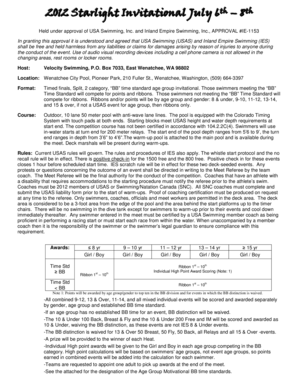

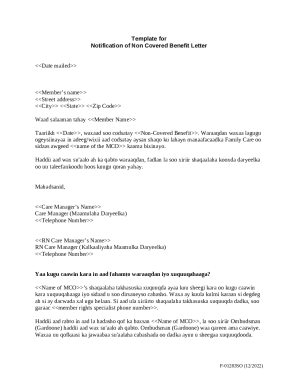

FL DR-14 2009 free printable template

Show details

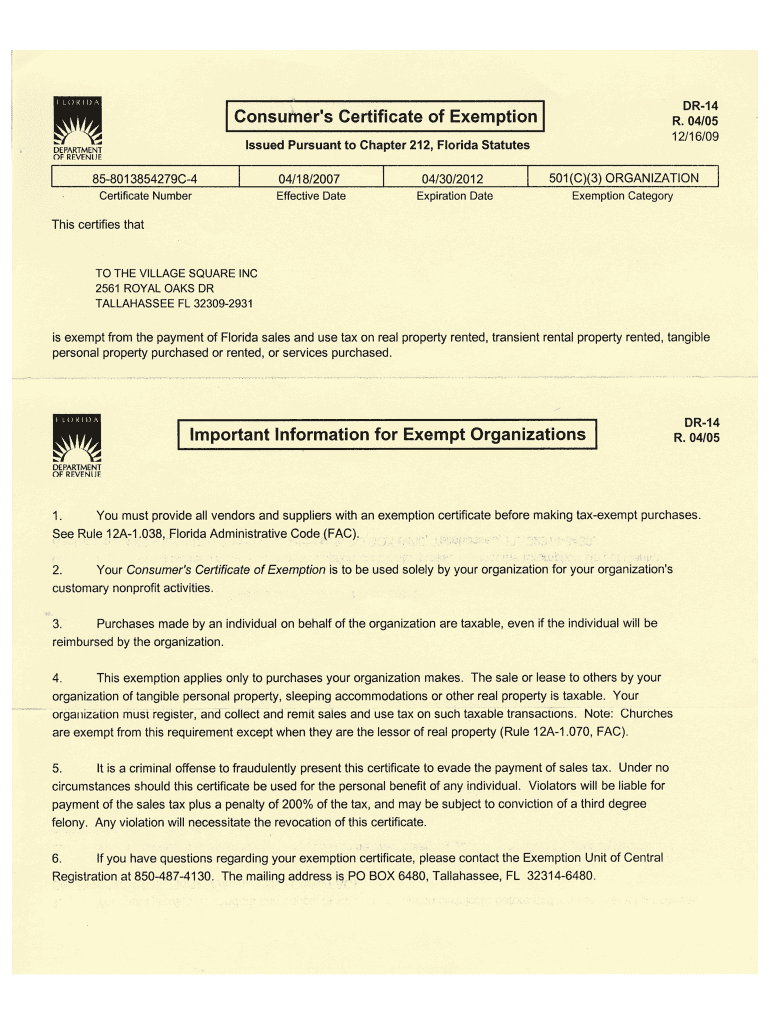

DR-14. Consumer's Certificate of Exemption R 04,05. BEPARTMEN1 Issued Pursuant to Chapter 212, Florida Statutes 12/16/09. OF REVENUE ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dr 14 2009 form

Edit your dr 14 2009 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dr 14 2009 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dr 14 2009 form online

To use the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit dr 14 2009 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DR-14 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dr 14 2009 form

How to fill out FL DR-14

01

Obtain the FL DR-14 form from the Florida Department of Revenue website or at your local office.

02

Enter your name and contact information in the designated fields.

03

Fill in the details of your business, including the business name, address, and employer identification number (EIN).

04

Provide information regarding the type of tax and relevant tax period.

05

Include any additional required documentation to support your application.

06

Review the completed form for accuracy and completeness.

07

Submit the form via mail or any other method specified by the Florida Department of Revenue.

Who needs FL DR-14?

01

Anyone who is applying for a tax exemption or requesting a refund for sales and use tax in Florida.

02

Business owners or organizations that qualify for certain exemptions under Florida law.

03

Individuals who have overpaid taxes and are seeking reimbursement.

Fill

form

: Try Risk Free

People Also Ask about

How much does a Florida resale certificate cost?

