NY NYC-200V 2012 free printable template

Show details

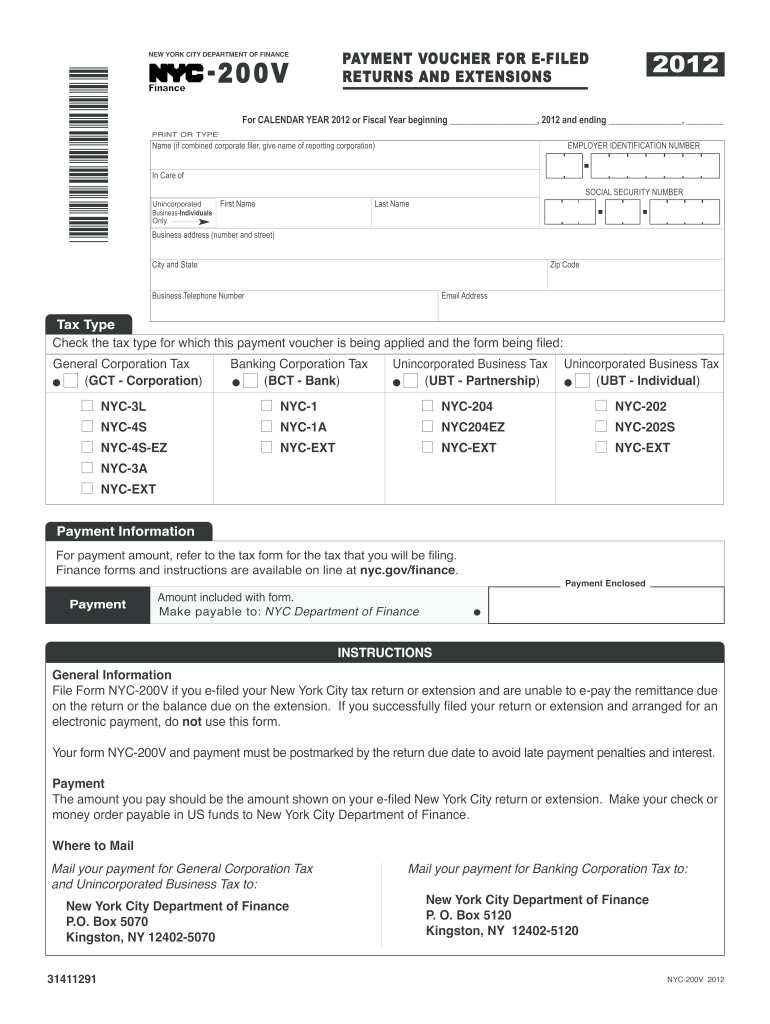

Finance forms and instructions are available on line at nyc.gov/finance. Payment Amount included with form. Make payable to NYC Department of Finance Payment Enclosed INSTRUCTIONS General Information File Form NYC-200V if you e-filed your New York City tax return or extension and are unable to e-pay the remittance due on the return or the balance due on the extension. If you successfully filed your return or extension and arranged for an electronic payment do not use this form. Your form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY NYC-200V

Edit your NY NYC-200V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY NYC-200V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY NYC-200V online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY NYC-200V. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYC-200V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY NYC-200V

How to fill out NY NYC-200V

01

Obtain the NY NYC-200V form from the New York City Department of Finance website or your local tax office.

02

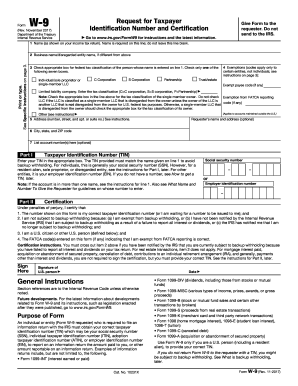

Fill in the taxpayer identification information, including your name, address, and taxpayer ID number.

03

Indicate the type of entity you are reporting (e.g., corporation, partnership).

04

Report your total income and expenses for the tax year.

05

Include any applicable deductions and credits.

06

Review the form for accuracy, ensuring all numbers are correct and calculations are accurate.

07

Sign and date the form, confirming that all information is truthful.

08

Submit the completed form to the appropriate tax authority by the due date.

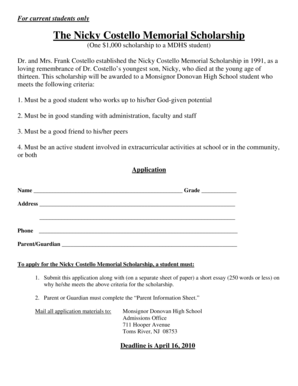

Who needs NY NYC-200V?

