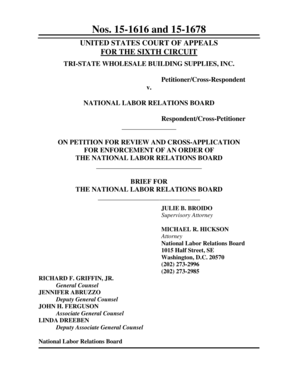

FL DR-14 2015 free printable template

Get, Create, Make and Sign FL DR-14

How to edit FL DR-14 online

Uncompromising security for your PDF editing and eSignature needs

FL DR-14 Form Versions

How to fill out FL DR-14

How to fill out FL DR-14

Who needs FL DR-14?

Instructions and Help about FL DR-14

What's another file ask this partly because I go through social media calling myself the audiophile man so its probably apt that I actually explain myself a little I'll explain the term audio file what does it mean for many people out there it's extraordinarily negative, and I see a whole host of negative comments associated with the word the derision is probably one of the descriptive terms I would use many people see the word audiophile as a bad thing now why is this there are a number of reasons firstly many hi-fi users associate the word audiophile with loads of cash lots of money to be an audiophile you have to have lots of cash and that just is not so secondly audio file or the name audio file or to be an audio file its often associated with snobbery as if you know is I call myself an audiophile then I will look down at you for daring to have said a budget turntable and a budget amp and the budget speakers how dare you even bring it the same air as me that sort of thing again totally wrong completely wrong and also the 10 audiophile seems to be used to categorize people who distance themselves from ordinary people who go on Facebook and seek advice or share their hi-fi almost as if the audiophile separates himself from the group from the crowd there's almost like speaking to the crowds from on high again it's connected with the snobbery thing all this is totally wrong I really don't know where this has come from I don't know who began this I don't know where the notion originated if you know where it began tell me, but that's not how I see audiophiles at all in fact in many ways I don't really see audio files associated with hi-fi per se an audio file doesn't see hi-fi as the main thing an audio file sees music as the main thing and your file doesn't pray at the altar of the high-five product the audio file just wants better music better quality music more information from their music that's what an audiophile wants that's what an audiophile is I know that your file is a don't know a seeker of truth I know I might sound a bit highfalutin rather philosophical, but that's what I want the truth as the guitarist play this as the drummer hit those drums when he was there was he heard what he experienced what the surrounding band were going through I want to be part of that I want to be part of that occasion I want to get closer to that time to those moments I want to experience the art that's all there is as an audiophile I want to be part of that artistic experience so what then is an audio file as far as I'm concerned an audio file is somebody who uses a hi-fi system as a tool nothing else right hi fight to me is not a thing in itself it's not the end result I wouldn't buy say I don't know a 50000 pound hi-fi system install this sit back and think my job is done I don't need to do anymore don't actually have to listen to any music actually I can just sit and gaze at this thing that's not what hi fires to me high-five is a means to an end hi...

People Also Ask about

What is a Florida DR 13?

How do I get a US sales tax exemption certificate?

Who qualifies for sales tax exemption in Florida?

Does Florida require a resale certificate?

What is a FL DR 14?

What is the number for tax exemption in Florida?

How do I report sales tax in Florida?

What is the collection allowance for sales and use tax in Florida?

Who is sales tax exempt in Florida?

Who qualifies for sales tax exemption in Florida?

Is Florida sales tax accrual or cash basis?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the FL DR-14 electronically in Chrome?

How do I complete FL DR-14 on an iOS device?

How do I fill out FL DR-14 on an Android device?

What is FL DR-14?

Who is required to file FL DR-14?

How to fill out FL DR-14?

What is the purpose of FL DR-14?

What information must be reported on FL DR-14?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.