WV IT-101V 2011 free printable template

Show details

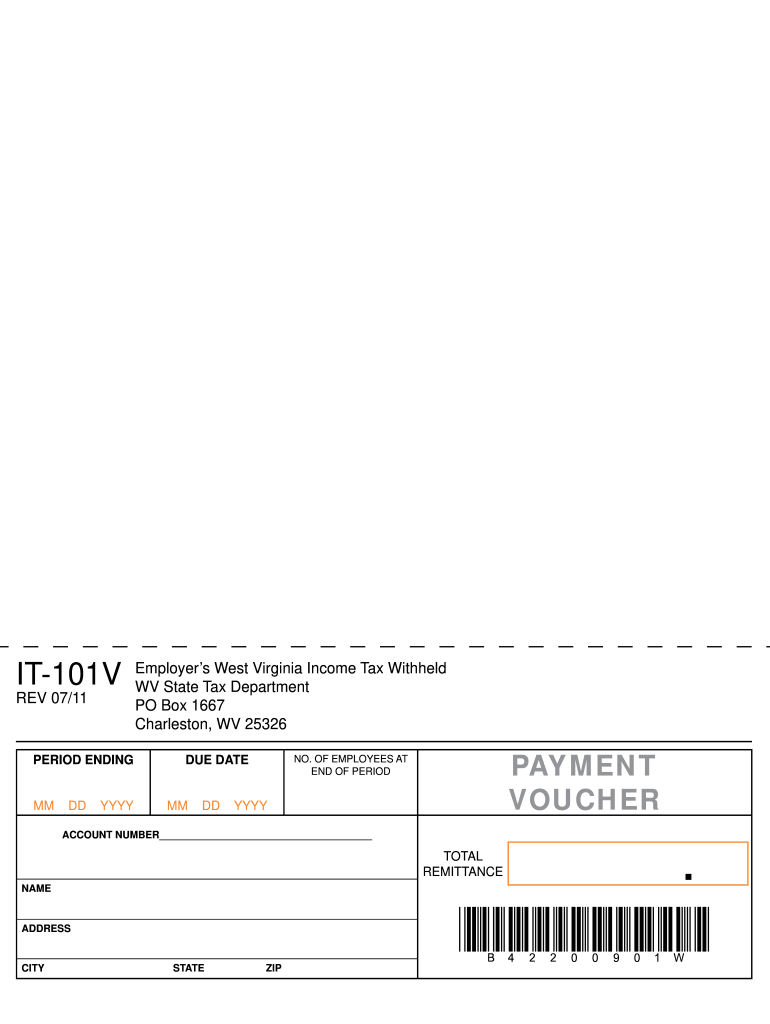

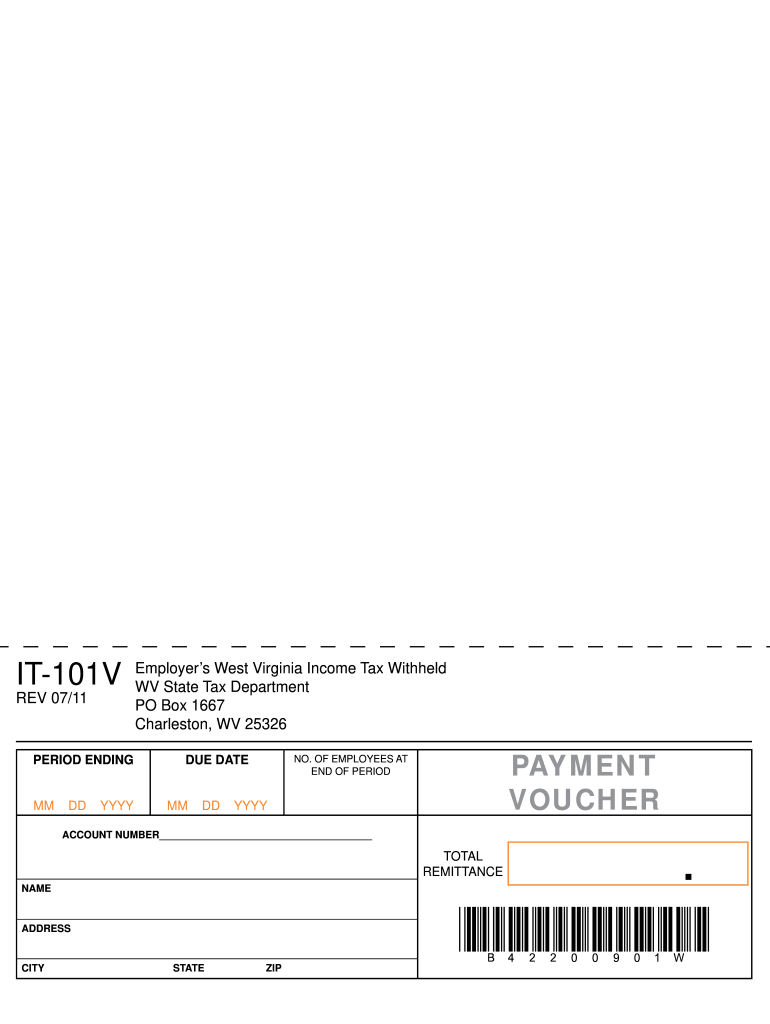

IT-101V REV 07/11 Period Ending MM DD YYYY Employer s West Virginia Income Tax Withheld WV State Tax Department PO Box 1667 Charleston WV 25326 payment voucher No. of employees at end of period Due Date Account number TOTAL REMITTANCE Name B42200901W Address City State zip.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WV IT-101V

Edit your WV IT-101V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WV IT-101V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WV IT-101V online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WV IT-101V. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV IT-101V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WV IT-101V

How to fill out WV IT-101V

01

Gather all necessary documents including W-2 forms and any other income statements.

02

Download the WV IT-101V form from the West Virginia Department of Revenue website.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Input your total income from all sources on the appropriate lines.

05

Subtract any applicable deductions to calculate your taxable income.

06

Refer to the tax tables provided to find your tax liability based on your taxable income.

07

Complete the sections related to any credits you may qualify for.

08

Review the form for accuracy and ensure all calculations are correct.

09

Sign and date the form before submitting it to the West Virginia Department of Revenue.

Who needs WV IT-101V?

01

Individuals who reside in West Virginia and are required to file a state income tax return.

02

Taxpayers who have earned income in West Virginia.

03

Residents who qualify for specific tax credits or deductions that need to be reported.

04

Anyone who has received income from sources that need to be reported to the state.

Instructions and Help about WV IT-101V

Whew whew whew or the way to be won woo woo woo woo Hui woo

Fill

form

: Try Risk Free

People Also Ask about

What is the current WV income tax rate?

West Virginia has a flat 6.50 percent corporate income tax rate and permits local gross receipts taxes. West Virginia has a 6.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 6.55 percent.

What is the WV individual income tax rate?

How does West Virginia's tax code compare? West Virginia has a graduated individual income tax, with rates ranging from 3.00 percent to 6.50 percent. There are also jurisdictions that collect local income taxes. West Virginia has a flat 6.50 percent corporate income tax rate and permits local gross receipts taxes.