01

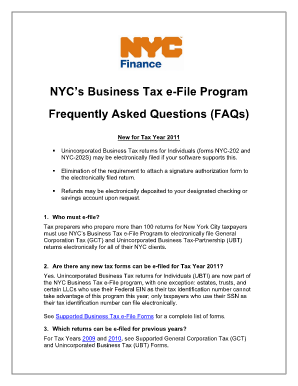

Any business entity operating in New York City that is required to report and pay the Unincorporated Business Tax (UBT) needs to fill out the NY NYC-200V.

02

This includes partnerships, sole proprietorships, and certain limited liability companies (LLCs).

03

Individuals running a business with income over the threshold as specified by NYC tax regulations also need to file this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax form for NYC?

New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. Most New York City employees living outside of the 5 boroughs (hired on or after January 4, 1973) must file Form NYC-1127.

What is nyc 400?

Every corporation subject to the New York City General Corporation Tax or Business Corporation Tax (Title 11, Chapter 6, Subchapter 2 or Subchapter 3-A of the Administrative Code) must file a declaration (NYC-400) if its estimated tax for the current year can reasonably be expected to exceed $1,000.

What is the state tax form for NY?

Pay all of your NY income taxes online at New York Tax Online Service. Complete Form IT-370 with your Check or Money Order and mail both to the address on Form IT-370.

Is there a New York City income tax?

NYC Tax Brackets 2022 New York City income tax rates are 3.078%, 3.762%, 3.819%, and 3.876%, depending on which bracket you are in. Where you fall within these brackets depends on your filing status and how much you earn annually.

Where can I get a paper copy of 1040?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

What is NYC 200 V?

NYC-200V - Payment Voucher for Tax Returns and Extensions Create a customized payment voucher by logging onto your e-Services account or download a generic NYC-200V Payment Voucher.

Do NYC parking tickets come in the mail?

Parking Ticket Payments Respond early enough to allow for mail delivery. To avoid penalties and interest, Finance must receive your response to the ticket by the 30th day from the date the ticket was issued.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

How do I pay my NYC estimated taxes?

You can pay directly from your preferred account or by credit card through your Online Services account. Note: There is no online option at this time for Forms IT-2658, Report of Estimated Tax for Nonresident Individual Partners and Shareholders, or CT-2658, Report of Estimated Tax for Corporate Partners.

Do I need to file NYC tax return?

If you had any income during your resident period or if you had New York source income during your nonresident period, you are required to file a New York State return. You will file Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

Does NYC accept federal extension?

New York does not recognize a federal extension. If you cannot meet the filing deadline for a NY business return, you should request a six-month extension of time by filing Form CT-5, Request for Six-Month Extension to File (For Franchise/Business Taxes, MTA Surcharge, or Both), on or before the due date of the return.

Where to get tax forms in nyc?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

What is considered NYC for tax purposes?

A New York City resident for tax purposes is someone who is domiciled in New York City or who has a permanent place of abode there and spends more than 183 days in the city.

What is NYC-200V?

NYC-200V - Payment Voucher for Tax Returns and Extensions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY NYC-200V on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign NY NYC-200V on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit NY NYC-200V on an Android device?

You can make any changes to PDF files, like NY NYC-200V, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete NY NYC-200V on an Android device?

Use the pdfFiller mobile app and complete your NY NYC-200V and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is NY NYC-200V?

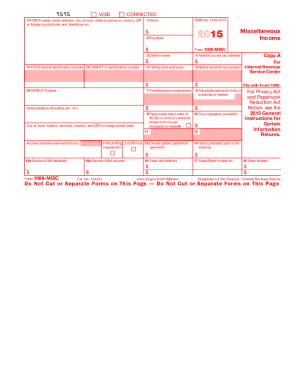

NY NYC-200V is a payment voucher used by certain taxpayers in New York City to submit payments for a variety of taxes, including the general corporation tax and unincorporated business tax.

Who is required to file NY NYC-200V?

Taxpayers who owe certain taxes assessed by the New York City Department of Finance and are making payments toward these taxes are required to file NY NYC-200V.

How to fill out NY NYC-200V?

To fill out NY NYC-200V, taxpayers must provide their EIN or SSN, the amount of the payment being submitted, the tax period for which the payment applies, and any other required identifying information.

What is the purpose of NY NYC-200V?

The purpose of NY NYC-200V is to facilitate the payment of taxes owed to New York City, allowing taxpayers to submit payments efficiently and correctly.

What information must be reported on NY NYC-200V?

The information that must be reported on NY NYC-200V includes the taxpayer's identification number (EIN or SSN), the amount of the tax payment, the type of tax being paid, and the tax year or period.

Fill out your NY NYC-200V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY NYC-200v is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.