 1099r plans fill. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is Virtus Tax Form 1099-R?

Virtus Tax Form 1099-R is a tax form used to report distributions from pensions, annuities, retirement plans, or other similar accounts. It is issued by financial institutions to the Internal Revenue Service (IRS) and the recipient of the distribution.

Who is required to file Virtus Tax Form 1099-R?

Financial institutions and entities that make distributions from retirement plans are required to file Virtus Tax Form 1099-R. This includes pensions, annuities, and other retirement accounts.

How to fill out Virtus Tax Form 1099-R?

To fill out Virtus Tax Form 1099-R, the issuer must input information such as the recipient's name, address, taxpayer identification number, the amount of distribution, any federal income tax withheld, and the reason for the distribution. It's essential to follow the IRS guidelines when completing the form.

What is the purpose of Virtus Tax Form 1099-R?

The purpose of Virtus Tax Form 1099-R is to inform the IRS and the recipient about distributions from retirement accounts, helping to ensure proper reporting of taxable income to the IRS.

What information must be reported on Virtus Tax Form 1099-R?

The information that must be reported on Virtus Tax Form 1099-R includes the recipient's name, address, taxpayer identification number, total distribution amount, any federal tax withheld, type of distribution, and the date of the distribution.

Fill out your mutual form 1099 r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Virtus 1099r Distributions Form is not the form you're looking for?Search for another form here.

Keywords relevant to virtus 1099r retirement

Related to virtus 1099 r fill

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.