What is withholding tax for non US residents?

Under US domestic tax laws, a foreign person generally is subject to 30% US tax on the gross amount of certain US-source income.

What is exempt from sales tax in WV?

Some goods are exempt from sales tax under West Virginia law. Examples include most textbooks, prescription drugs, and medical supplies.

What is the WV state withholding tax rate for 2023?

What is the new West Virginia income tax rate? Annual Earnings2022 Income Tax Brackets2023 Income Tax Brackets (NEW)Over $20,000 but not over $30,0006.0%$619.75 + 4.72% of excess over $20,000Over $30,0006.50%$1,091.75 + 5.12% of excess over $30,0003 more rows • Apr 11, 2023

How does non resident withholding tax work?

If IRS considers you to be a foreign person (or nonresident alien) for tax purposes, SSA is required to withhold a 30 percent flat income tax from 85 percent of your Social Security retirement, survivors, or disability benefits.

How long does it take to get my WV state tax refund?

The typical refund timeframes for correctly filed returns are: For an e-filed return: Seven to 8 weeks after the acknowledgement is received from the state. For a paper return: Ten to 11 weeks after the return is received by the West Virginia Tax Division.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the WV IT-101V electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your WV IT-101V.

How can I edit WV IT-101V on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing WV IT-101V right away.

How do I complete WV IT-101V on an Android device?

Use the pdfFiller Android app to finish your WV IT-101V and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is WV IT-101V?

WV IT-101V is a West Virginia Individual Income Tax Return form used by residents to report their income and calculate their tax liabilities.

Who is required to file WV IT-101V?

Individuals who have taxable income in West Virginia and meet the filing threshold are required to file the WV IT-101V.

How to fill out WV IT-101V?

To fill out WV IT-101V, provide your personal information, report your income, claim deductions and credits, and calculate your tax due or refund.

What is the purpose of WV IT-101V?

The purpose of WV IT-101V is to allow individuals to report their income to the state and determine their tax obligations.

What information must be reported on WV IT-101V?

The information that must be reported on WV IT-101V includes personal details, income from all sources, deductions, credits, and the computed tax liability.

Fill out your WV IT-101V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WV IT-101v is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.