How much does a resale license cost in Florida? There is no cost for a sales tax permit in the state of Florida when registering online, however, there is a $5 fee if applying by mail.

Who qualifies for sales tax exemption in Florida?

Certain groceries, any prosthetic or orthopedic instruments, any remedies which are considered to be common household remedies, any seeds and fertilizers, and any cosmetics are considered to be exempt in the state of Florida.

How do I renew my Florida tax exempt certificate?

Renewing Your Certificate: Your Consumer's Certificate of Exemption will be valid for a period of five (5) years. If you wish to renew your exemption, you must submit another Application for Consumer's Certificate of Exemption (Form DR-5) and copies of the required documentation.

How do I get a sales tax permit in Florida?

To apply for a Florida sales tax license, you may use the online form or download Form DR-1 and submit it to the Department of Revenue or a taxpayer service center. There is no fee to register for a Florida sales tax license.

What products and services are subject to sales tax in Florida?

In the state of Florida, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer.

Who must pay sales tax in Florida?

Any person making taxable sales in Florida must separately state Florida sales tax on each customer's invoice, sales slip, receipt, billing, or other evidence of sale. The sales tax and discretionary sales surtax may be shown as one total, or the sales tax and surtax may be shown separately.

How do I get a Florida sales tax certificate?

Annual Resale Certificates Available Online If you file paper sales and use tax returns, your certificate will be mailed to you with your annual coupon book or your paper return. Using your tax account information, you may download and print your certificate.

How much does it cost to get a Florida resale certificate?

How much does a resale license cost in Florida? There is no cost for a sales tax permit in the state of Florida when registering online, however, there is a $5 fee if applying by mail.

What is Florida's tax certificate expiration date?

Certificates expire on December 31 of each year.

How long is a sales tax exemption certificate good for in Florida?

Sales tax exemption certificates expire after five years. The Department reviews each exemption certificate sixty (60) days before the current certificate expires.

How long does it take to get a sales tax certificate in Florida?

How long does it take to receive your Florida sales tax permit? You should be able to retrieve your certificate number(s) online after three business days.

Who qualifies for tax exemption in Florida?

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

What qualifies a person as tax exempt?

Typically, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year. Internal Revenue Service.

How do I get tax exemption?

Tax exemptions can be availed by investing in the following tools: Senior Citizen Savings Scheme (SCSS) Sukanya Samriddhi Yojana (SSY) National Pension Scheme (NPS) Public Provident Fund (PPF) National Pension Scheme (NPS)

How much is a sales tax permit in Florida?

Florida does not charge a fee for applying for a seller's permit, and your license won't expire unless you don't use it for more than a year. If your Florida seller's permit has been canceled for any reason, you need to obtain a new one before resuming sales in the state.

How do I get a Florida sales certificate?

To apply for a Florida sales tax license, you may use the online form or download Form DR-1 and submit it to the Department of Revenue or a taxpayer service center. There is no fee to register for a Florida sales tax license.

What sales are exempt from sales tax in Florida?

Florida's general state sales tax rate is 6% with the following exceptions: Retail sales of new mobile homes - 3% Amusement machine receipts - 4% Rental, lease, or license of commercial real property - 5.5%

Who qualifies for sales tax exemption in Florida?

Facilities that are registered as 501(c)(3) nonprofit, educational or charitable entities are free to purchase materials, supplies and most services without paying Florida sales tax.

What items in Florida are exempt from sales tax?

Florida offers generous exemptions to manufacturers. New machinery and equipment are not subject to Florida sales tax. Repair parts and labor to that machinery and equipment are also exempt. Utilities including electricity and natural gas consumed in production are exempt from Florida sales tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my dr 14 2009 form in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your dr 14 2009 form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute dr 14 2009 form online?

Easy online dr 14 2009 form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the dr 14 2009 form electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your dr 14 2009 form.

What is FL DR-14?

FL DR-14 is a Florida Department of Revenue form used for reporting the distribution of business income and expenses.

Who is required to file FL DR-14?

Businesses operating in Florida that have income distribution to partners, shareholders, or members are required to file FL DR-14.

How to fill out FL DR-14?

To fill out FL DR-14, you need to provide information regarding the entity, income distributions, and expenses incurred during the reporting period.

What is the purpose of FL DR-14?

The purpose of FL DR-14 is to ensure accurate reporting of income distribution from partnerships and other business entities for tax purposes.

What information must be reported on FL DR-14?

FL DR-14 requires reporting of entity details, income distributions made to members or partners, and deductible expenses related to earning that income.

Fill out your dr 14 2009 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dr 14 2009 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.